When the Reserve Bank of India conducted a special investigation (Asset Quality Review 2015–16) into the quality of loans dispensed by big banks, few could have foreseen the lasting impact of the fallout that came afterwards. It forced banks to do away with the opaque policies adopted to conceal bad loans and severely hampered their ability to grow. It was a moment of reckoning for the banking industry and it severely crippled many incumbents, except a certain HDFC Bank. In what is now a barren, beat down industry plagued by bad loans, its the giant that keeps on giving. So our story today will try to connect the pieces that gave way to the bank's runaway success and hopefully provide a more coherent narrative of the Bad Loan epidemic in India.

To understand HDFC Bank and the premium it commands in the market, it's important to examine the sequence of events that has propelled the bank's growth. More often than not, we get wound up in the pursuit of analyzing financial metrics, metrics that help us understand things as they stand today. But this pursuit is futile if it does not include the myriad events that have shaped those very metrics. Consider for example the Net Interest Margin (NIM), a profitability metric that's widely tracked by most analysts. A high NIM is usually considered an indicator of prosperity. However, the number will tell you precious little about the causal factors that have enabled the bank to improve its NIM to existing levels. These factors are significant because it's these underlying components that combine together to give banks their competitive advantage and when they stray away from the time-tested methods of the past, the advantage dissipates, in turn, eroding the margin. As the philosopher, George Santayana once said, "Those who do not remember the past are condemned to repeat it". So it's imperative to understand how HDFC got here in the first place so that we can better understand where it goes in the future.

The first piece of the puzzle begins with understanding commodities. These are items that can't be differentiated sufficiently i.e. gold or sugar. Traders that deal with commodities often base their purchase decision on a single attribute — price. So to be able to sell more of a commodity, you have to be willing to sell it at a lower price. This encapsulates the underlying economics of commodities. It's helpful to extend this principle to financial institutions as well because like commodities, money behaves remarkably similar to one. There is very little separating my money from yours. So banks that are in the business of lending can carve an advantage for themselves if they can make their money available at cheaper rates. In banking parlance, they call this — cheap credit.

So the ideal bank would easily outpace its competitors in gaining market share if it somehow managed to keep doling out loans at low interest rates. HDFC Bank, however, doesn't do that. In a highly commoditized industry, the bank has been able to add market share by offering a better product, or in this case, better all round service. Imagine you wanted to borrow money and you had to wait 8 days for the loan to be made available. There is a cost associated with waiting that long and if a bank can come through on its promise in less than 8 days, you would forego a lower interest rate for convenience. This idea is at the heart of HDFC Banks' ethos. Despite offering credit at higher rates, its managed to add market share by differentiating its service. That's not to suggest that other banks haven't tried their hand at improving their product offering. In fact, many banks have experimented in fine-tuning their offering for some time now. However, very few banks have had the conviction to back their product offering by charging higher interest rates. As the popular saying goes — "The proof is in the pudding" and HDFC Bank stands out on this front.

However, contrary to popular belief, credit isn't all that commoditized and banks can accelerate the pace at which they lend by resorting to alternate means. And this brings us to the second point — risk-taking. Outside of making cheaper credit available, a provider of capital can push for growth if he can extend credit to clients nobody is willing to entertain i.e. if he is willing to assume risk nobody wants to take. Assuming more risk can, in fact, accelerate growth, but it can prove fatal if the person accepts a level of safety that is considered inadequate. HDFC, however, continues to defy these time-tested theories. Its managed to continue growing despite its remarkably low-risk appetite. But to understand how all of this is possible, we have to dissect another issue at hand — the Twin Balance Sheet Problem

For some time now, India has been trying to grapple with a very serious problem characterized by companies borrowing too much and banks harboring large amounts of bad loans — loans that are unlikely to be paid back. The seeds were sown during the economic boom of the 2004–2008 era when GDP growth was constantly surging at 9–10 per cent every year. Periods of economic boom are always characterized by excesses — an excess of wealth, productivity, labour and prosperity. This excess was premised on cheap credit that was plentiful during the period. In a bid to exploit the growth opportunities available, big companies started making grand plans. On the back of excessive borrowing sprees, they launched new projects worth lakhs of crores, particularly in infrastructure-related areas such as steel and power generation setting off the biggest investment boom in the country's history.

When banks across the country were scurrying to find Infrastructure companies to lend to, HDFC bank largely stayed away from financing these large projects in high-risk sectors, instead, focused on its low-risk retail clientele. Even whilst dealing with corporates it had a no-go policy when it came to certain industries. While it was more than willing to lend to Kingfisher Breweries, it refused to bet on Kingfisher Airlines. The industry standard, however, was to laud executives that kept growing their loan book by resorting to ever more innovative financing arrangements coupled with perilous lending standards. In a battle to woo prospective corporate clients, caution was seldom exercised. Perhaps it would have made more sense to hold the champagne on ice until the debtor actually paid back the loan because as most of them would find out things were about to go south.

HDFC Bank's Executive Director Paresh Sukhthanka on being asked about the company's relative absence in lending to Infra Companies — "It's not that we haven't participated in infrastructure. We have probably had a lower concentration of our loans in infrastructure. I'd say that risk management is also about deciding what you want to do and don't want to do; be it with infrastructure or others segments and then doing it better… So I don't think our strategy has been to avoid taking risks. I think we have been taking risks, when we have understood those risks and wanted to take those risks" — Forbes Interview, 2013

At this point perhaps it's important to note that the high growth period of the 2004–2008 era was unsustainable. Most companies had overstretched themselves preparing for opportunities that never existed in the first place. Costs ran well above budgeted levels and revenues did not meet expectations. Companies that had planned extensive expansion campaigns were bleeding cash and were suddenly found wanting.

The prudent measure then would have been to force defaulters to pay up or liquidate their assets. In the event that this strategy proved unviable, banks could initiate bankruptcy proceedings against their debtors. This was a long drawn out process without fixed timelines. So the banks and the companies that borrowed from these institutions found a rather convenient workaround. As a chapter in the Economic Survey 2016–17 succinctly notes — "The strategy was, … to "give time to time", meaning to allow time for the corporate wounds to heal. That is, companies sought financial accommodation from their creditors (banks), asking for principal payments to be postponed, on the grounds that if the projects were given sufficient time they would eventually prove viable."

But as the bad loans kept piling up, their lending ability slowly started deteriorating. The safety nets they originally considered adequate started withering away as the banks continued to battle growth concerns led by debt-ridden companies. After many years of refinancing, banks finally woke up to the collective realisation that most of their clients were in no shape to pay up and their condition wasn't going to improve any time soon. When the RBI finally forced banks (through an Asset Quality Review) to recognise their NPAs (Non-Performing Assets/Bad Loans), the cat was out of the bag. Multiple banks were forced to recognise NPAs that they had chosen to sweep under the rug and this was when HDFC could truly shine. During the economic boom, HDFC grew at the same levels as most other private banks. But once the default rates picked up, HDFC grew at much faster rates than other private banks

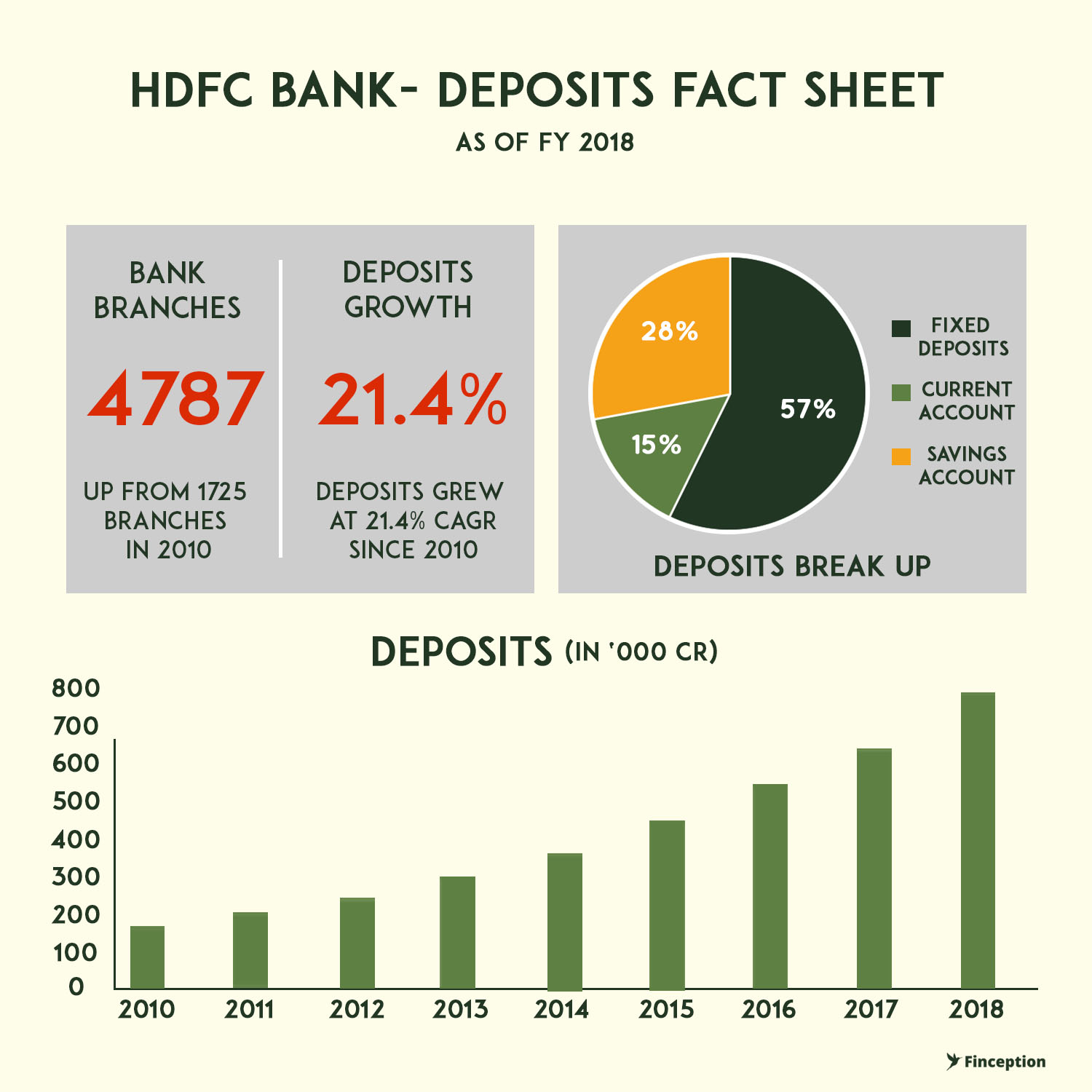

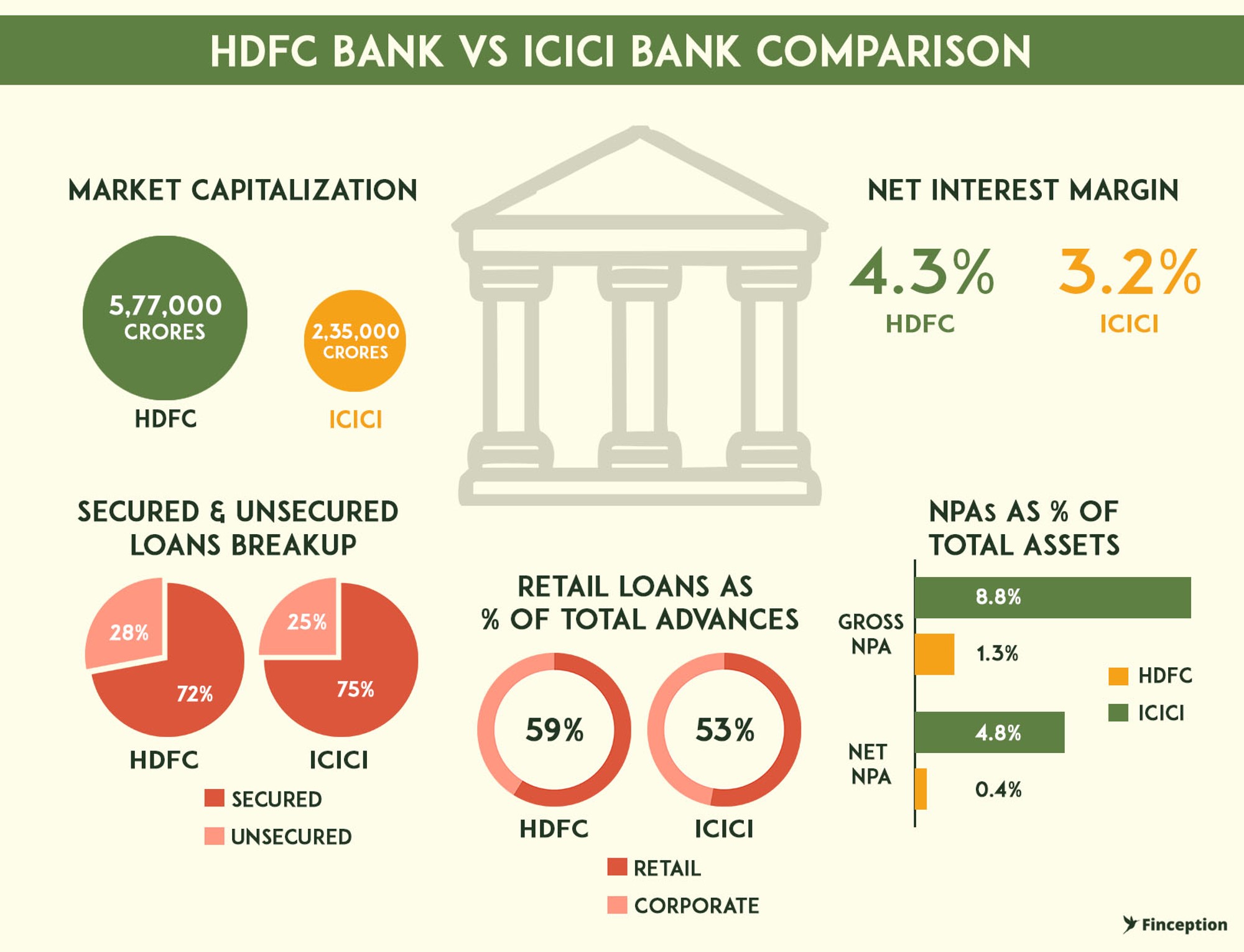

Their NPA figures (1.3% GNPA) stood far below the industry average and to the bank's credit, it had emerged relatively unscathed during the Asset Quality Review. This did two things — stressed banks that were unable to assume new lending risks gave way to banks with healthier balance sheets while it also limited the growth potential of several banks that had to curb their lending appetite. With most of its competitors reeling under the after-effects of the bad loan epidemic, HDFC bank continued to march along. They could now assume risks very few banks could take. Almost 28% of the loans they offer remains unsecured, higher than the industry average. But true to their ethos, most (~60%) of these loans are given out to retail clients who've already proved their creditworthiness to the bank. Besides this, their extensive retail clientele also provides them with a cheap source of credit (through deposits) and so they pay considerably less to mobilize funds as opposed to other banks. All these elements coalesce together to give HDFC Bank that slight edge over its competitors.

Now, while it might seem that HDFC bank owes much of its success to its own prudence, I believe that its success is instead a by-product of its competitors' recklessness. Industry dynamics had forced most of the incumbents to overplay their hands and when greed got the better of them, there wasn't much left they could do. HDFC Bank found itself in a sweet spot by following an approach that emphasized limiting losses in declines above ensuring full participation in gains. So if you are currently paying a premium to buy the stock, maybe its warranted because you won't find another bank like HDFC until at least, the incumbents in the industry can sober up and thoroughly clean up their books.

. . .

Enjoyed reading? Show us your love by sharing...

Tweet this articleReview & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsDisclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

READ NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts