At the turn of the new millennium, Yogesh Mahansaria, a bright-eyed 25-year-old was asked to take control of a small tyre manufacturer in Aurangabad. He had been working there for a few years with his father and was seen as someone who could turn around the company's fortunes and when his chance came, he did it with style. And then in 2006 when it seemed like the humble tyre company was just about to take off, he was abruptly asked to leave. By all measure, this was an unceremonious exit for a man who had virtually transformed the company from being a loss making entity to a $120 million global brand. But the controversial move nonetheless ushered in a new era and it's now on a quest to reach a billion dollars in annual turnover. Our story today is about Balkrishna Industries, a company that makes Off-Highway tyres (OHT) used in Agriculture and Mining equipment and whose stock has gained cult status within the investor community. But before we get to the meat of the story and the inherent investment opportunity we need to take a small detour and go back in time.

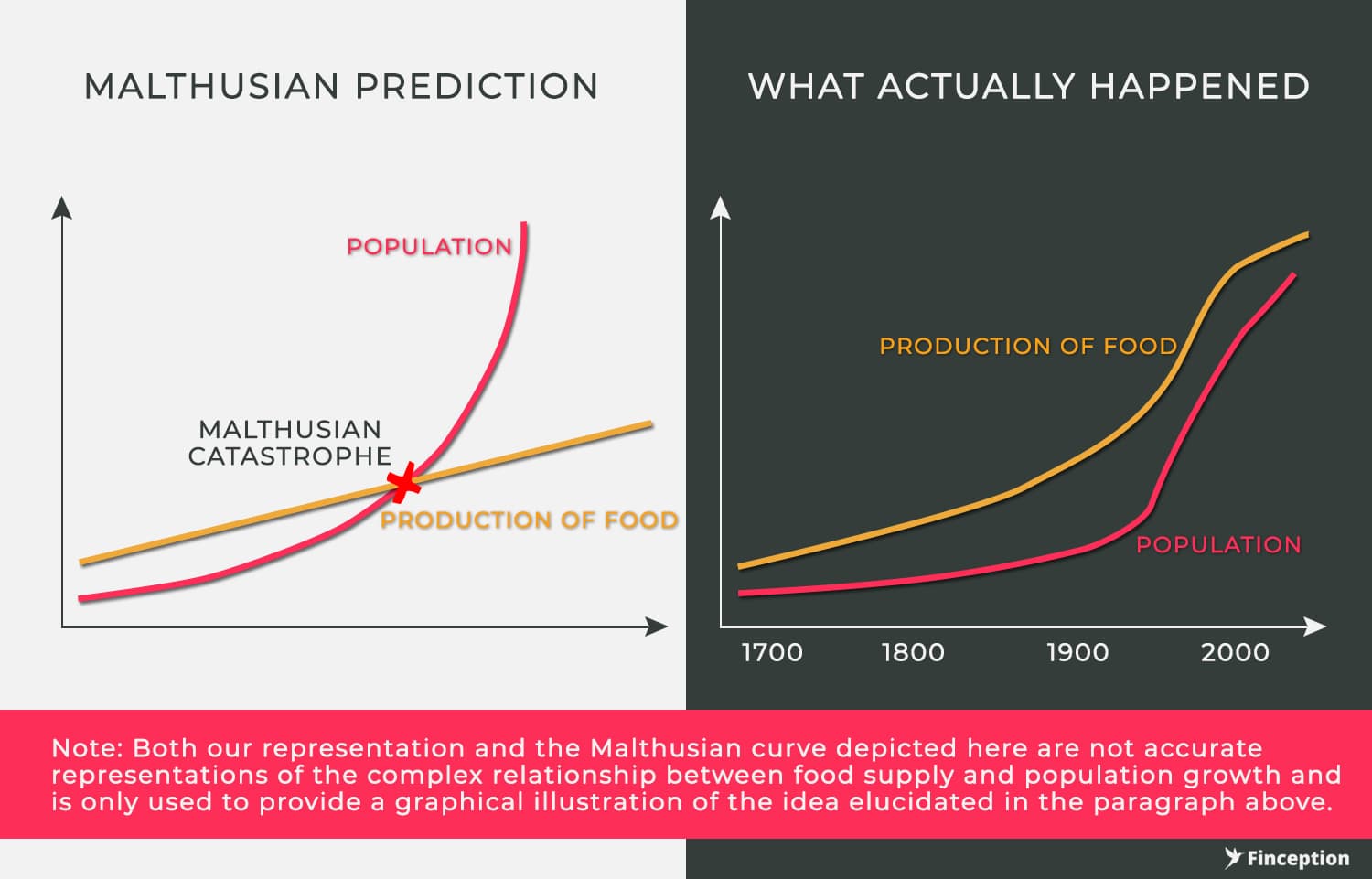

When Robert Malthus propounded one of the most controversial ideas of the 18th century there was considerable fear about humanity's ability to survive in the face of rising population. His principal contention was that while food production would grow linearly, population growth would be exponential. This, he believed would lead us to a point where world population would far outstrip food production rates and create a widespread scarcity of grain and foodstuff. Malthus was of the opinion that such a crisis could be averted only if natural forces intervened to fix the imbalance between food supply and population growth through natural disasters such as floods and earthquakes. Luckily for us, Malthus turned out to be wrong. As history would have it, people did not die of starvation, instead, the industrial revolution paved the way for farm mechanisation which in turn drastically improved farm productivity. And almost two centuries later this idea forms the cornerstone of the investment thesis most people ascribe to Balkrishna Industries.

Whilst dealing with an investment opportunity, any decision on future outcome relies heavily on an investor's ability to weave a compelling narrative about the stock. Considering Balkrishna tended to Agricultural producers (65% of the revenue comes from the agricultural tyre segment), the story that most people put together focused on farm automation i.e. "As farmland decreases and population grows, more farmers will resort to improving productivity by moving away from manual labour to semi/fully automated farm equipment." This, they believed would create a booming market for Off-Highway tyres and provide considerable demand visibility for the company. However, this view oversimplifies the complexities inherent in assessing future demand and it offers an incomplete assessment of the current scenario.

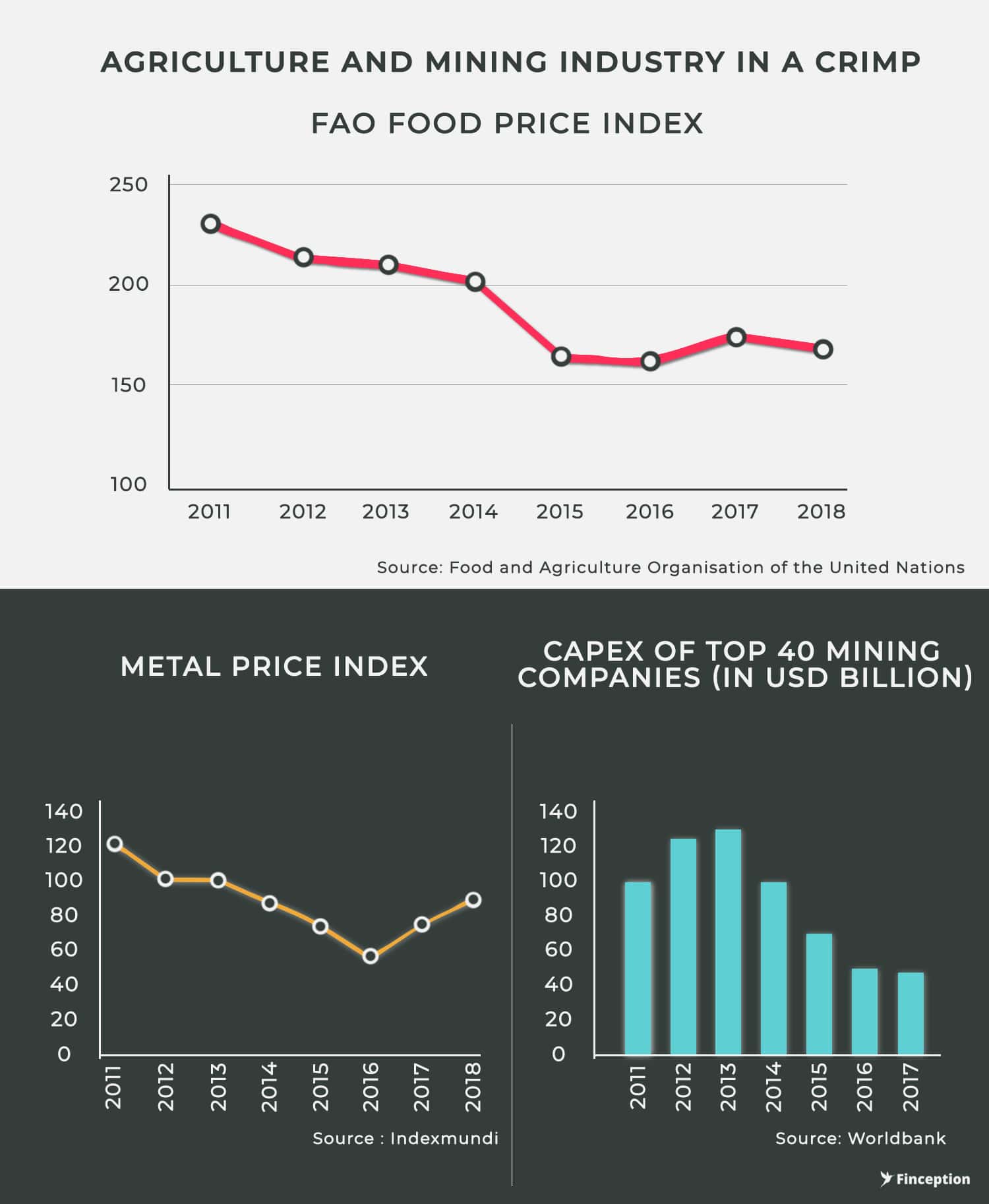

Farm mechanisation does not happen overnight and is often overshadowed by more immediate concerns. Take for example how farmers react to declining food prices. In an uncertain price environment farmers often delay their purchase decision until they can be fairly certain about their return on investment. So, if food prices are on a decline, it's unlikely you will see a boom in the agricultural OHT segment. According to the Food and Agricultural Organisation of the United States, the food price index has been on a steady decline for quite some time now. From 229 points in the year 2011 to 168 points last year, the index has seen a drop of nearly 26% over 7 years. So despite the mechanisation narrative, short term trends have been unfavourable towards farmers and agriculture in general.

Point of Interest : Titan International Inc., the largest producer of specialty tyres in the United States had this to say about the matter in 2018 — Rising interest rates and sluggish commodity prices also threaten farmer demand for new equipment through the remainder of this year and beyond. These uncertainties create the potential for farmers to further delay upgrading their equipment

It's also ironic that most of the untapped opportunity for farm mechanisation rests in Asia whilst Balkrishna Industries continues to generate a bulk of its revenue from exports to Europe and the U.S. The mechanisation narrative would make sense if investors were to witness an increase in domestic sales or exports to other Asian countries. However, that hasn't happened and even if it did, it's unlikely that a retail investor will notice the marginal impact of this trend on yearly sales volume.

Another contention is that Balkrishna's growth was driven by the mining sector. Mining companies that operate large vehicles need heavy-duty off-road tyres and the sector contributes to about 13% of the company's total sales volume. So if there ever was a burgeoning demand for Off-Highway tyres somewhere, it must have been lurking in the underbelly of the mining industry. However, the mining companies have been fighting their own demons for quite some time now. As one industry report from 2016 succinctly quotes — "The golden age of mining — underpinned by the rise of emerging markets which require large quantities of metal — is now a distant memory… The slump in raw material prices.. aggravated by the oil counter-shock of 2014 [has] suffocated the mining sector supercycle." Since 2012, very few mining companies have engaged in large scale greenfield expansion and its only in the past two years that we have seen some recovery in the mining sector. So contrary to popular belief, Balkrishna Industries was operating in an unfavourable business environment that should have crippled the stock and yet seemingly defying all odds they've grown both in size and stature. How do you explain such a contradiction?

In an Op-ed piece describing the effects of Globalisation, Thomas Freidman, a Pulitzer Prize-winning journalist made a prescient remark back in 2005. He wrote — "French voters are trying to preserve a 35-hour work week in a world where Indian engineers are ready to work a 35-hour day ... Next to India, Western Europe looks like an assisted-living facility with Turkish nurses… The dirty little secret is that India is taking work from Europe or America not simply because of low wages. It is also because Indians are ready to work harder and can do anything from answering your phone to designing your next airplane or car. They are not racing us to the bottom. They are racing us to the top."

When Balkrishna Industries started manufacturing Off-Highway tires, they had two distinct advantages — access to cheap labour and a growing talent pool. Their competition meanwhile was dealing with cost overruns and an expensive workforce. So when the company started selling tyres at a significant discount to most available alternatives they found a niche market that they could tend to. In fact, the depressing business environment aided Balkrishna's cause as opposed to stifling its growth. As food prices began to decline, farmers scouting for economical replacement tyres found considerable value in the company's product offering. Whilst there isn't any direct proof to substantiate this claim there is some anecdotal evidence to suggest that distressed farmers were indeed looking for cheaper alternatives.

When the former CEO of the American Tyre maker, Titan International, shunted an offer to buy-out an ailing tyre plant in France he offered an unusually honest assessment of the entire scenario. "The French farmer wants cheap tire. He does not care if the tires are from China or India …. Titan is going to buy a Chinese tire company or an Indian one, pay less than one Euro per hour and ship all the tires France needs. You can keep the so-called workers. Titan has no interest in the Amien North factory." In fact, unlike most companies that grew on the back of increasing demand, it seems Balkrishna, like other Indian tyre manufacturers, grew largely at the expense of their competitor's inability to cut costs.

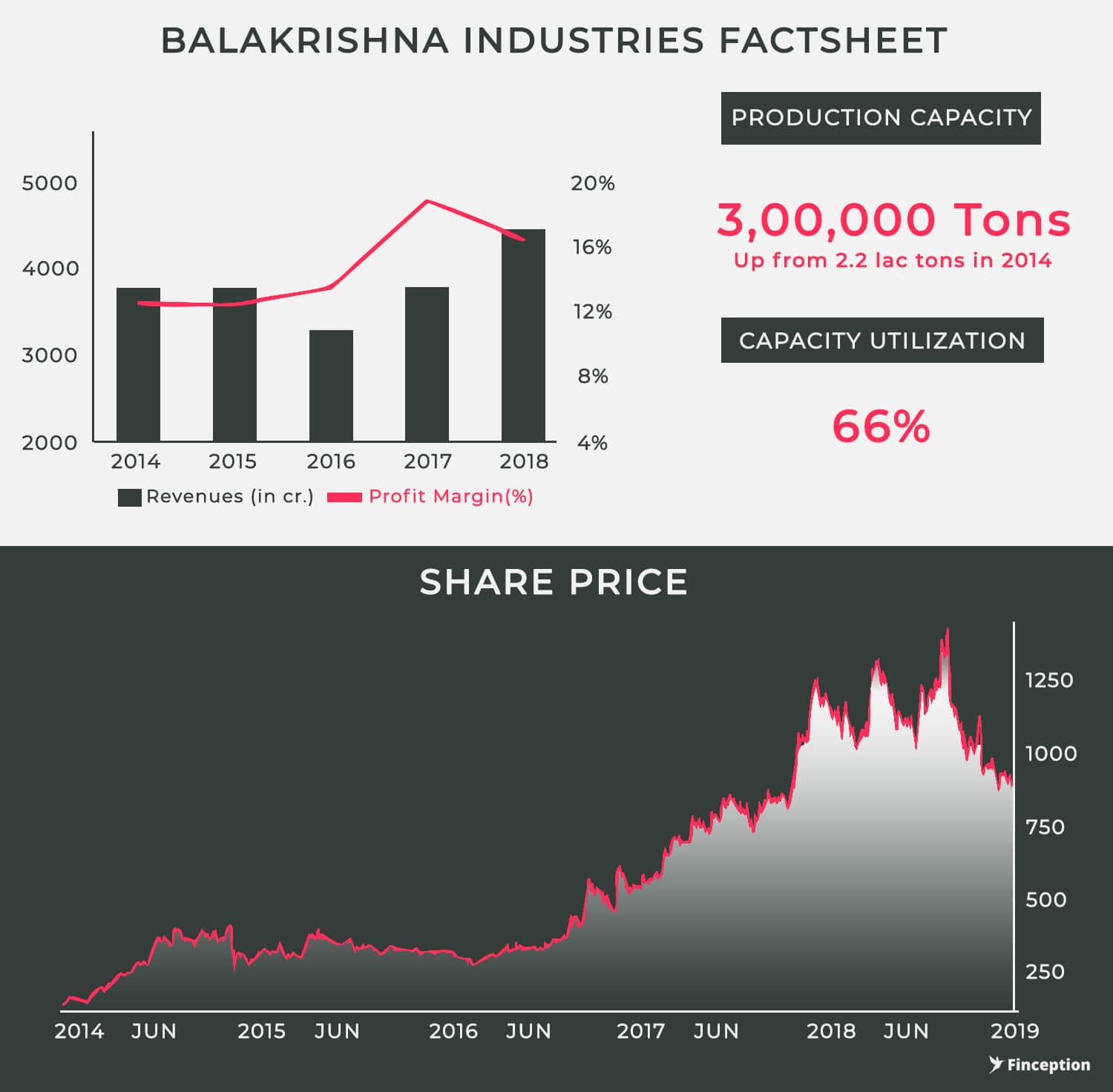

Back in 2004, the giants of the tyre manufacturing industry — Bridgestone, Michelin and Continental, dominated the competition catering to over 50% of the market. However, with the introduction of Asian manufacturers, they slowly began to cede market share and are currently down close to 30%. Balkrishna Industries, on the other hand, continues to grow. From 3% in 2011 to 5% in 2018, they've consistently managed to add to their total market share by following a cost-effective model. This addition in market share was complemented by a benign price environment for natural rubber (the principal raw material used in the production of tyres) over the past two years which augured well for both profits and the stock price. Another important feature of Balkrishna's growth story is that the Chinese have largely stayed away from the market.

Unlike other sectors, the OHT segment is a large SKU low volume business i.e. a business where the end consumers seek multiple varieties of tyres in low quantities and the Chinese don't tread areas where mass production becomes unviable.

Point of Interest : We intentionally used the words "largely stayed away" to explain Chinese disinterest in the OHT segment because while they haven't had any significant market share in this specialty sector, they did in fact start dumping cheap tyres everywhere back in 2016. This move had a visible impact on the top line of most tyre manufacturers, including Balkrishna

And that brings us to today. Although there is little Chinese competition now, the landscape is considerably different than it once was. When in 2011, there was only one large low-cost OHT manufacturer in the world, now there's two. Welcome to the second coming of Yogesh Mahansaria.

After his resignation from the board, Mahansaria went on to birth another Off-Highway Tire manufacturing facility — The Alliance Tyre Company (ATG). With the backing of a private equity firm he first bought out an ailing plant in Israel outbidding competition and seemingly snatching it from the clutches of the U.S giant Titan International. He then set up two plants in India to reap potential cost-saving benefits and bought out another plant in the U.S to avail opportunities in the American markets. Within 10 years he had built a company that could match Balkrishna in size and it seemed as if the company's promoters — The Poddar family had a new nemesis in town. Unfortunately for us, the drama ceased abruptly in 2016, when Yokohama tyres bought out ATG for a whopping $1.2 Billion. For the uninitiated, Yokohama is one of Asia's largest tyre manufacturing company and their new subsidiary (ATG) is on an aggressive expansion campaign deploying the same strategy that helped Balkrishna Industries thrive.

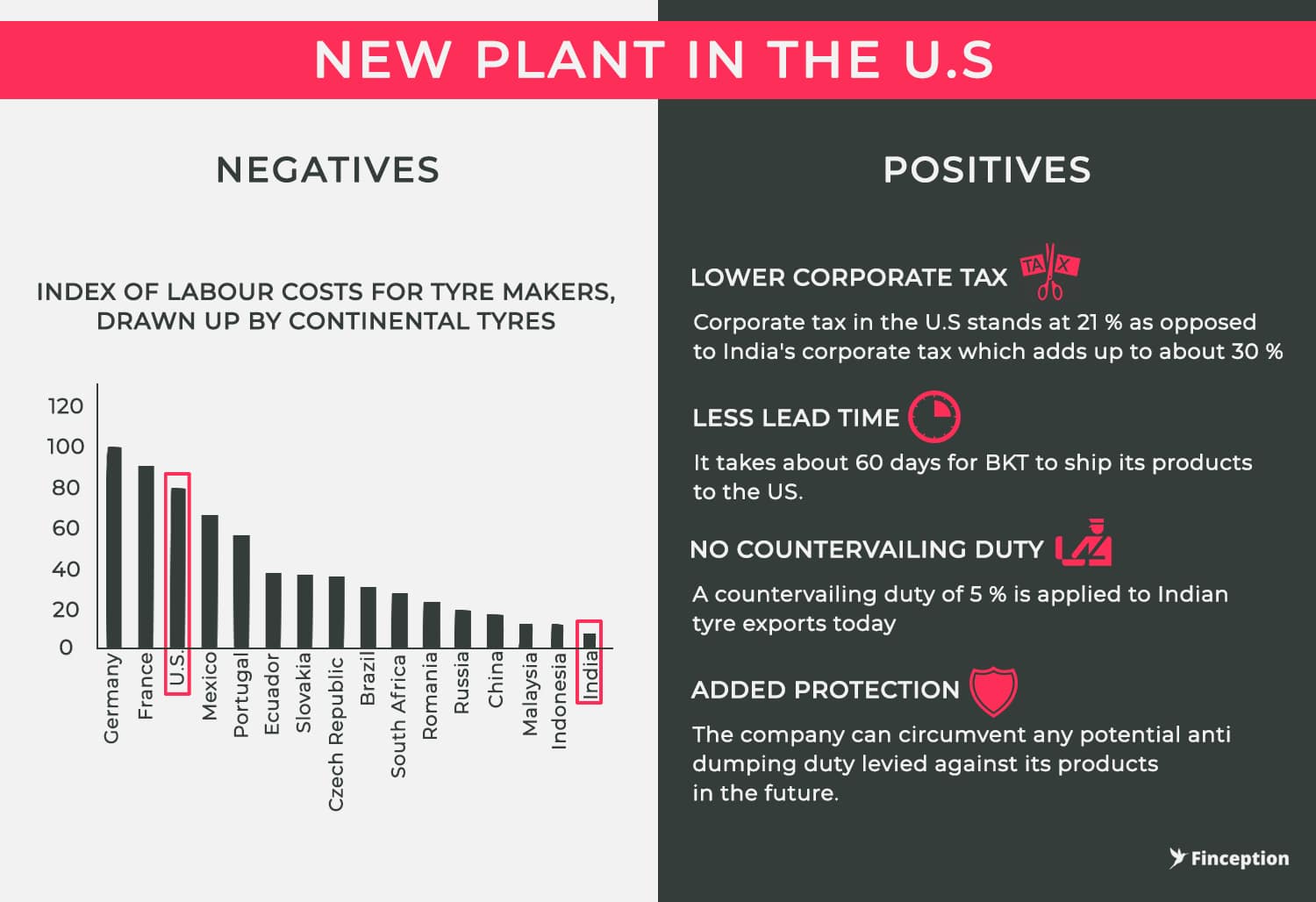

While lax competition initially provided the perfect launchpad for Balkrishna's growth story, new competition looms on the horizon with deep pockets in tow. It seems the chips are finally down and the company has been forced to play its hand. It has initiated new plans to expand capacity including a plant to manufacture carbon black, a key raw material used to manufacture tyres. It has also initiated plans to set up a manufacturing plant in the U.S. When news of this development broke, the stock price tumbled precipitously and for good reason. Labour in the U.S is about 10 times more expensive than India and the uncertainty involved in adding new capacity in foreign soil can erode investor confidence pretty quickly. On a more positive note, the last time the company undertook capacity expansion it did it with considerable panache. But with intense competition looming large very little is certain.

Usually, in our story, it would be at this point we would tell you that the future of Balkrishna Tyres hangs very much in the balance and offer you our best wishes if you were to invest in the stock. However, there is something else we must address before we wrap this one.

If there's one criticism that we often receive, it's that we never offer a target price — that we lack conviction in our analysis and that we never take a clear stand. Consider for a moment the method of forecasting. Imagine you had to put a number on Balkrishna's stock price, you'd first have to consider the political climate and the macroeconomic variables surrounding agriculture and mining. You would then have to plug in the savings impact of the Carbon Black plant, competitive threats from ATG, potential cost overruns in adding new capacity, profitability of the new plant in the U.S, future opportunities accruing out of new unexplored territories, threats of anti-dumping duties and its immediate impact on cash flows, cost of debt and other black swan events. Once you are done with that pesky little bit, you'd have to assess the current mood of the market i.e. decide if the market is paying more/less than the intrinsic value of the stock (In 2011, the stock was trading at a P/E multiple of 9. It's currently trading at about ~20). Depending on how long you are looking to hold the stock, you might have to assess the future mood of the market as well. Finally, you toss out all the calculations you've so painstakingly constructed, listen to your gut and put out a number that's closest to market consensus (or if you're looking to stand out, throw a number that's furthest away from the consensus) It's no wonder then that Burton Malkiel famously remarked — "Financial projection appears to be a science that makes astrology look respectable"

The fact of the matter is even if we did offer you a target price, it would at best be a well-meaning guess and not much more. It would only perpetuate a pernicious illusion that the future is more "knowable" than it is. No amount of financial acrobatics will ever yield consistently accurate projections and no model will ever produce a perpetual streak of world-beating returns. So despite the seemingly infallible analysis, the only way to make big money in the market is to make a qualified bet and pray for divine intervention. Make no bones about it fellow reader, for you are playing with chance. If you still harbour illusions about taming randomness then we pray that the odds forever side with you. But if there's one thing that's certain in life, it's that lady luck owes no allegiance for she dances on the annals of victory and broken dreams with equal fervour.

. . .

Enjoyed reading? Show us your love by sharing...

Tweet this articleReview & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsDisclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

READ NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts