"There is only your precious queen left, and there is also one throw of the dice remaining. Stake her and win yourself [and all that you have lost] back with her" — Shakuni to Yudhishthira in the epic Mahabharatha

As Yudhishthira contemplates the consequence of this wretched game of dice, Shakuni prods him, taunts him and finally pushes him to wager his queen. Yudhishthira, the eldest of the Pandavas has already lost his brothers and all that he owns and is now on the verge of ruin. A feeling of disgust fills the opulent halls of Dhritarashtra's palace. The Rajasuya ceremony is quickly becoming the undoing of the greatest warriors on the face of the planet. Time stands still as Shakuni grins. Yudhishthira cannot decline Shakuni's wager. He agrees — "I will play you for her." Shakuni heaves and rolls the dice and in an instant, he screams for joy — "We have won" and thus begins the epic saga of Mahabharatha.

Gambling is a terrible vice and our history is filled with references carefully highlighting the destruction wielded by the game of chance. From Rig Veda to Manusmriti, Shakuni to Chanakya, gambling is expounded upon extensively so that people fully understood the grave implications of rolling dice. However, we are a company that deals with information on stocks and financial markets and unravelling the complex moral dilemmas implicit in gambling is frankly beyond our limited intellectual capacity. So, our focus today isn't on the moral or the social impact of gambling. Instead, we will focus on how gambling has evolved in India and use Delta Corp, a listed gaming company as a blueprint to understand the current dynamics of the country's Gambling Industry.

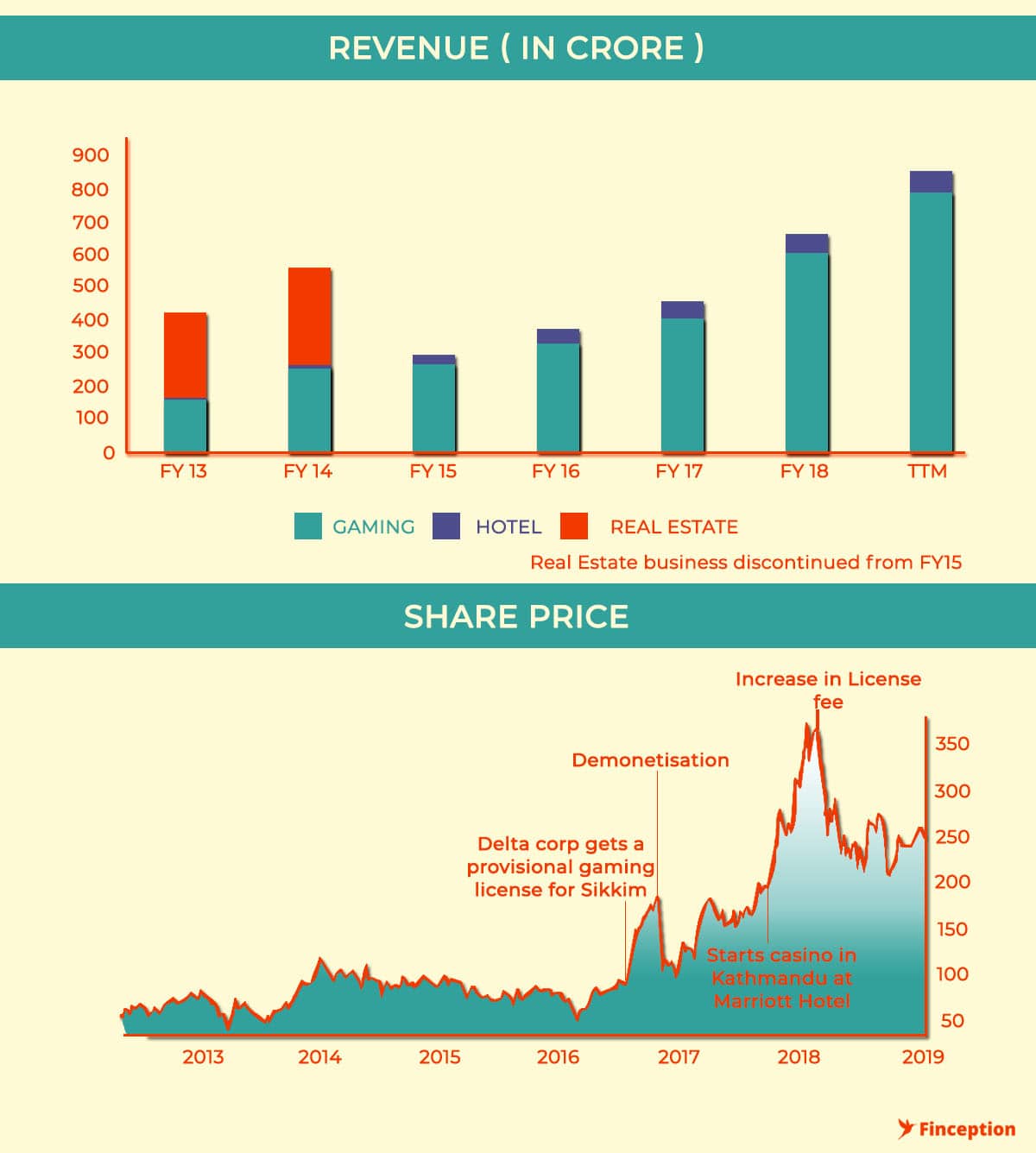

Delta Corp Limited ("Delta Corp") is the only listed company that currently operates both physical and online casinos in India. It has over 1800 gaming positions and is quickly becoming a favourite among investors at Dalal Street. But before we look into the physical operations of the company, we need to dissect a more modern phenomenon — Online Gaming and Delta Corp's gambit in occupying the top place.

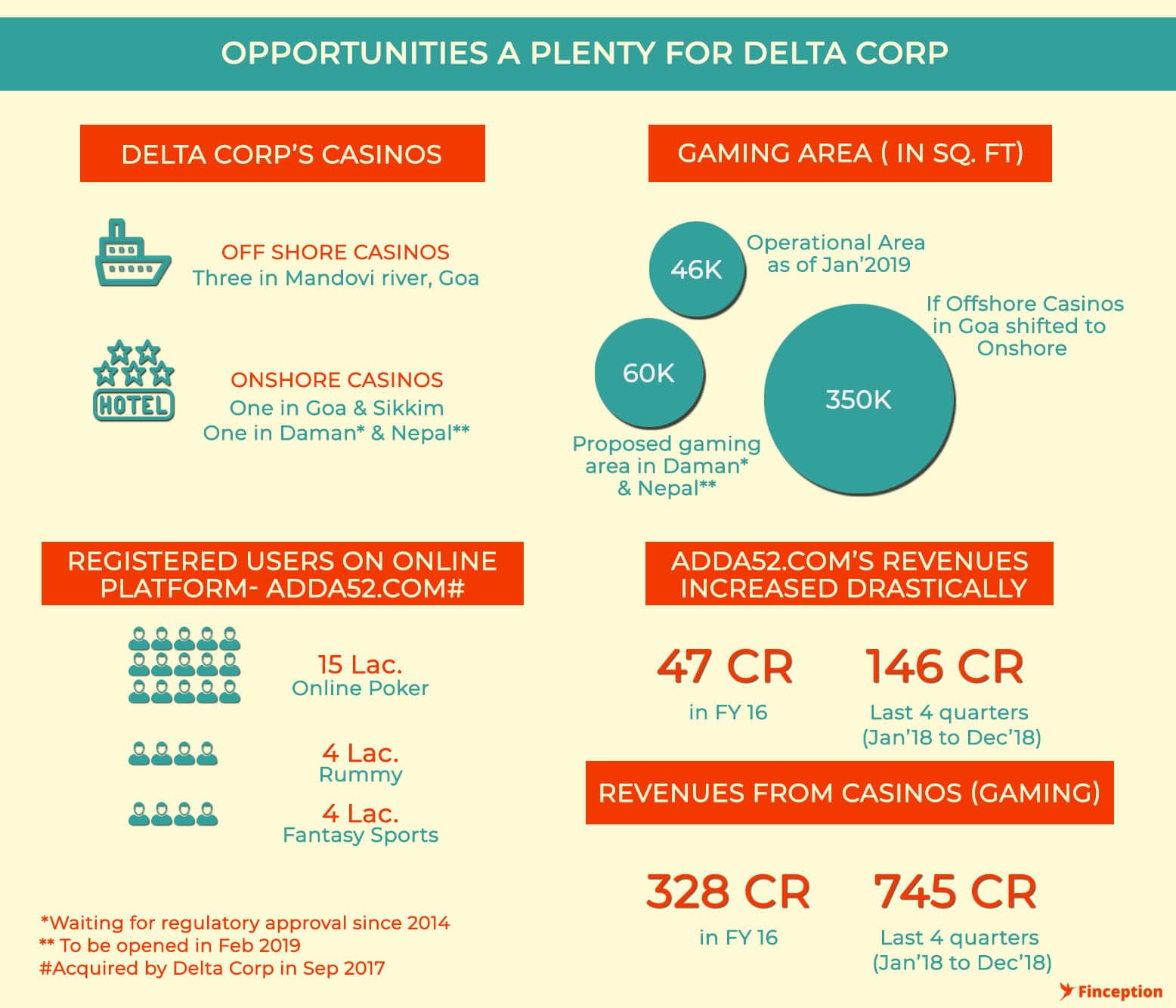

On September 2017, Delta Corp fully acquired Gaussian Network, the owners of adda52.com — India's largest online poker platform. Since then, adda52's revenues have gone from 47 Cr. (FY 16) to 146 Cr. (TTM) prompting many investors to consider the possibility of online gaming becoming a serious revenue source for the company. However, unlike their offline casino business, evaluating its online counterpart can be particularly tricky. The prevailing notion about the online casino industry is that incumbents offer little to no differentiation and that, in an industry where differentiation is hard to come by, carving out a competitive edge is virtually impossible. However, this is a gross oversimplification of the complex dynamics at play. While there is very little separating two competitive poker platforms, the scale at which they operate can have a visible impact on the overall experience.

adda52 is one of the early movers in the online casino market in India. So it's had a veritable advantage in gaining market share. According to the company's own estimates, it has a market share of close to 60%. This statistic is telling because it's a metric that correlates with player liquidity — the total number of players active at any given moment. If you have a large group of talented players to choose from, it creates an enticing proposition for new customers to keep visiting the game. So if a competitor does not have a large enough active client base, it becomes increasingly hard to sustain and grow the platform.

Another element that's often overlooked is the acquisition cost. As the market matures i.e. as more people enter the online gaming industry, the cost of acquiring a new customer increases disproportionately. Back in 2007, when the global market for online poker was at its infancy, a research report from Redeye elucidated how the customer acquisition cost for a betting company, RedBet was likely to triple (from 6,000 SEK to over 19,000 SEK) in a matter of 3 years. India presents the same opportunity today as the global market did 10 years ago and economics of running an online casino often boils down to a simple mantra — it's much cheaper to retain an existing customer than to acquire new ones. So new entrants in the online casino business are at an automatic disadvantage.

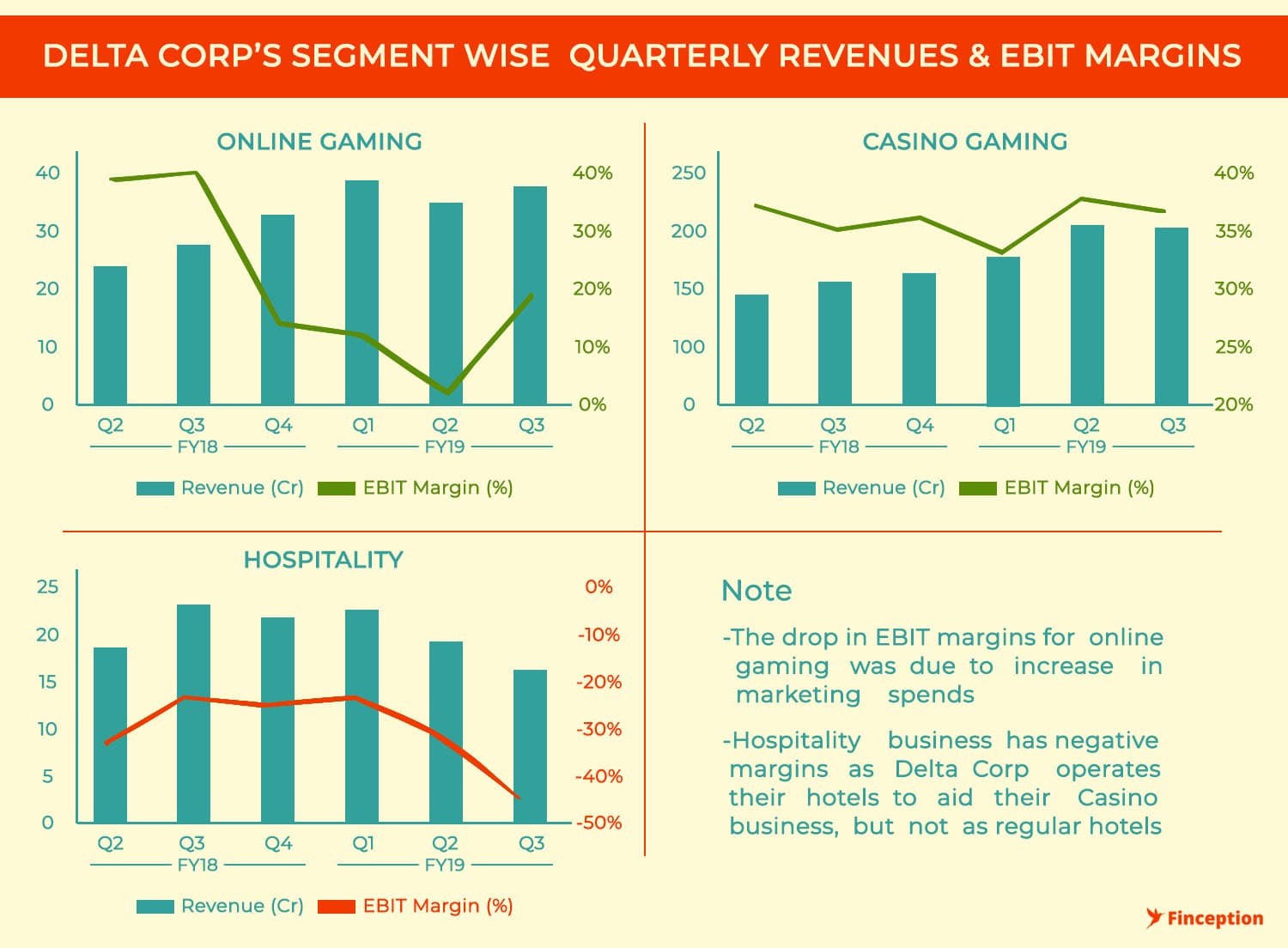

However, it is still an industry characterised by cut-throat competition and most players have resorted to gaining market share by aggressively increasing marketing spends i.e. bonuses and promotional offers. Unless you are backed by private equity or a Venture Capital fund, a sustained marketing campaign will likely bleed you dry. While we don't have data for Indian companies, most online casinos in the U.S spend close to 40% of their expenses on marketing and sometimes even go overboard in a bid to thwart competition. Publicly listed companies, on the other hand, cannot afford such misadventures because they are under the perpetual scrutiny of investors who vie for higher margins. During the second quarter this fiscal year, DeltaCorp ramped up their marketing spends considerably and their operating margin (online games) shrunk from 12% to around 2%. Within a single quarter, they scaled back their marketing operations stating that the endeavour did not yield desired outcomes. So its unlikely you will see Delta Corp engage in excessive marketing exuberance unless they believe that they can still maintain reasonable operating margins. How, you ask?

Not all games are created equal. Like tangible products, some online games offer higher margins than others. So if a company can lure in users by offering attractive promotional schemes, it would be willing to compromise on its margins if it could redirect some of these users to other high margin games on its website. We are speculating on the matter because unlike the online casino business, where Delta Corp (through adda52) dominates the market it's plotting to enter another lucrative segment — Fantasy League, the kind of "skill-based" game that Dream 11 pioneered (in India). According to a report in the-ken, the fledgeling gaming segment already has about 70 incumbents. So it won't be easy for Delta Corp to make a dent here. Now, we don't quite know how the company intends to monetise the Fantasy League or the fee structure it's got in place, but our guess is that the platform could serve as an avenue for Delta Corp to redirect some of its users to other Casino games, where we know the company has plush margins. Its quite possible that the Fantasy League could offer even better margins than the online casinos, but considering the investment the company would have to make in player acquisition, marketing schemes and other bonuses its unlikely the high margins will materialise in the near future.

For the uninitiated, a fantasy sport is a type of online game where participants assemble imaginary or virtual teams of real players of a professional sport. These teams compete based on the statistical performance of those players in actual games. This performance is converted into points that are compiled and totaled according to a roster selected by each fantasy team's manager — Wikipedia

So despite the competitive landscape, it seems as if Delta Corp has got a lot going for it and there's considerable upside in the online gaming industry. But nothing in life is certain and it would be deeply ironical if we chanced upon certainty in the gambling business. On October 2nd 2006, the U.S House of Representatives passed the "Unlawful Internet Gambling Enforcement Act" and the U.S Senate approved it with almost unanimous consent. Within 2 weeks, President Bush signed the act into law and operations of most online casinos came to a grinding halt overnight. The Act prohibited gambling businesses from knowingly accepting payments in connection with the participation of another person in a bet or wager that involved the use of the Internet. It's important to note that under most state and federal laws at the time poker games were deemed to be games of chance (gambling) and it dealt a crippling blow to the online casino industry

In the wake of this news, Partygaming, a company that operated a network of gambling websites, most notably Partypoker.com saw its market value erode by 60% in a single day of trading. In an environment devoid of significant oversight, U.S members of Congress enforced a blanket ban on most online casino activity offering very little headroom for incumbents. As of today, India does not have a central regulatory framework to oversee online gaming activity (except for the outdated Public Gambling Act of 1867) and in the event, the Central Government is forced to play its hand, we could see a complete overhaul of the online gaming market. Fortunately for the optimists, it seems that Shahi Tharoor has taken up the mantle and is about to introduce a Bill that aims to regulate online gaming activity in India before somebody else decides to cripple it completely.

On December 28th 2018, Congress Member of Parliament, Shashi Tharoor introduced a private member's bill (PMB) in the Lok Sabha to introduce regulations and a licensing framework for online sports gaming in the country in an attempt to provide more clarity and reduce future black swan events that could see the government clamp down on all online gaming related activity that involves money. Despite the obvious merits inherent in the Bill, members of the LokSabha are unlikely to pay much heed. In fact, it is unlikely to even elicit a discussion in the house.

As the website Youthkiawaaz.com reports — "In recent years, governments have tended to view PMBs as an intrusion by non-Ministers into their domain. A perception also seems to have been built that the passage of such a Bill would mean that the government is incompetent and far removed from the needs of the people. As a result, the passage (and even discussion) of PMBs is not encouraged. This has led to an unofficial convention where, if a PMB finds support in the House, the Government usually requests the Private Member to withdraw her/ his Bill with the assurance that the Government will introduce a Bill on the same issue." The last Private Bill to be acted into law was introduced back in 1970. So if the new Bill on Online Gaming were to see the light of day, we would be pleasantly surprised.

Outside of the regulators, courts also have a say in how online casinos/games are operated in India. To fully understand the nuance in their arguments it is important to understand the fundamental difference between a game of chance and a game of skill. Gambling is betting on an uncertain outcome or risk-taking in the hope of gaining an advantage. A game of skill, on the other hand, depends on the player's superior knowledge, training, attention, experience and adroitness. Considering most games incorporate both skill and chance, courts have relied on the "skill test" to separate the two. If it could be proved that a game is preponderantly a game of skill and not of chance, then the game is said to have passed the "skill test". In 2015, the Supreme Court of India declared online rummy, poker and card games as games of skill. However, it allowed for states to pass laws regulating betting and gambling. For now, online casinos are illegal in Gujarat, Telangana, Assam and Odisha but there's no saying when this equation could change.

In what looks like a largely uncertain endeavour (online gaming), the only semblance of certainty comes from the company's offline casino operations. It is also quite paradoxical that the certainty in the offline casino business emanates from excessive regulation as opposed to no regulation at all. Offline Casinos are legal in Goa, Sikkim and Daman and the overbearing interference of the state coupled with limited license offering deters new entrants and excess competition. When the state of Goa increased the gaming licensing fee back in March 2018, Delta's stock price cracked 15%. However, the disproportionate hike in prices crippled smaller players and Delta Corp's revenues have improved considerably since then. If there is any uncertainty in the offline business, it's restricted to the hospitality division. Margins in the hospitality business are terrible. They consistently make losses and it's prompted several investors to lobby and request the management to drop the business entirely. But as Jaydev Mody, chairman of Delta Corp notes— " It is complementary to our casino business where we invest 90% of our capital in hotels and 10% in casino and then we get 80% of our revenue from the casino and 20% from Hotels". During peak holiday season, hotels become scarce and for Delta Corp to keep entertaining new patrons it has to offer them a place to stay and so hospitality becomes indispensable.

So with good revenues in tow, Delta Corp is now on a mission to expand. They're awaiting regulatory approval to move their offshore operations to onshore sites and there are talks of huge investments (1500–1800 Cr., without debt) to create a Las Vegas type experience with the new onshore facility. Operations in Nepal are about to commence in February and with a new airport in Sikkim, the company believes visitations will see an upturn soon enough. So it seems that the gaming industry in India is in pretty good shape after all and looking to move towards a new, albeit uncertain era. As for Delta Corp there's both good and bad news. The optimist points to abundant opportunities in the gaming industry, increasing disposable income and Generation X seeking new/better experiences, whilst the pessimist points to uncertainty, elections and the high valuation of the stock (P/E of 36 TTM).

. . .

Enjoyed reading? Show us your love by sharing...

Tweet this articleReview & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsDisclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

READ NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts