On October 13th 2017, a little-known market research company called MRSS India had a small, yet significant update on its website. The update read “Our stock is up 5500% since IPO and has reached a record price of Rs. 610.” This was going to be an ominous update because soon after the announcement, the stock price began to slide and it’s currently languishing at about Rs. 40. Back in May 2018, one of our first assignments was to look at this company as a potential investment opportunity for a client, when the stock was still trading at Rs. 220. After careful analysis of the numbers and a painstaking review of the annual reports, we were convinced that the company was in line to double its revenue and likely to do the same with its bottom line as well. In addition, our review heaped praise on the promoters, management and a strategic acquisition of a Singapore based company for what we thought was a bargain price.

When the results were announced a couple weeks later, we felt vindicated because our predictions were in line with what the company posted. Unfortunately for our client, the experience was harrowing, to say the least, because, despite the stellar financials, the stock price tumbled from Rs. 200+ to about Rs. 100 in a single day of trading. We were quite perplexed by the subsequent developments. We couldn’t figure out who was selling or why and it kept bothering us. It was only much later that it dawned on us that we might have glossed over a few details that should have piqued our interest. So today’s story is about vigilance and detecting potential signs of trouble. It’s about being deeply sceptical of tall claims and treading the markets cautiously. But before we delve any further, a point of interest.

We must preface this story by saying that none of the companies we are about to cover have been penalised by any regulatory/legal authority for any wrongdoing. Most of the coverage here is speculative and is borne out of an academic interest and does not imply trickery or deciet from the part of promoters or the management.

By the time the euphoria of starting a startup had died down, we had abandoned the rose-tinted glasses for a more pragmatic worldview. We visited MRSS India once again and saw that the numbers had a few inconsistencies that had seemingly somehow slipped right under our noses. For one, the company had claimed to be a leader in deploying technological resources to conduct market research and yet housed only 25 lakhs worth of computers and computer systems in its offices while making close to 44 Cr. in revenues (Standalone). This isn’t of particular interest until you note that its sister company, Focus Suites, another market research company houses close to 2.5 Cr worth of computers & servers, despite earning less than a third in revenues (compared to the standalone entity — MRSS India) and largely restricting itself to fieldwork and qualitative research.

It wasn’t just the computers, the acquisition of the Singapore based market research entity also started looking suspect. The company paid 3.1 Cr for an entity that made close to 22 Crores in revenues, no debt and had a cash balance of Rs. 2.6 Cr. One could look at this and say MRSS got itself a bargain by paying only 50 lakhs or you could see this as an opportunity to quiz the management about how such a deal came by in the first place. And then there are the damned computers again. In what can only be described as a bizarre move, the company discarded computers worth 1 Cr. (out of a total 2 Cr. worth of computers) from within the newly acquired entity and still somehow managed to double revenue (consolidated basis).

Now the company might have a perfectly reasonable answer to explain away all the discrepancies but these niggling elements are reason enough for investors to be proactive during discussions with the management. If you can’t have a sit down with the management, shoot a mail to investor relations, but always try and plug in loose ends.

Our next assignment was to look at a construction company which at the time looked like a proper bargain. It had posted revenues of close to ~Rs. 250 Crores and profit margins of ~23% the previous year. The company was poised to receive awards worth Rs. 1,100 Cr. through arbitration and based on the valuation, seemed like an investor’s ultimate dream package.

However, on digging some more, we found that over 50% of all the company shares were pledged as collateral which according to RBI’s own estimates was an extremely risky endeavour. There were other concerns alongside the pledging which prompted us to then write to the investor relations department seeking clarification. They wrote back, asking us to wait for another week until the release of the annual report. A week later, however, there was no annual report, instead, the company’s auditors (PwC) quit and the stock price tanked. As a guiding principle it perhaps pays to remember — If something seems too good to be true, that something probably is too good to be true

Pro Tip: Digging into financial statements of companies to detect accounting gimmicks is no easy task and we harbor no illusions about the difficulties rife in interpreting accounting statements. But perhaps it pays to consult a friendly Acccountant while investing vast sums of money in relatively untested companies if you can’t do it yourself.

When we first looked at 8k Miles Software Services limited, it was purely out of an academic curiosity. Unlike MRSS India and Atlanta Ltd., we did not publish a report on 8K Miles, instead were looking to learn more about a software company that had seemingly grown at exorbitant rates and had rewarded its shareholders handsomely. However, soon after we opened the financial statements, we saw one glaring mismatch — The company’s earnings on paper and the cash it kept generating.

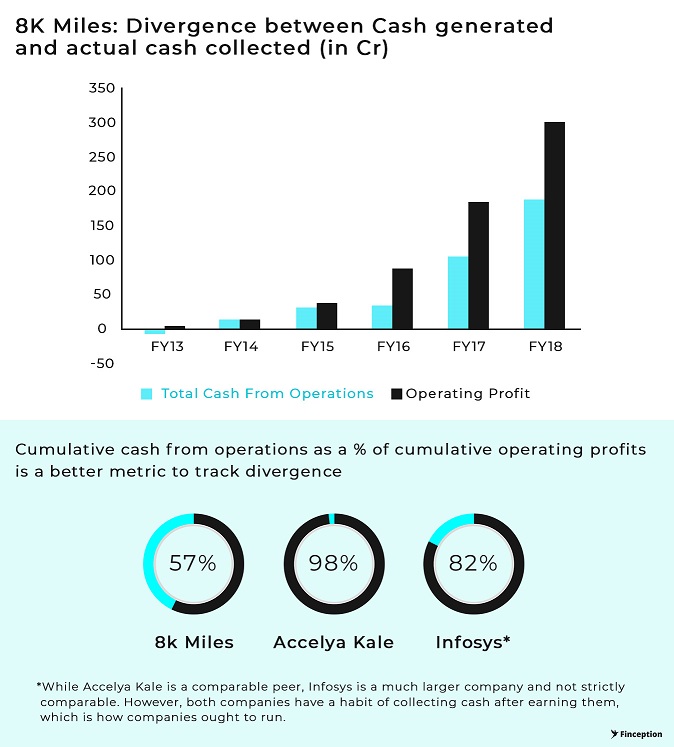

A neat trick to identify potential signs of cash mismanagement is to look at the divergence between the company’s net profit and free cash flow i.e. the cash left over after a company pays for its operating expenses and capital expenditures. A huge difference between the numbers could potentially tell you one of two things — The company has difficulty collecting cash from its clients or it’s reporting revenue aggressively in a bid to boost growth. For 8K Miles, the divergence kept increasing and there were potential signs of cash mismanagement.

If you are more technically inclined, you could also look at the Cumulative CFO/Cumulative EBITDA: This ratio is a check on a company’s ability to convert its operating profits into operating cash flows. Given enough time, a company’s profits should ideally translate into cash. A low ratio (i.e considerably less than 1) could potentially indicate signs of cash mismanagement

However as we would soon find out, this was the least of their worries. Their auditor had already resigned the previous year and their Chief Financial Officer, soon after. The promoter kept alleging that some of his shares were illegally sold, their intangible assets ( assets that are not physical in nature i.e. patents, trademarks etc.) kept piling and the Managing Director kept telling everybody how nobody understood the company’s business model. John Maynard Keynes, the brilliant economist and one of the most prolific investors of the 20th century once remarked — “As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes….One’s knowledge and experience are definitely limited and there are seldom more than two or three enterprises at any given time in which I personally feel entitled to put full confidence.”

Tall claims warrant great skepticism — The company also said it had 50 Cr. worth of Blockchain tech on its balance sheet. Very few companies across the world have any commercially viable blockchain projects and most of them are still proof of concept ideas. Valuing these intangible assets is almost as hard as monetising them as of today. Even likes of IBM & Microsoft, leaders on this front don’t have “blockchain” assets on their books.

Related Party Transactions (RPTs) represent transactions between the company and entities closely related to it, including its own directors, promoters, and other subsidiaries. Imagine dealing with vast sums of money between your own people and institutions without good reason, when you are expected to be the custodian of a publicly listed company. At one extreme, such transactions could simply amount to adequate compensation paid towards employees or board members; at the opposite extreme, such transactions could be an avenue for misappropriation of company assets. This often does not reflect well on the management or the promoters, yet there isn’t anything materially illegal about such transactions so long as you can support them with good reason. However, there are times when you simply cannot offer any reason, let alone a good one.

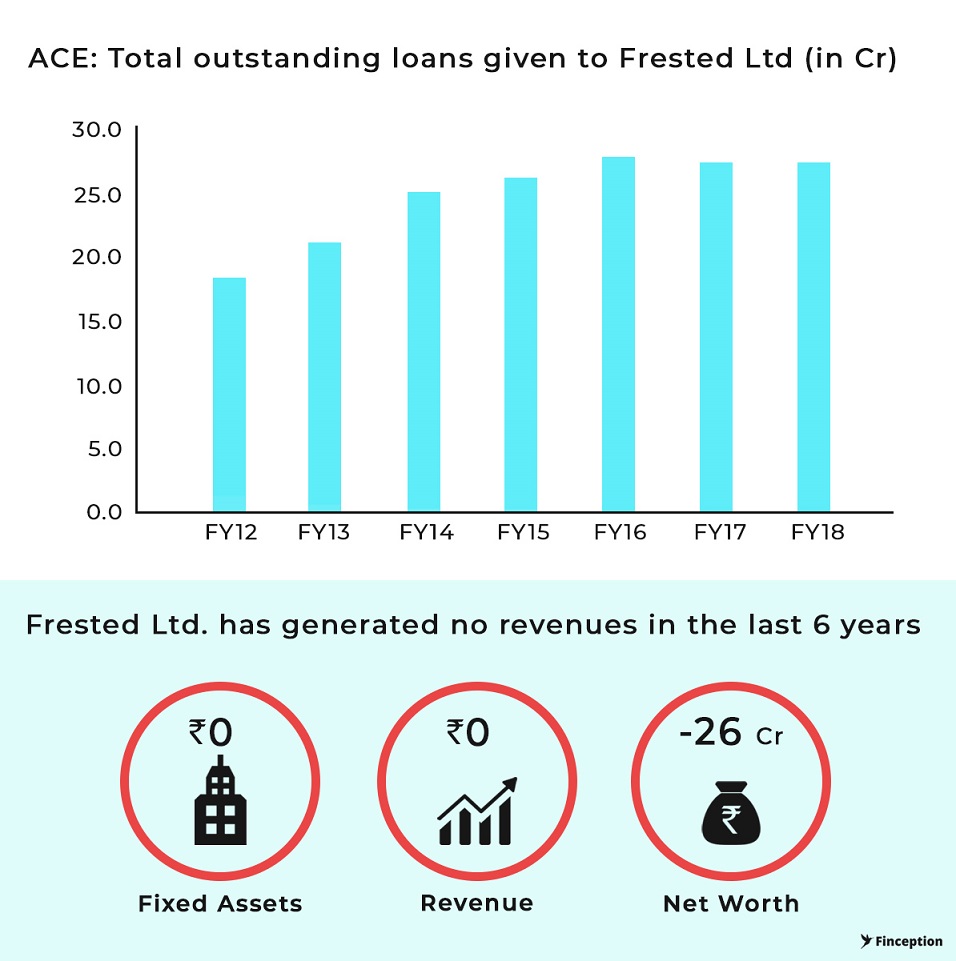

A case in point is Related Party Transactions of a company called Action Construction Equipment(ACE) Ltd. Its stock price tripled in value over the course of 6 months on the back of impressive performance which prompted us to go read the story some more and there it was. A rather inexplicable transaction between the company and one of its subsidiaries. The company seemed to be giving out loans to its subsidiary Frested Ltd ( The total loans disbursed to this entity had increased from 18.5 crores in FY12 to 27 crores in FY17) despite the fact that the subsidiary had been non-operational, had generated no revenue and had very little assets on its books. Perhaps investors of ACE would do well to query the management on this issue. But the point is suspect RPTs can have a material impact on investor confidence.

Researchers in the US have found that frauds involving RPTs have a smaller financial impact than frauds that do not. However, frauds that involved RPTs are more likely to have involved the CEO and/or CFO and to have involved misappropriation of assets than are non-RPT frauds. Taken together, these findings are consistent with the argument that — conditional on the existence of fraud — the existence of a related party transaction increases the qualitative, if not the quantitative impact of the fraud. It’s a bit of a stretch to extend this argument to Dalal Street in the absence of any concrete evidence, but its still food for thought.

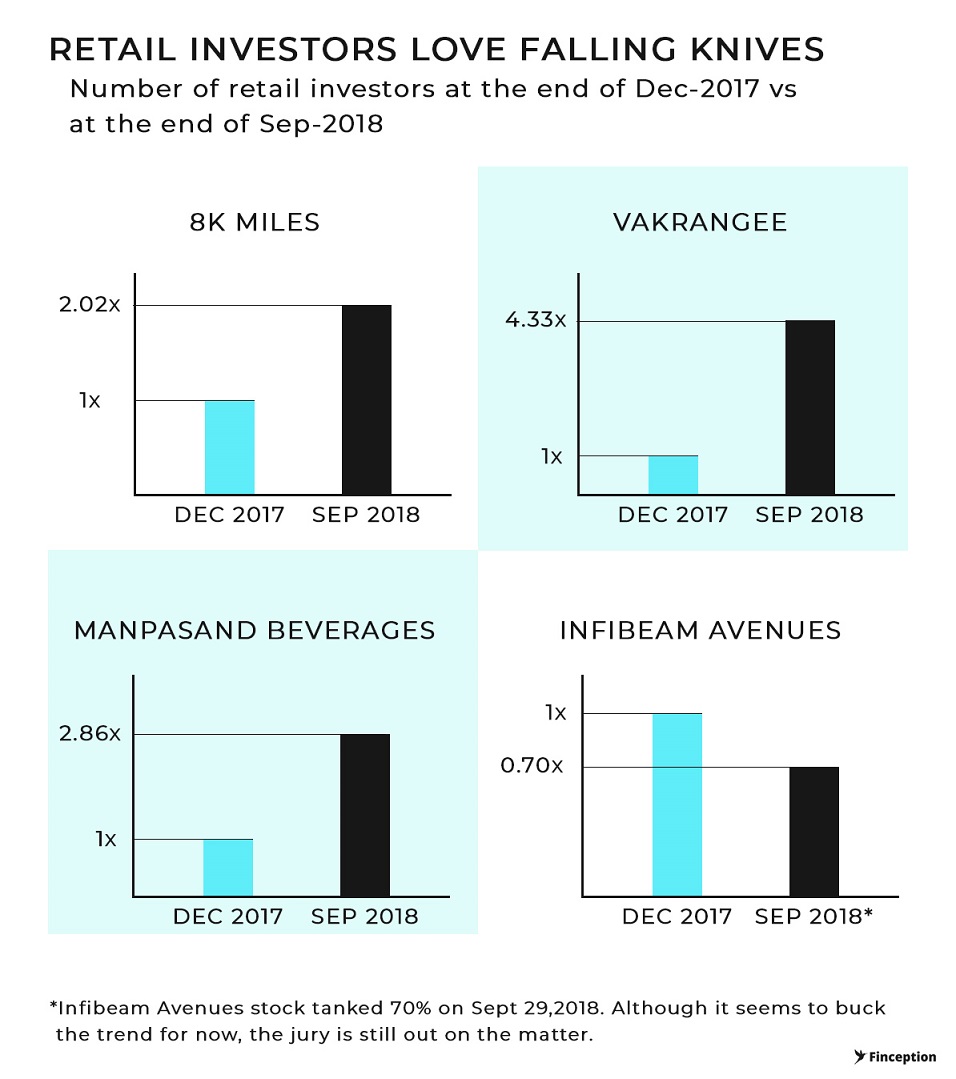

Now all of this would seem pretty irrelevant if retail investors were prudent and cautious whilst making investment decisions. Unfortunately, though, it seems most of them have a penchant for risk-taking, especially whilst catching a falling knife.

A falling knife, in stock market parlance, is used to describe a rapid decline in the price or value of a security. The term unto itself doesn’t say much but the general consensus among investors and traders alike is that buying into a stock that is falling in value can be extremely dangerous. Although there is a significant money-making potential, timing the market(buying at the bottom and selling at the top) is an extremely challenging endeavour. However, evidence suggests that retail investors aren’t particularly averse to the idea of catching falling knives, instead are eager to throw more good money into a burning pyre.

It seems investors are more confident about their predictions than they ought to be, especially when they have little to no idea about the investments they make. At times of crisis, most investors selectively filter for information that supports their existing worldview and try to contort new evidence to fit into this narrative. People hate losing much more than they enjoy winning and so when the stock price drops, instead of cutting losses they double down on their bet in the hope of turning it all around. So how do you immunize yourself against such bias?

The companies listed above have seen a sharp erosion in their market value due to alleged corporate governance issues

Karl Popper the Austrian British philosopher saw this as a very real problem. As a way to cure this ill of self-confirming theories and belief systems, he came up with what is now called Theory of falsification: the idea that a theory or belief system can only be scientific if it clearly lays out what specific evidence would prove it wrong. Although Popper was trying to confine his ideas to scientific theory, it provides a useful guide for investors as well. After all, if we find evidence that seems to contradict our beliefs, we should reconsider if we need to abandon or modify them at least.

In practice, if you’re going to claim that you know something, you have to be willing to admit that you could be wrong about it and describe the kind of evidence that could disprove your investment hypothesis. You have to make yourself falsifiable. This is important for two reasons — If you’ve made every attempt to disprove an investment hypothesis there is comfort in knowing that you can mitigate some of the risks involved in investing. But its also true that such endeavour often leads you towards intellectual safety and certainty, which can prove to be vital if you are a retail investor.

While we have tried to elaborate on some of our own experiences dealing with suspect numbers and mischievous financial reporting, this piece is in no form or shape comprehensive enough to deal with the myriad financial shenanigans that occupy the minds of those who try to deceive and cheat gullible investors and so we end this story by making a call to you, fellow reader — to be wary of everything you see and hear about stocks and always read between the lines.

Suggested Reading : Financial Shenanigans by Howard M Schillit. If you are interested to read our amateur reports from earlier, you can find them here (MRSS India and Atlanta Ltd). “Hindsight is always twenty-twenty — Billy Wilder.”

. . .

Disclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts