Published 4th Apr, 2019

On the 2nd of March, I packed my bags to go home and enjoy a nice vacation. As soon as I landed, however, a fellow passenger who I had greeted with a smile earlier began to strike up a conversation. He told me he was attending an investing conference scheduled the very next day and asked me if I was interested in going. Although I politely declined his invitation, the thought of missing a serious investment conference began to plague my mind and eventually, I caved in. So despite having to cut my vacation short and travel an arduous 100 odd Kms, I decided to go anyway in the hope of learning something new. And boy did I have a blast. The topic was "Investing 2020" and the speaker prepared an exhaustive note that involved recommendations, mental frameworks and investing tools for the average retail investor. But there was one theme he kept touting repeatedly over and over again — The Indian Consumption story. For all the positives that came out of the talk, I couldn't stop thinking about the almost blind faith he had in the Indian Growth Narrative and how everyone around me seemed to agree in unison.

If you were to pick up an analyst report today and glance through it, in all likelihood you will also find a reference to the Indian consumption story. This in itself isn't a problem. When you are building an investment thesis or covering a stock, even if it's an elementary prognosis, it should ideally include your opinion of the broad macroeconomic outlook for this country. Even the best companies are likely to falter if the economic future of a country looks bleak and so offering a well-informed opinion on the matter is likely to benefit the reader. However, it is also important to remember that an assessment of the economic scenario alone shouldn't be the core tenet of your investment thesis. If the only reason you expect the stock do well in the foreseeable future is that you see a booming economy in front of you, then most rational people would agree that such an assessment is incomplete. Unfortunately, however, we are at a point in history when we are seeing an overwhelming consensus within the retail public and certain sections of the analyst community that a few stocks are likely to outperform solely on the merit of the Indian consumption story. Our story today tries to offer a radically different view — that the Indian consumption story is not some divine panacea and is fraught with uncertainties like most other things related to investing.

For the uninitiated, the Indian consumption story is the quintessential growth story of this country. The story is always told the same way. India is after all one of the fastest growing economies in the world. As we move closer to the future, more people will lift themselves out of poverty and assimilate with the burgeoning middle class. With improved well being the story posits that they will likely spend more and in turn aid the economy resulting in a virtuous cycle of growth. This increased spending i.e. consumption will then reflect in the growth of Indian companies and through it affect the stock markets and so a bet on the consumption story is a reliable way of making wealth, at least that's the hope. In support of this theory pundits often point to rising income, cheap credit, urbanisation and low inflation as proof that the Indian growth story is as robust as ever. In addition to this, there is one other theme that most people believe will be the driving force of the consumption story — the demographic dividend. India is a young country. Over the next few decades, it will have the largest working class population in the world. Unlike other economies whose population is ageing, India is at the precipice of reaping the advantage of hosting a large working class and this much is undisputed truth. While other predictors like inflation and credit availability dance to their own tunes, the working-class population will almost certainly emerge over the course of the near future and barring a nuclear catastrophe, young boys and girls you see around you will become the hard-working men and women that build the nation of tomorrow.

Point of Interest — Demographic dividend occurs when there is accelerated economic growth aided by a decline in fertility and mortality rates. A country that experiences low birth rates in conjunction with low death rates receives an economic dividend or benefit from the increase in productivity of the working population that ensues

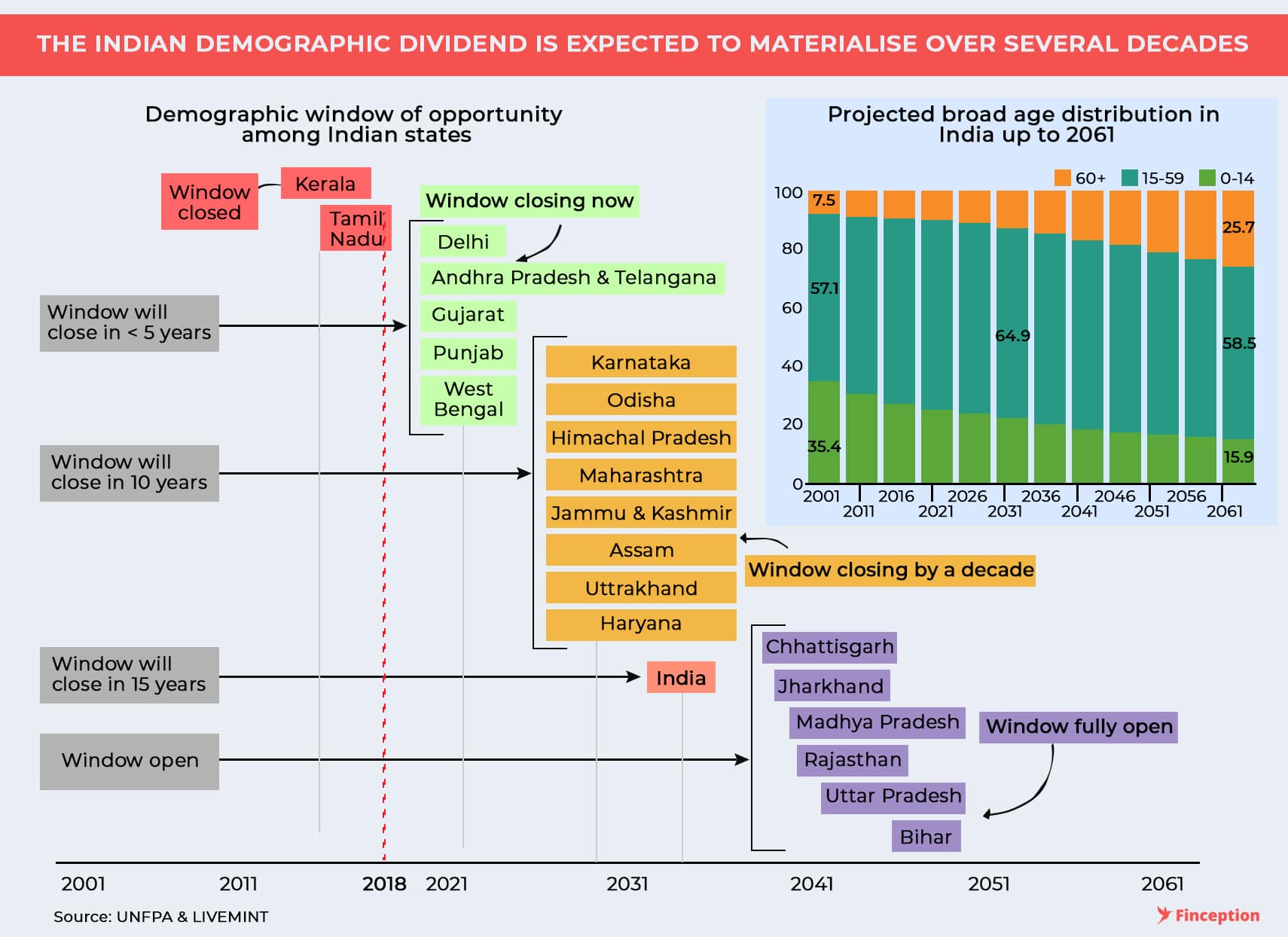

Unfortunately, this is where all the certainty ends. While there is an almost unanimous consensus that India will reap the benefits of a young population, academic opinion and anecdotal evidence on the matter is far from convincing. In an excellent paper observing the effects of a burgeoning working class population on the economy, Bloom & Canning (2004) make some startling revelation. Their assessment is that both empirically and theoretically there is nothing automatic about the link from demographic change to economic growth. Age distribution changes merely create the potential for growth. Whether or not this potential is captured depends on the policy environment. In Taiwan for example, the economy experienced accelerated growth on the back of huge investments in education. A highly skilled labour force and a high savings rate provided the perfect recipe for economic prosperity. However, Latin America largely squandered its opportunity. Policy Makers in India are well aware of this fact. In fact, SBI only recently warned about the dangers of India losing its demographic dividend by citing the example of "empty primary government schools in Karnataka". Unless there is an environment that facilitates useful education, the demographic dividend will likely remain a pipe dream. Even other factors like increased urbanisation are not divine decrees. While there is little debate surrounding the migration of workers from the rural workforce to non-farm areas, there is considerable debate about the pace at which non-farm jobs are being created in this country. Even if one were to assume that a favourable policy environment will prevail and India will, in fact, reap every single ounce of benefit accruing out of the demographic dividend, readers must bear in mind that these benefits are likely to accrue over multiple decades and not all at once. A recent study on the demographic dividend in India by United Nations Population Fund (UNFPA) shows that the demographic dividend opportunity in India is available for five decades from 2005–06 to 2055–56, longer than any other country in the world. Another interesting fact is that this window of opportunity is open at different times in different states. While the likes of Delhi and Andhra Pradesh are expected to see this window open over the course of the next few years, Kerala apparently has its shutters down already. So when you are looking at the Indian growth opportunity, it also makes sense to zoom in and look at where the opportunities are likely to materialise and when.

Even if one were to assume that the Indian consumption story will materialise without a hitch not all companies will do equally well in the face of economic prosperity. Consider the behaviour and performance of the Indian financial market which includes banks, financial institutions, housing finance, insurance companies and other financial services companies. As the consumption story has unfolded over the last couple of decades*, more people have borrowed than ever before and this has translated to increased prosperity for financial institutions. However, it is also important to note that during the same time frame many financial institutions simply went bankrupt or merged with larger entities leaving very little wealth on the table for their shareholders. Consider for example the catastrophic fall of the Global Trust Bank. After being involved in the Ketan Parekh Scam and having lent heavily to individuals speculating in the stock market; the bank promptly folded in 2004 after it posted a series of extensive losses. Eventually, though the company merged with the Oriental Bank of Commerce, but not before several investors had to part with their hard earned money. So while the growth story might, in fact, be intact it can't possibly insulate you against scams and strategic blunders. So it's not wise to rationalise a stock purchase using the Indian growth story and not having done your due diligence. In fact, a better approach here would be to bet on entire industries. If you can't predict the individual success of companies but are fairly certain about the likelihood of success of the industry itself you can simply go and buy the industry i.e. the relevant Nifty Index.

*While some economists have pointed out that the demographic dividend window opened up only after the millennium, some others have posited that the window opened as early as 1975

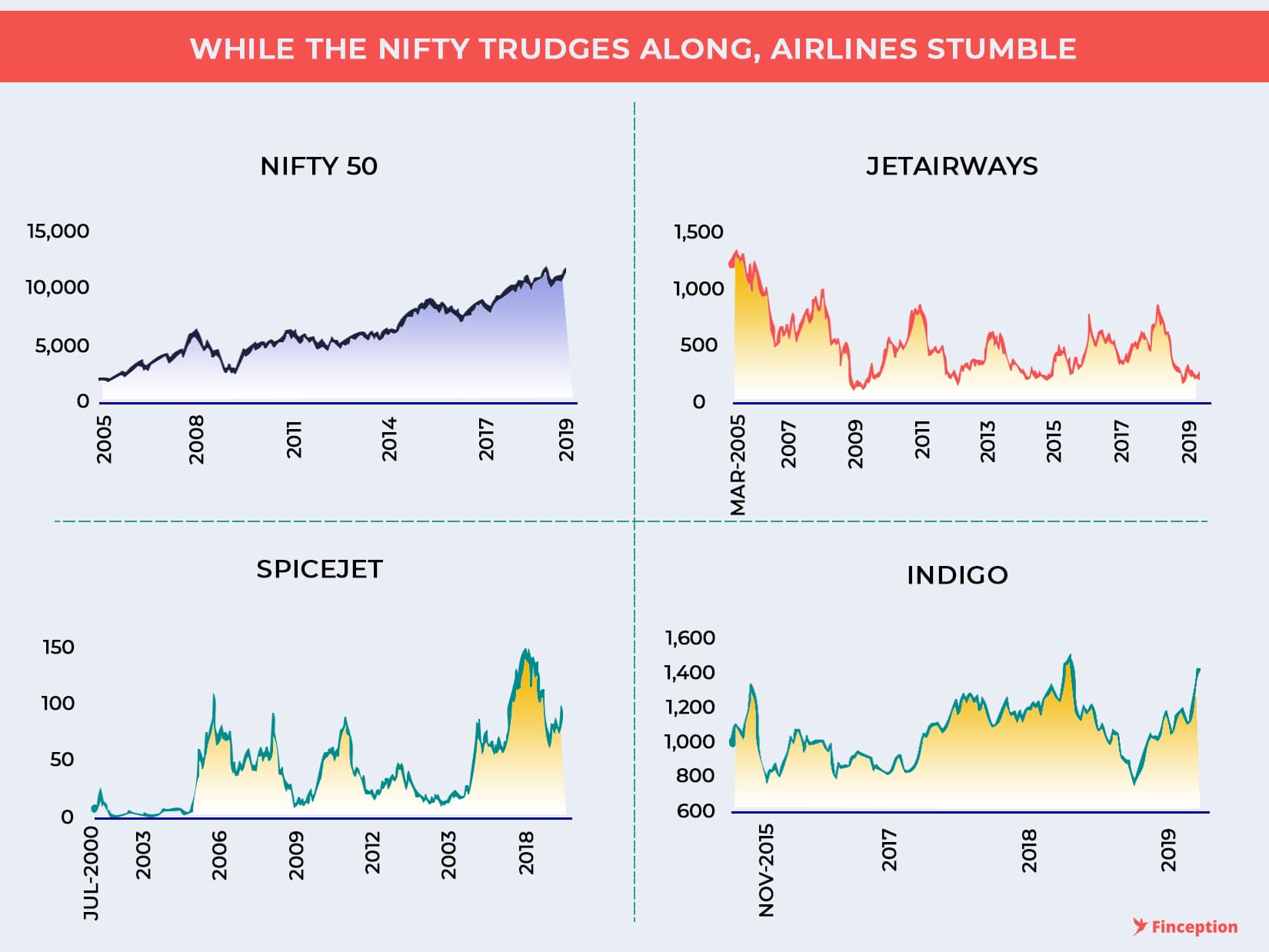

However, sometimes even betting on entire industries won't help you if the industry dynamic in itself is lopsided. Consider for example airlines, a likely benefactor of the consumption story in India. India is expected to be the 3rd largest civil aviation market by 2024. The total number of airports are likely to more than double over the course of the next decade with the market size expected to reach a whopping 290,000 Crores by 2023. When facts are packaged as neatly as this, one can only presume that even if there was some short term turbulence, airlines have a very bright future ahead of themselves considering the large working-class population India will host. Unfortunately, there is overwhelming evidence to suggest that this is in fact not true. Back in the '50s as civil aviation expanded in the United States and the economy began to rejuvenate, the expectation was that Airlines would do well. Considering the overwhelming opportunity available and the number of people taking to the sky you would not doubt for a second the money-making potential here. However, as more people got to the sky there was an interesting development brewing within the sector. There was very little separating the flying experience on any two airlines. In economic parlance, they call this commodification. When flying experience becomes overtly similar, the only differentiator is the price. If there are 5 flights flying out of Newark to San Francisco, the passenger will likely choose the option that costs him the least. And as the industry began to see intense competition price wars took its most logical course and close to a hundred airlines went bankrupt. The real question here is why did nobody do anything about it? Well, for one airline promoters still believed there was real money-making potential here and investors followed suit. The overwhelming consensus around the new age flying experience was too hard to ignore and when one airline went bust another one promptly took its place. Unfortunately, the Indian experience is unravelling much like the U.S experience, with very few airlines having made money for their investors and promoters alike. This is not to suggest that airlines are doomed for good. Instead, it's an urge to exercise caution. The consumption story will not automatically translate into gains and you must make no bones about it.

None of this is to say that the growth story of this country is long gone and dead. In fact, there is overwhelming evidence that despite the uncertainty surrounding India's future policy measures, India will likely do well over the course of the next few decades. However, it is particularly damaging to assume that as India does well (or to be more precise as pockets within India does well) everything operating inside India will do equally well. While it might seem intuitive, it is not as obvious as most people believe it to be. As Carl Sagan writes in his book 'The Demon-Haunted World' — "Do not trust what is intuitively obvious. That the earth is flat was once obvious. That heavy bodies fall faster than light ones was once obvious. That bloodsucking leeches cure most diseases was once obvious. That some people are naturally and by divine decrees slaves was once obvious. That there is such a place as the centre of the Universe and that the Earth sits in that exalted spot was once obvious. [However] the truth may be puzzling or counterintuitive. It may contradict deeply held beliefs" The point of this story is not to dissuade you from investing in the growth story of India. Instead, it is an attempt to convince you of the merits of investing in the Indian growth story based on the promise of individual stocks, not the other way round. Our hope is that the next time you hear the 'Indian Consumption story' being touted as a probable justification for an imminent rally in a stock, you will be critical, skeptical and mostly importantly alert to the possibility of things going wrong.

. . .

Enjoyed reading? Show us your love by sharing...

Tweet this articleReview & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsDisclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

READ NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts