In this section we trace the company's journey from a small tractor company to a motorcycle behemoth and the secret sauce that propelled this growth

James Collins, the best selling author, and business guru makes a telling remark in the opening paragraph of his book 'Good to great' - "Good is the enemy of great. We don't have great schools, principally because we have good schools. We don't have great governments, principally because we have good governments. Few people attain great lives, in large part because it is just so easy to settle for a good life. The vast majority of companies never become great, precisely because the vast majority become quite good - and that is their main problem."

Eicher started off importing tractors in a post-colonial India at a time when India was on the cusp of an economic revolution. Iconic companies of the present era were forged during this period. Yet, Eicher, for all its might stuck to importing tractors and doing very little outside of it. During subsequent years the company did try dabbling with trucks and engines - seemingly flirting with greatness but never quite fully embracing it. It was frustrating perhaps to be so intimately involved in the production and manufacturing of some of India's earliest tractors and trucks, yet, to not have emerged as a market leader in any of these segments and so, for almost 4 decades, Eicher was simply content being a 'good' family run business. It was during the closing of the 20th century that Eicher made an acquisition that would go on to change the company's fortunes altogether. In 1995, the company acquired Enfield Motorcycles, an English motorcycle brand with a rich legacy but whose financials were marred with poor economics.

The popular myth that Enfield has forever been a financial powerhouse is just that - a myth. It's a fictional account perpetuated by the masses with no basis in reality. Sure, Royal Enfield has always had a cult-following and owners of the iconic brand continue to swear by its legacy. But for large parts of its existence, Royal Enfield was a loss-making entity - so much so that the management at Eicher Motors considered shutting down shop and liquidating the motorcycle business a few years after acquiring it.

And so we have a reasonably good company with a struggling brand at the precipice of mediocrity. It is a story that's about to get very exciting in a relatively short span of time with a power move from a brash, young, third-generation heir to the Eicher Empire - Siddhartha Lal. Siddhartha and his team are about to embark on a turnaround operation that is likely going to serve as case material for business schools in the near future.

The turnaround begins with a rather somber event - divestment. To divest is to sell assets and business interests you think you no longer need. Back in 2006, Siddhartha Lal, the CEO of Eicher Motors initiated a divestment operation like no other. Imagine running a business empire selling trucks, buses, tractors, footwear, garments, and a few other products on the side and you had to make a choice - to be average across 15 different business verticals or be great in a couple? What would you pick? It's not a hard choice that, but at the time, it seemed unprecedented. In one sweeping move, Siddhartha had decided to exit most business interests, retaining only the motorcycle (Royal Enfield) and the truck divisions. All other interests were either sold off or liquidated. One observer called it an apocalyptic fire sale. It was a gutsy move that could have pushed the company to the brink of ruin, yet, Siddhartha remained steadfast.

With the divestment operations concluding, the focus was back on Royal Enfield. By this time however, Royal Enfield was barely trudging along. Sales had remained stagnant for quite some time and a desperate reboot was long overdue. Royal Enfield, for all its worth, had one glaring issue. The company's motorcycles ran on outdated tech and broke down often, preventing Enfield from becoming a truly aspirational brand - and this, the company knew was going to be a significant roadblock. It was in 2010 that the balance then tipped in Eicher's favour after the introduction of the Royal Enfield 'Classic'. The Classic was a game-changer for Eicher Motors. It retained the look and feel of the older generation bikes but incorporated new tech, engine, and transmission with improved reliability. Eicher Motors had finally struck gold.

As 2010 was heading to a close, the company had sold 50,000 bikes (annual), the maximum their production facilities could produce in a year. Waiting periods would easily cross 6 months and consumer appetite for the new renewed set of Enfield motorcycles was insatiable. Royal Enfield motorcycles were selling like hotcakes and the company promptly invested in expanding capacity. By 2012, they were selling 1.1 lakh bikes and by 2014 the company had tripled this number to 3 lakhs.

Meanwhile, Eicher Motors spun off the truck business into a new company. They formed a joint venture with Volvo called VECV Ltd.- Volvo Eicher Commercial Vehicles. Volvo brought its manufacturing expertise to the table and Eicher Motors its distribution. The once dormant truck business was also up and running.

The truck business contributes about 250 crores in profits (FY 2018)

Today, the company no longer stands at the precipice of mediocrity but on the verge of greatness. The company made revenues close to 9000 Crores in 2018. Out of the 5000+ listed public companies, less than 146 can stake claim to such a distinction.

Meanwhile the company’s profits quadrupled during the same period touching ~2000 Crores in 2018

Eicher's stock price has multiplied so prodigiously that it has single-handedly created more Crorepatis in India than the popular quiz show "Kaun Banega Crorepati". From a modest ₹ 24 to ₹ 27000+ today, the stock price has multiplied over a 1000 times signaling a new era in Eicher's history and scripting, what is perhaps one of the greatest turnaround stories of this decade.

. . .

This section offers a comprehensive review of the stock and what the future holds for Eicher Motors

Now before you jump on the bandwagon and invest your life savings in Eicher hoping to become a millionaire, a word of caution. Past performance is not indicative of future results and so perhaps it's wise to exercise some discretion. Also, if you are an investor it pays to see what the 'ever reliable' analyst thinks about the company.

Most analysts had nice things to say about Eicher. But these insights were mostly premised on a few common themes that looked suspiciously similar. So we thought we would dig into the analyst reports some more.

“We maintain our positive view on account of new product launches (RE), untapped export opportunity and CV (Consumer Vehicle) cycle recovery”- Generic Analyst

After the successful launch of the Royal Enfield Classic in 2010, the company launched the Continental GT, a café racer bike touted to be a counterpoint to the existing macho line of motorcycles. Unfortunately, after the initial euphoria surrounding the launch, sales (monthly) started declining, at one point reaching double digits. The company now plans to discontinue the model and start fresh again with a new 650 cc engine.

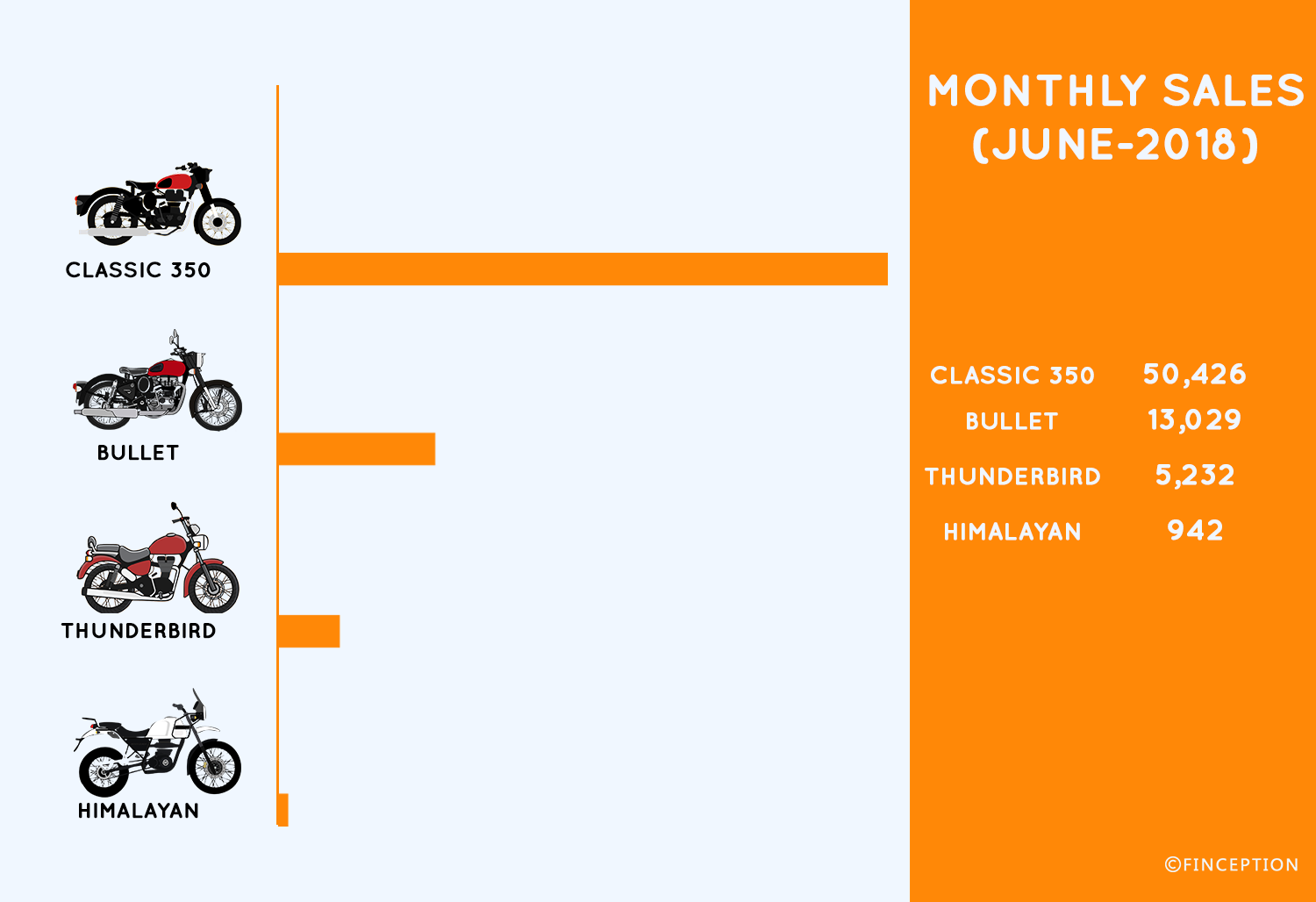

It then launched the 'Himalayan' - an adventure touring motorcycle that was supposed to offer riders the ultimate offroading experience. Plagued with quality issues the Himalayan failed to live up to sales expectations as well. The company sold less than a 1000 Himalayan motorcycles in the month of June, 2018. While these numbers look better than the figures for Continental GT, it pales in comparison to the Royal Enfield Classic whose sales reached 50,000 during the same period.

The next initiative was the introduction of a Personal Utility Vehicle called the Multix. The company spent 50 Crores in setting up the venture. However, after the initial interest subsided, the Board of Directors decided to wind down its operations. The accumulated loss from this venture - 312 crores.

Pro tip 1 : New product launches do not necessarily translate to growth. If you plan to invest in Eicher, seek how these new products perform before you rely on product launches to automatically fuel growth.

Royal Enfield is now present across 50 countries through a network of over 500 multi brand outlets and 36 exclusive stores. This geographical expansion began in the late 2000's and it's yet to fully pick up steam. The company's export figures are negligible compared to the overall sales. The biggest roadblock - Quality and Reliability. Despite the recent developments in engine tech and transmission, Enfields are still prone to breakdowns. Outsiders will not take kindly to quality issues and this could prove to be a humbling experience for the company as they try and seek a foothold in the global markets. For its part, Royal Enfield had this to say about the matter

" We have earmarked an investment of Rs. 800 crores in 2018–19 in all areas of its business. The investment would be towards setting up additional production capacity at Vallam Phase-2, completing construction of the Technology Center in Chennai this year, investing towards the development of new motorcycles to meet the upcoming regulations and to expand Royal Enfield's portfolio for its global markets" - Eicher Motors.

Pro tip 2 : Selling in India and selling abroad are two very different things. Untapped global markets do not mean untapped riches

However we do not want to mislead you into thinking Eicher has a problem with its financials or its cash position. On the contrary Eicher' problem stems from having too much cash. This was once a problem reserved for politicians and bootleggers, yet, today we see many cash rich companies spend a great deal of time working on how to effectively deploy all their wealth.

For now, Eicher is happy investing most of its cash(~$1 billion) in fixed deposits, mutual funds and expanding plant capacity. But that doesn't mean the company has no aspiration to grow and expand its horizon outside of 'Royal Enfield'. A few months earlier we got a slight whiff of the kind of expansion its seeking

On September 13, 2017, there were news paper reports about how Eicher had plans to bid for Ducati, the legendary Italian motorcycle brand for a whopping 1.8–2 Billion dollars.

Eicher is a financial powerhouse. It's virtually debt free and has in its coffers enough cash to potentially wield off any short term financial turbulence with tremendous ease. Its balance sheet is clean as a whistle and its income statement is the stuff of legends. Most of its financial ratios serve as a benchmark for other manufacturing companies. One ratio in particular that sums up its operational excellence is Inventory holding days.

Eicher's inventory holding period stands at 28 days, a remarkable number. No part, no engine, no motorcycle stays in the company's warehouse/production facility beyond 28 days

But despite all this, the stock price trades at historic highs not least due to the financial ratios or the stellar income statements. It's the man behind the numbers that inspires such confidence and reverence among Eicher loyalists. Sidhhartha Lal isn't your typical CEO. He does not care much for business suits or clean shaves. Instead, his unrelenting devotion rests squarely on production targets.

Every year, in his annual address to the shareholders, Siddhartha sets production estimates for the subsequent year and every year there is the usual skepticism - Contracting sales, ineffective distribution, ambitious targets. Yet, like a monk, Siddhartha goes about meeting his production targets with unrelenting discipline and then selling as many bikes. Siddhartha's prediction for the financial year 2018 stood at 8,25,000 motorcycles. The company sold 8,20,000, just 5000 shy of his prediction. Like a mystic, he predicts, like a perfectionist, he delivers.

But times change and the skeptic continues to grow restless. After reaching euphoric highs of ₹ 33,000, the stock price now hovers at about ₹ 27,000. There is nervous excitement in the air - Nervous because nobody quite knows if Eicher can still find ways to grow at the same pace. Excitement, for if Eicher does figure out a way, shareholders could see their wealth multiply exponentially. Word on the street is that Eicher Motors is planning another full fledged push into tapping the global markets. There are rumors about a whole new line of motorcycles designed specifically to compete against the likes of Harley Davidson and Triumph. The 'Good to great' journey beckons Eicher once again.

The stage is set and the battle lines drawn. Siddhartha has spoken

“The company plans to produce 9,50,000 motorcycles in 2018–19”

The skeptic has responded

“The target is too ambitious”

Review & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts