When China sneezes the world catches a cold. Over the past few years, this quote has mutated into indisputable truth. But very few people understand how China's impact can be as far-reaching as it is. When the rush for Graphite electrode (GE) began last year, the entire investor community started focusing on the Indian twins- Graphite India Limited and HEG India, two GE producers whose fortunes turned overnight. But it was, in fact, Chinese policy that ultimately propelled the two companies to aim for the stars. So today we look at the story behind the great rush for GE and how an Indian Company, HEG India can make or break itself on the back of the Chinese dragon.

We begin this story with steel and China's place in the equation. China has been at the forefront of steel production for quite some time now and since most of their factories are directly owned by the Chinese State, they almost always have access to cheap credit (debt). This helped China boost their export count at the expense of regional steel manufacturers elsewhere. When the world was being overrun with cheap steel from China there was precious little other steelmakers could do except urge lawmakers to hike import duty on Chinese steel (making it more expensive) or simply sell their output at dirt cheap rates. This put steel Manufacturers world over in a spot of trouble. However, there was another interesting dynamic being played out elsewhere.

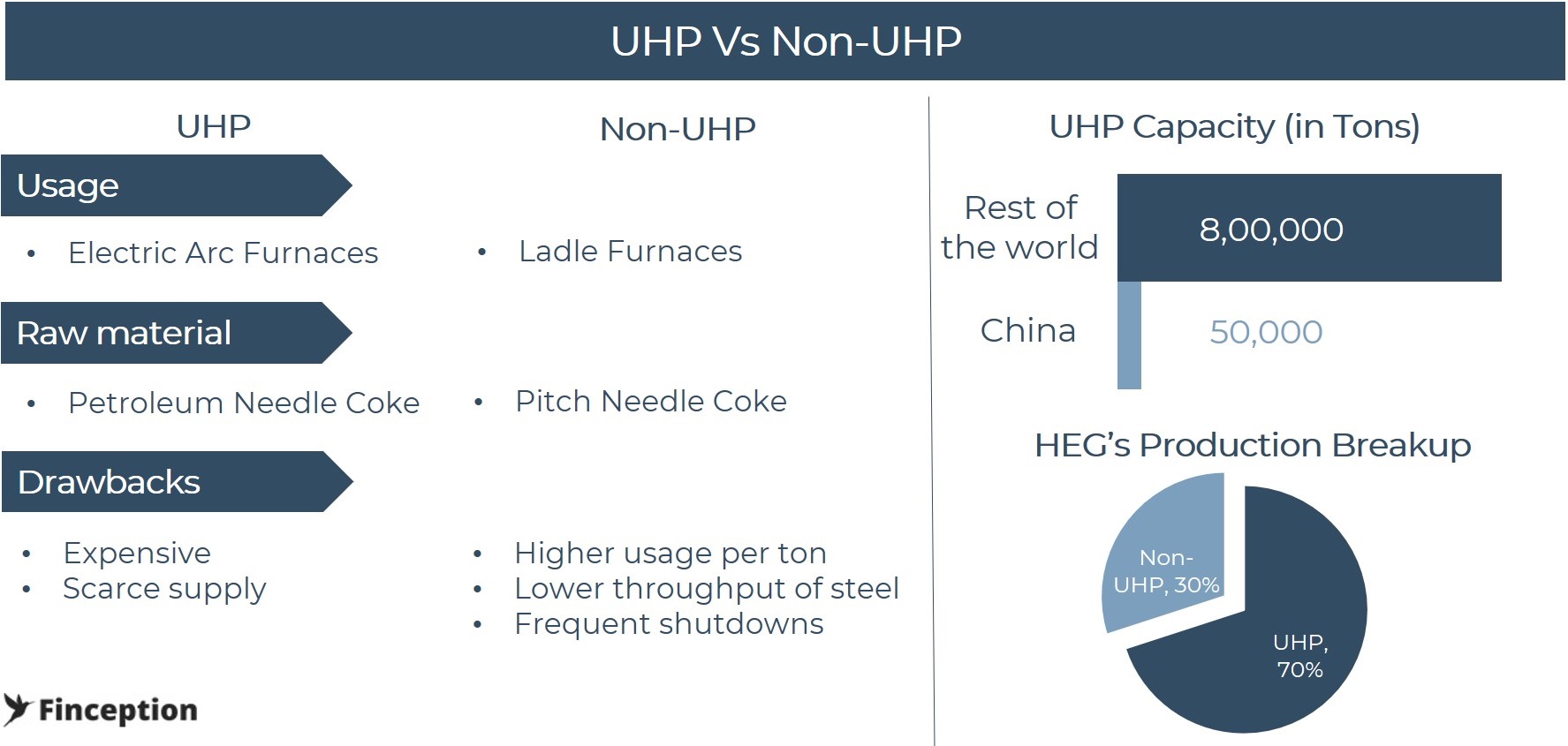

Steel Manufacturers in China largely relied on Blast Furnaces to produce their steel. These old furnaces take in hot air and convert iron ore into steel under extremely high temperatures and are considered to be prime polluters in Beijing. In a world that was moving closer to environmentally friendly alternatives, this was seen as problematic. Thankfully, the world had already begun switching to more efficient steel producing techniques. One method, in particular, called the Electric Arc Furnace (EAF) process was gaining significant traction. These eco-friendly alternatives to Blast Furnace use Graphite electrodes to melt scrap steel in electric arc furnaces to produce new steel. This development should have put electrode graphite manufacturers on the map, unfortunately, the story didn't quite play out as most people expected.

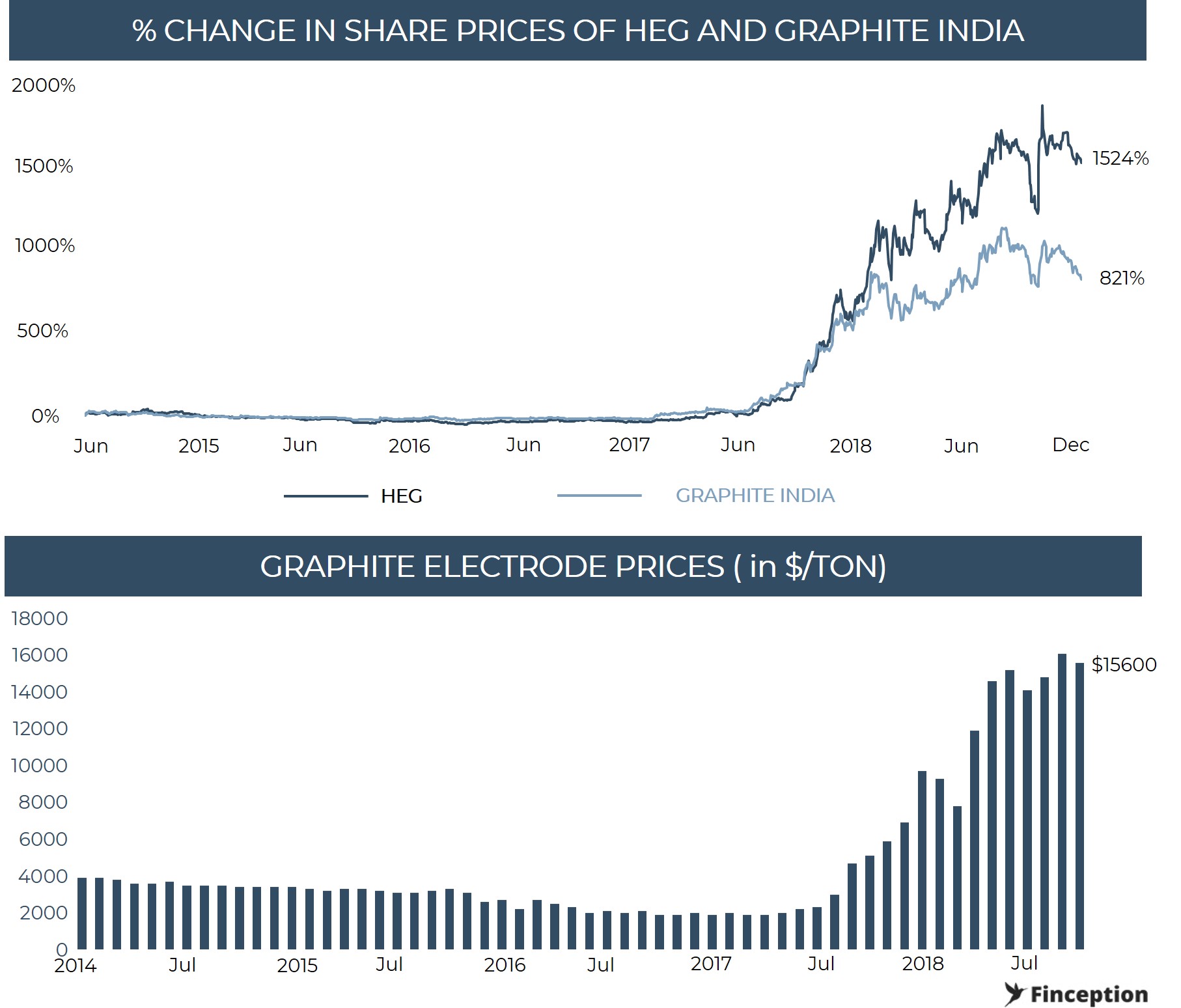

Graphite Electrode Manufacturers are a peculiar kind. There have been virtually no new entrants in this space for the past 40 years and the incumbents have been hobbling along without much fanfare. These electrodes are extremely hard to manufacture and for the longest time hasn't been a lucrative endeavour. Also, the main ingredient required to put together these electrodes, a high-value item called needle coke (named because of its shape) was extremely hard to come by, putting off any new developments in the space and then a period of severe depression crippled the entire industry. Between 2015 and 2017 EAF steel manufacturing facilities found it difficult to compete against the cheap steel coming out of blast furnaces in China and when they cut down on production graphite electrodes fell out of favour. Prices hit rock bottom and many facilities across the world became unsustainable.

In 2017, China was the biggest producer and consumer of Graphite Electrodes, followed by the European Union and Japan.

Back in India a humble manufacturer of Graphite Electrode was trying to turn the tide. HEG India was already burdened with losses and significant debt as of FY 2017. Very few people saw the stock as a worthwhile investment opportunity until the Chinese sneezed. News started pouring in that Beijing was on a drive to close thousands of steel mills and other polluting plants including several Graphite Electrode Manufacturers. On any other day, this news wouldn't have made top headlines. However, this time things were slightly different. Steel supplies had become dearer overnight.

In lieu of Blast Furnaces closing down across China, EAF Steel producers had to step in to fill the void and the demand for Graphite Electrodes continued to rally. Unfortunately, the terrible market scenario that prevailed in the Graphite Electrode industry the previous year had wiped out ~20% of the total manufacturing capacity making them a scarce product overnight as well. Some began calling them strategic resources. The prices doubled, in some cases even tripled. Companies that had already entered into long-term contracts could not fully capitalise on the new found riches, but the ones that mostly sold on the spot were in line for huge paydays and HEG India suddenly found itself in a very sweet position.

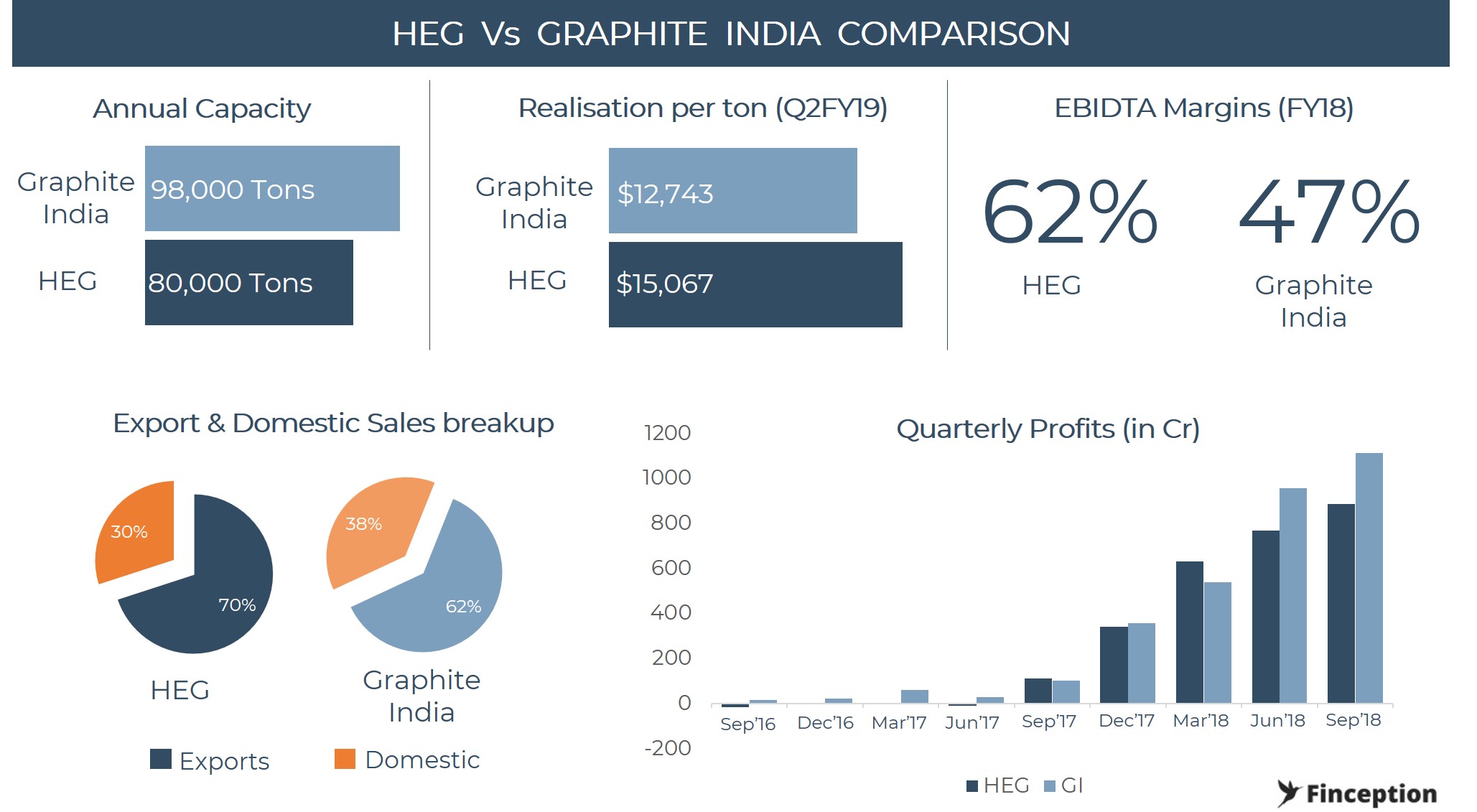

The stock price soared (from Rs. 300 to 3000+) and the earnings multiplied prodigiously. From making losses to the tune of 47 crores (FY17) the company turned a profit of over 1000 crores in FY18. They wiped off their long-term debt and paid dividends of ~320 Crores. This year, the company has done even better. It made profits of over 1600 crores in just 6 months and its planning to buy back shares at a price of Rs. 5500 when the current market price is at ~Rs. 3900. The company doesn't know what to do with the money anymore. If there is ever a story of changing fortunes HEG will be a serious contender to top that list. However, the past is of little interest to investors. It's the future that they crave for.

Based on data from the past two quarters, HEG has been selling its graphite electrodes at an average price of about $15,000 per tonne. Its also running at peak capacity, meaning they can't grow by selling more (Huge expansion sprees are also out of the question because it's hard to source needle coke, the raw material used to produce GE). So, by and large, the company can continue to outperform if GE prices continue to soar, or if the collective public suddenly realises that the stock is undervalued and they start bidding up the prices, which is what a lot of research analysts believe ought to happen. So for the stock price to continue its prodigious climb prices for Graphite Electrodes have to rise in tandem. Surely that is something that we can predict right? Well......

Is it undervalued? The stock currently trades at a P/E of ~6 (Trailing Twelve Months Earnings). Since the rally, the P/E has contracted prompting several analysts to claim that the stock is in fact undervalued based on global estimates. However, valuations are a tricky game and you'd be best advised to exercise extreme caution while trying to unearth the "true" value of the stock

On March 23rd, one of the world's largest producers of Graphite Electrode, Graftech, filed its prospectus with the U.S. Securities and Exchange Commission to go public. The IPO generated a lot of interest but it also prompted Indian Investors to go have a peek. While outlining the risks involved in investing in Graftech, the company noted — "Pricing for graphite electrodes has historically been cyclical and, in the future, the price of graphite electrodes will likely decline from recent record highs." This isn't the only cue that pointed towards a decline. As of March 1, 2018, the company has already booked three- to five-year contracts, representing ~ 60% to 65% of their production capacity from 2018 through 2022. The contracted price was $9,700 per tonne. So clearly, the company did not expect the prices to stay well beyond $10,000 for a sustained period.

Another hint comes from Nomura Research. In its endeavour to cover another large GE Manufacturer, Showa Denko (Japanese Manufacturer), they visited China to find out if the myth of Chinese Suppliers shutting down shop was in fact true. After their visit, they had a very cautious story to tell. It seemed that the graphite electrode manufacturers did take a hit but the ones that complied with regulatory (environmental) standards were up and running already and looking to add more capacity. Another seeming observation they made was that the country was also ramping up its needle coke production — the scarce all important raw material used to manufacture graphite electrodes. More Chinese Graphite Electrodes would inevitably bring down prices. This prompted Nomura to revise their earnings target for Showa Denko, on the premise that prices of Graphite Electrode would peak at $8,500 per tonne and then moderate. This was back in April 2018.

Outside of declining prices, HEG has another worry. Prices of Needle coke has been on the rise and this hasn't affected the margins until now mainly because it takes a while for the company to order the material and then use them in production. However, starting this quarter we are likely to see some pressure on input prices. It is entirely possible that the company decides to pass on this extra cost to its buyers or it could take some of this burden itself. But despite what it chooses to do, it seems that the golden period is about to end, Or is it?

The upside is that since these predictions were made, prices of Graphite Electrodes have in fact rallied further. As we have already noted Indian Manufacturers continue to sell Graphite Electrodes at prices close to $15,000 per tonne. So what seemed unlikely back in April no longer seems unlikely anymore. It's not just the analysts that are stumped. It seems the companies themselves are stumped as well. Tokai Carbon, another company that manufactures Graphite Electrode had to revise its earning estimates upwards this November, in lieu of recent developments. The only explanation on hand is that the supply-demand mismatch continues to persist and China still isn't ready to bridge the gap. Considering Chinese manufacturers are increasingly looking to adapt to EAF based production methods most of China's Graphite Electrode production will perhaps go into meeting this new burgeoning demand. And if China remains a net importer (Imports more GE than it exports) the price is likely to stay up for the foreseeable future.

Another assessment is that Chinese Graphite Electrodes are less efficient(HP Grade) as opposed to the widely used UHP graded electrodes. So the belief is that, even if Chinese production does catch up, UHP electrodes will continue to rule the roster. However, investors must bear in mind that steel manufacturers will use UHP so long as it makes economic sense and if prices continue to remain sky high it's likely they will switch to the lower grades HP electrodes.

Since the story began to unfold last year, multiple investors have been looking at it as a cyclical play, characterised by ebbs and flows. However, despite the inherent cyclicality in the business (it continues to follow the steel industry which is cyclical) the structural shift in pricing is likely to stay that way for some time. The only thing that could disrupt this structure is the Chinese juggernaut. And unfortunately, very few people seem to know what the Chinese are up to. Even the Chinese authorities themselves have little clue about the country's GE Manufacturing capacity. So any bet that you take will also ultimately depend on your knowledge of China's capacity. For now, it seems like the demand-supply equation is tightly in balance. But if China walks in to play spoilsport all of this could change very quickly. Not overnight. But quick enough nonetheless.

. . .

Disclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

Enjoyed reading? Show us your love by sharing...

Tweet this articleReview & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts