In his 2005 bestselling novel "Bounce", Matthew Syed talks about the power of practice and sacrifice that yields high performance. The book offers a compelling narrative of the hard work and sacrifice that goes on behind the scenes to nurture and create high performers in sport, art and science. It's also an insightful exposition of the Iceberg Illusion, depicting what people see vs. what they don't. As Syed goes on to explain — "When we witness extraordinary feats … we are witnessing the end product of a process measured in years. What is invisible to us — the submerged evidence, as it were — is the countless hours of practice that have gone into the making of the virtuoso performance … What we do not see is what we might call the hidden logic of success". And it's this hidden logic that also forms the basis of what many consider the holy grail of investing.

In an attempt to see through icebergs, two professors at the Columbia Business school, Benjamin Graham and David Dodd, began expounding an investment philosophy that focused on finding securities/stocks that appeared to be underpriced. It was an exercise in identifying bargain opportunities by assessing future cash flows. This gave birth to a whole new investment paradigm called Value Investing and proponents of the value investing mantra began to scour the market in an attempt to discover outstanding companies trading at a reasonable price.

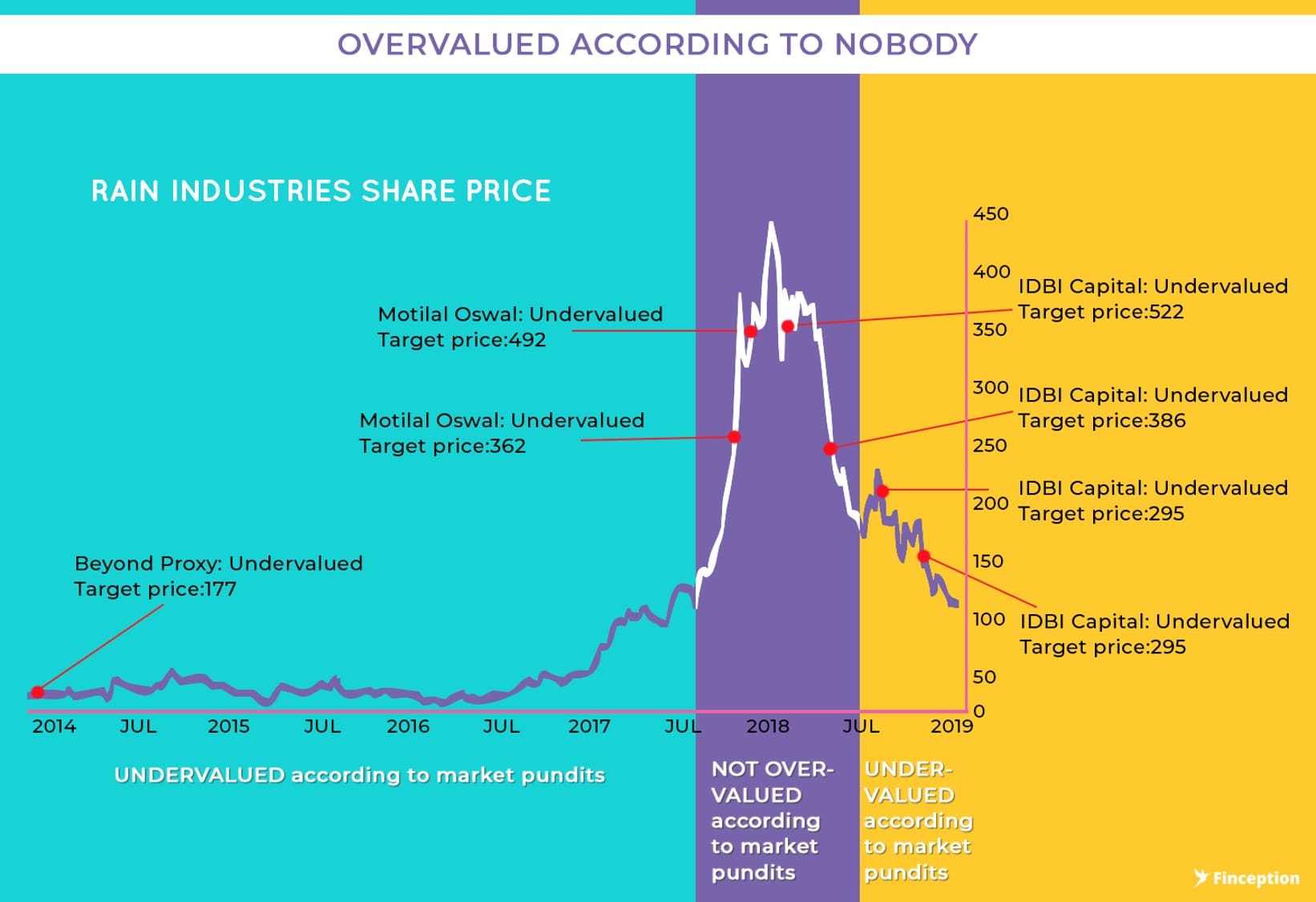

While the principle of value investing began to gain traction in the U.S and created enormous wealth for its early adopters, the Indian example stood in stark contrast to its U.S counterpart. It seemed that most Indian companies that fit the "value" bill, had in reality very limited potential to actually realise most of their future earnings given excessive borrowing or poor accounting practices. Value Investing simply wasn't working in India and the only recourse to buy quality companies was to pay a premium. This was the prevailing mantra in the Indian Investment community until in 2013, a report from an American research company (Beyondproxy) claimed that it had chanced upon a value stock and an opportunity that came once in a lifetime all bundled inside a little-known company from Hyderabad called Rain Industries.

The depressed valuation of this leveraged, underfollowed, niche market, stable margin, and oligopolistic natured business provides an opportunity for a serial capital compounder — Excerpts from a report by Beyondproxy

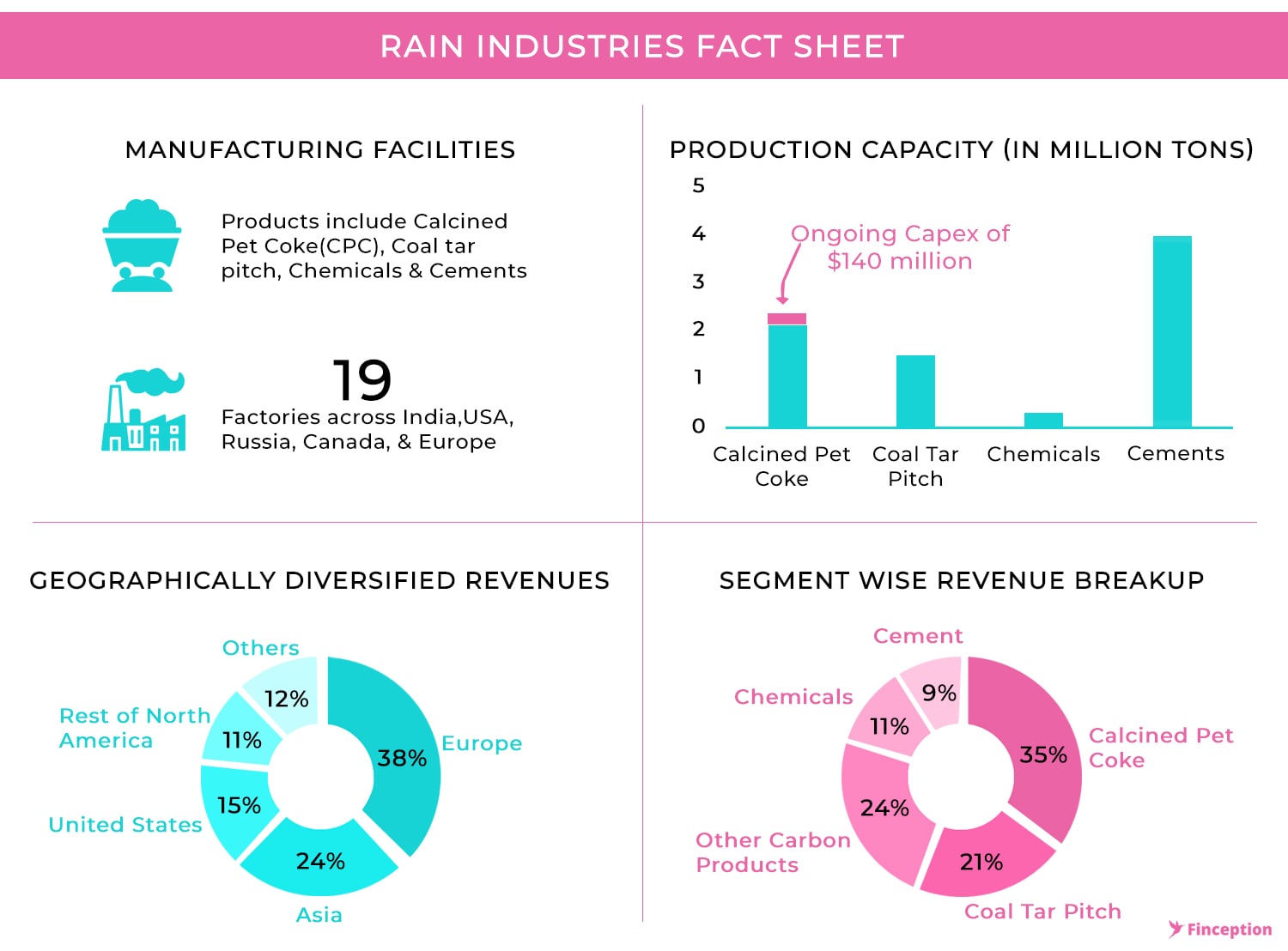

Rain Industries traces its origin back to the 1970s. It began as a cement company owned by a certain Radhakrishna Reddy and a few partners catering to the burgeoning demand of the Indian Infra sector. Within a couple decades, Mr Radhakrishna's son, Jagan Mohan Reddy, a Purdue educated, second generation entrepreneur set out to make a name for himself and began dabbling with the esoteric calcination business. At this point, we need to offer you a brief on calcination, because, its one of two themes that form the pillar of this story. With the calciners, the young promoter was trying the cater to the aluminium industry. When they make aluminium in large smelters one of the key raw material that the industry uses is carbon anode. Now carbon anode is primarily made from Calcined Petroleum Coke or CPC, the stuff that the young Reddy was trying to cook up in his labs (calciners) and because it was a business dominated by a few players, it made sense for him to take a stab at it.

However, making CPC isn't all that hard so long as you can source the right materials. CPCs are primarily made from what is called anode grade green petroleum coke (GPC). Its a by-product of oil refining and with a little magic you could easily make more of this stuff. Unfortunately, green pet coke comes in different grades and the one that's used to make CPC, the good stuff (low sulphur, less metals) is becoming increasingly scarce, but we will get to that bit in a while. So with the basics covered here's how the economics work. Once you have anode grade GPC secured, operations involve little processing (GPC and CPC prices move in tandem) and low fixed costs. So to make a real dent on margins, the company has to sell truckloads of CPC and for Jagan to move into the major leagues, he needed to expand and expand quick

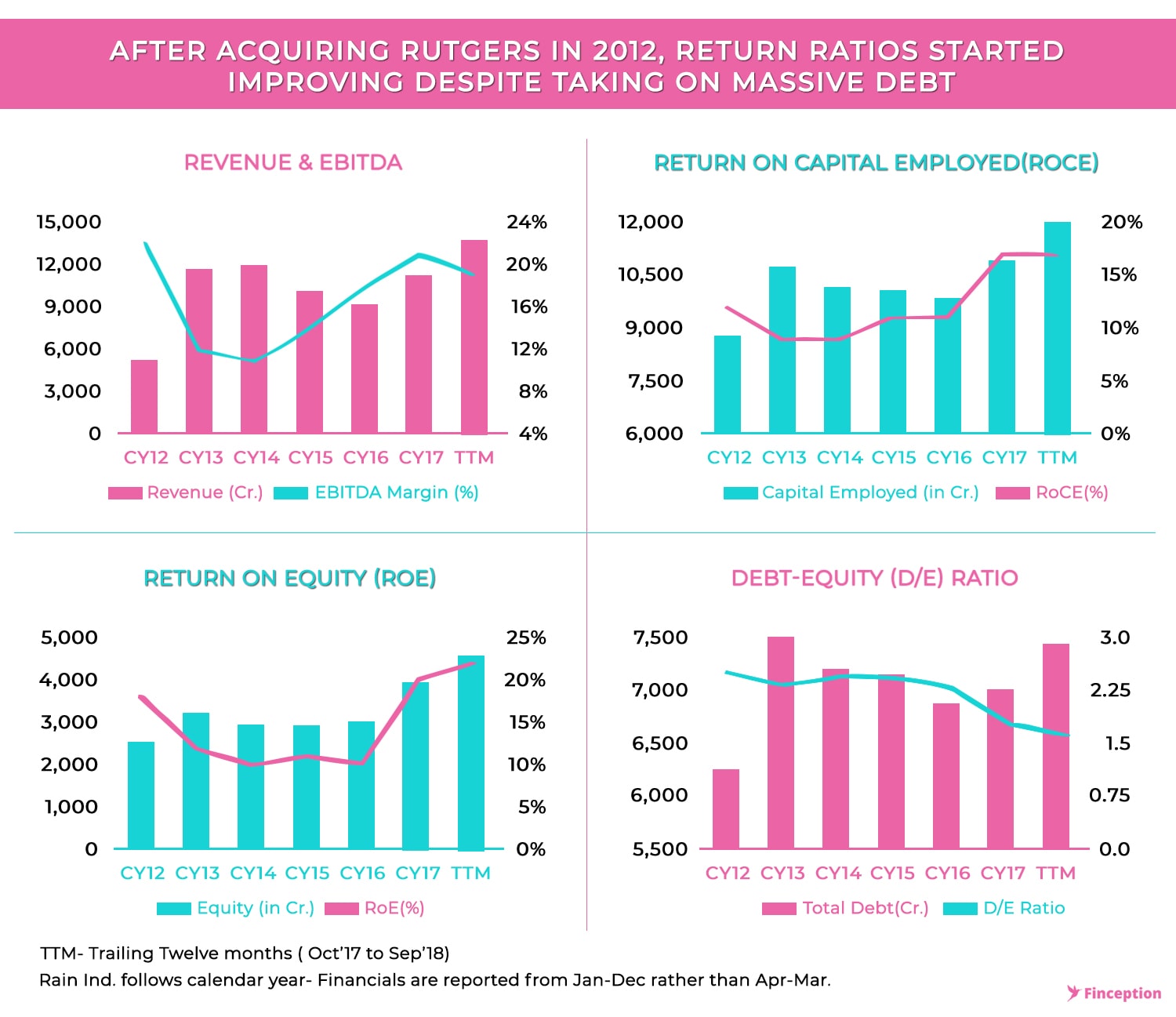

In a bold move, Jagan Mohan Reddy decided to merge his father's business with his own and plotted an acquisition that can best be described as pure insanity. By borrowing more than what his entire business was worth and acquiring a company in the U.S Jagan was venturing into territories seldom explored. In 2007, Rain acquired CII Carbon and became the second largest calciner in the world. Over the next 5 years, the company began to pay back some of that debt (US$728 mln to US$413) and continued to dabble with the odd acquisitions — a plant in Egypt, a calciner in China until in 2012, Jagan shocked the industrial community once again by acquiring a leading Belgian Coal Tar Distillation Plan, Rutgers, for an exorbitant sum, close to a Billion dollars. Coal tar Pitch (CTP) like CPC is used to make Carbon Anodes, but unlike pet coke, CTP has multiple end uses.

So here was a company that was making~US $2 bln in revenue with the majority of its operations located overseas after having borrowed US$1.3 bln from foreign investors and probably sitting on a gold mine. But Indian Investors were never going to touch this bad boy despite the obvious money-making potential. There was so much uncertainty surrounding the business — the debt, the foreign affairs, the opaque industry and it seemed unlikely anybody would gamble. However, there was one small US research firm that kept peddling a very different narrative. To quote the author of the report— "I believe Rain is a potential "triple play" — essentially you're buying a quality business, trading at a depressed valuation, and one that is operated by a competent and well-aligned management team — providing several avenues for capital appreciation." The report was released in 2013 and surprisingly, it did not elicit a lot of interest for two years until it made its way into the hands of Mohnish Pabrai, the veteran investor and fund manager.

"About 2½ years ago a benevolent human (whom I have yet to meet or speak to) sent me an elegant write-up on a Hyderabad, India-based company I had never heard of called Rain Industries. Within a few hours of reading and validating the facts he presented in the write-up, I knew that a huge winner had been dropped into my lap"— Mohnish Pabrai in his quarterly letter to investors

As he scoured through the report, he began to find evidence of a smart manager making prudent capital allocations. Returns on most ratios were improving. The company was slowly chipping away its debt. It was consolidating its position as market leader and as illustrated by the author, Pabrai was beginning to think there was an anomaly here after all.

When valuing a business most money managers tend to look at free cash flows. If a business is going to make money for 10 years and keep churning out cash in the process, it had to be worth a lot more. Rain Industries was already servicing a large debt, so it was imperative that the company generate consistent cash flows and prudent forecasts of the company's free cash flows yielded results that showed Rain would have little problem in servicing its debt obligation, Mohnish Pabrai picked up a stake in the company soon after. This was the moment of reckoning that most investors were hoping for. A big money manager offering visibility on a beat down stock would surely change its fortunes. Unfortunately nothing happened. Zip. The stock stayed where it was.

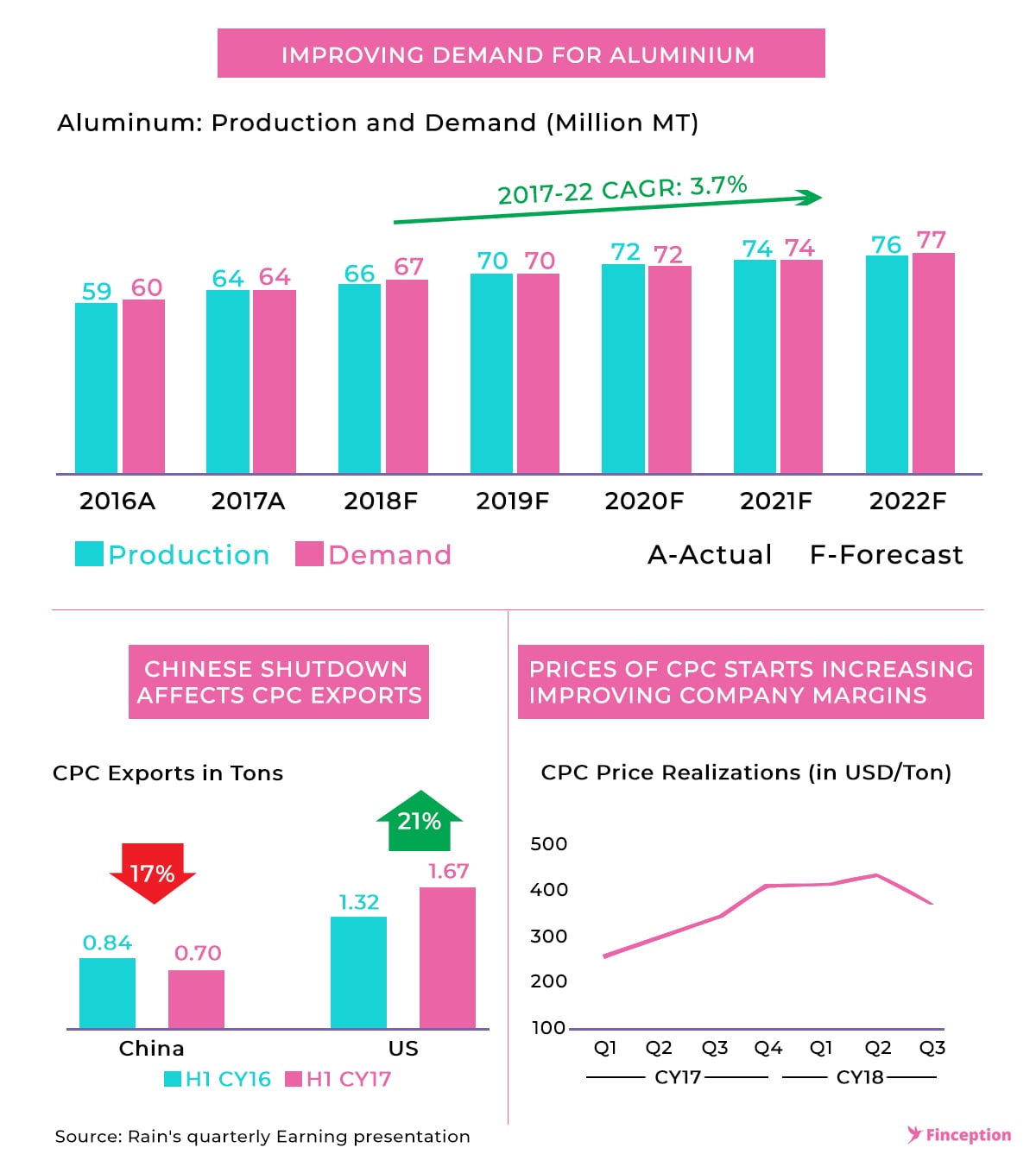

A well-known principle of chemistry establishes that ingredients can be mixed together with little effect until a third ingredient- often an innocuous catalyst- triggers a chemical synthesis. To trigger certain types of reaction a catalyst is indispensable. After having seen very little change in its stock price, many observers were beginning to think that the valuation re-rating was unlikely to happen any time soon. By 2016, margins were shrinking, there was a glut in aluminium supply and selling CPC and CTP was becoming increasingly harder and then in late 2016 the trigger finally arrived. There was news coming out of China that the country was about to witness a widespread shutdown of polluting plants in a bid to make cities more environmentally friendly.

The Chinese Government banned the use of low-grade pet coke. This was the not-so-good stuff companies used to power their cement and steel plants (also highly polluting) and when they couldn't use it any more they had to shift to anode grade GPCs (less polluting). This sudden demand for GPCs immediately translated to higher CPC prices. Companies like Rain that already had long term contracts with GPC suppliers were temporarily shielded and they could benefit from higher CPC prices. The Chinese government also shut down a few Calcining plants and this added to the crisis pushing prices even higher. The final nail in the coffin came when China decided to close down its blast furnaces, a highly polluting variant of steel manufacturing plants. Coal tar, the raw material used to make coal tar pitch(CTP) is a byproduct of producing steel in a blast furnace and when they closed down these plants, Chinese CTP manufacturers were denied their precious raw material taking coal tar pitch prices to new highs as well. The cascading events soon translated into improving margins and the stock caught on like wildfire.

A survival trait that humans have adapted since time immemorial is the ability to seek out information that aids their survival. These could be social cues that help you fit in or behavioural traits that help you adapt to ambiguous situations. It's an evolutionary mechanism that prods us to "follow the herd", lest we stand out. However, when you carry this sentiment over to financial markets, the outcome can prove particularly disastrous especially when large fund houses are also in on the herd.

In a 2005 paper titled "Thy Neighbour's portfolio," researchers concluded that a mutual fund manager is more likely to buy (or sell) a particular stock in any quarter if other managers in the same city are buying (or selling) that same stock. This was an attempt to study how investors spread information and ideas about stocks to one another directly, through word‐of‐mouth communication. When information spreads quick enough the surge in buying activity and the resulting bullish sentiment will self reinforce and propel the markets to react even faster setting off a dangerous chain reaction. When the collective conscience of the market finally realises that prices have reached unsustainable levels the sentiment reverses. Such booms and busts are characteristic of all financial markets, regardless of size, location, or even the era in which they exist.

As Howard Marks noted in his 1991 memo — " The mood swings of the securities markets resemble the movement of a pendulum. Although the midpoint of its arc best describes the location of the pendulum "on average," it actually spends very little of its time there. Instead, it is almost always swinging toward or away from the extremes of its arc. But whenever the pendulum is near either extreme, it is inevitable that it will move back toward the midpoint sooner or later. In fact, it is the movement toward an extreme itself that supplies the energy for the swing back"

So the euphoria that gave way to the meteoric rise of Rain also took it down like a pack of cards. Once the industry conditions returned to normalcy, CPC and CTP prices moderated and the supernormal margins began to evaporate. There was also news of a Supreme Court ban on Indian coke imports, suggestions that aluminium prices were on the decline, pressure on CPC and increasing bond yields* — all negative news that added to the panic. But despite the greed and fear, it's worth looking at where the stock price stands today. The original investment thesis presented simply stated that the stock was undervalued and prodded investors to wait for the inevitable correction in prices. Beyondproxy's target price back in 2013 was ~Rs. 170. However not much changed for the next 4 years until the Chinese effect propelled the stock to unimaginable highs and brought it back to ground zero. One could argue that since the publishing of the original report business operations and external conditions have improved for the better. However, in almost anticlimactic fashion, the stock price stands at 120 as of today. The correction came and went before investors could get a hold of their bearings.

*Rain issued bonds to refinance (roll over) their original debt. The yields on some of these bonds have seen an uptick in recent months pointing to a higher risk profile. (The yield on a bond maturing in 2025 has increased from 6.5% to 9.7% since August). Source: FINRA

"There are some strong tail winds that have emerged that simply did not exist in 2015. As a result, I believe we still have some room to run on this winner — and, barring any meaningful negative developments or more compelling ideas, I intend to let it run." — Mohnish Pabrai on January 2018

True to Pabrai's predictions, the stock price did run. Unfortunately, it ran on the opposite lane. After offering Pabrai a 12x return on his investment, the stock price went back to 120. This unfortunate sequence of events has prompted several people to criticize the veteran investor for his gross misjudgement. While we believe some criticism is due, we want to play the devil's advocate here. Pabrai could, in fact, have booked some profits on his investment but it's also quite possible that he was simply acting as a prudent money manager would. When new information (Chinese Intervention) was presented to him, he simply reevaluated his position. This kind of Bayesian thinking is central to good decision making. His original position was that the stock had room to multiply 10 times but in the face of additional tailwinds, he revised his estimates.

As the popular website, FarnamStreet notes in one of its articles — "Knowing the exact math of probability calculations is not the key to understanding Bayesian thinking. More critical is your ability and desire to assign probabilities of truth and accuracy to anything you think you know, and then being willing to update those probabilities when new information comes in." Pabrai's bet was on Jagan Mohan Reddy and the quality of his management team. It was a bet on his ability and foresight to take the business to new heights and more importantly it was a bet on the company's future. His investment decision was premised more on new information and less on short term market gyrations. The events that transpired over the year did precious little to change his conviction. Maybe that's the right approach to investment after all. Maybe all you need is courage and conviction to back your ideas through bumpy roads and heavy winds. Maybe all it takes is a bit of old fashioned guts.

. . .

Enjoyed reading? Show us your love by sharing...

Tweet this articleReview & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsDisclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

READ NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts