As Mallya stepped out of India in 2016, the focus was on the 9000 Crores he owed to the banks. All the talk surrounding his departure was restricted to how he had defrauded institutions of billions and managed to leave the country without a hitch. And yet there was very little talk of all that he had left behind. Things that took an entire century’s worth of effort to build and nurture, things like United Breweries (UB).

“The company was bought by the late Mr. Vittal Mallya in 1947, and since then, has consistently tasted success and never looked back. Today, each one of the 89,763 outlets selling beer in India, sell at least one brand from United Breweries” - United Breweries Website

The whole Mallya fiasco did not affect United Breweries. Instead, with the backing of Heineken — a global powerhouse in the alco-beverage sector United Breweries has been swatting competition and growing at a pace faster than most of its peers. Its revenue (Net of Excise Duty) stands at over 5,600 Crores and its profits close to 400 Crores. It’s share price hovers at about Rs. 1300, a 10 fold increase over its share price in the year 2008 and it’s poised to expand into uncharted territories in the pursuit of growth.

Our story on United Breweries is a humble attempt at deconstructing the business and the stock.

. . .

If you followed our detailed guide on how to brew beer and tried to do it yourself, you’d be left with a useless mix of water, hops and grains. The focus here is not to teach you how to brew your own own beer, instead walk you through the ingredients that go into making beer. Our hope is that through this exercise you will have an understanding of the company’s expenses and what drives them in most cases. The 4 main ingredients that go into making beer are barley, hops, yeast and water and by our estimates United Breweries makes around 14 Million Hectoliters of beer, enough to fill 1,000 Olympic sized swimming pools. A small change in the price of yeast or barley could have a credible impact on their income statement.

Barley in particular proved to be a tough nut to crack because for the longest time beer manufacturers relied on outside imports to meet their demand and importing always proved to be a sub optimal solution. It is next to impossible to control prices and in the case of barley, beer companies were almost always at the mercy of external forces that dictated its price and as such, profits too were ultimately subject to the same forces.

Since then however, most companies have made a concerted effort to reduce their dependence on imports and focus their efforts to procure raw materials indigenously. By working closely with Indian farmers, companies have been able to exercise some semblance of control in reigning their input costs. However, despite these improvements, a sustained increase in commodity prices (barley, yeast etc.) could still have a considerable impact on the company’s bottom line.

Pro Tip: While it is extremely difficult to predict prices of commodities 2 years down the line, it pays to keep a tab on what’s happening in the commodity market. If there is news that prices of barley could spike in the near future, maybe its time to pay close attention to United Breweries' profit margins.

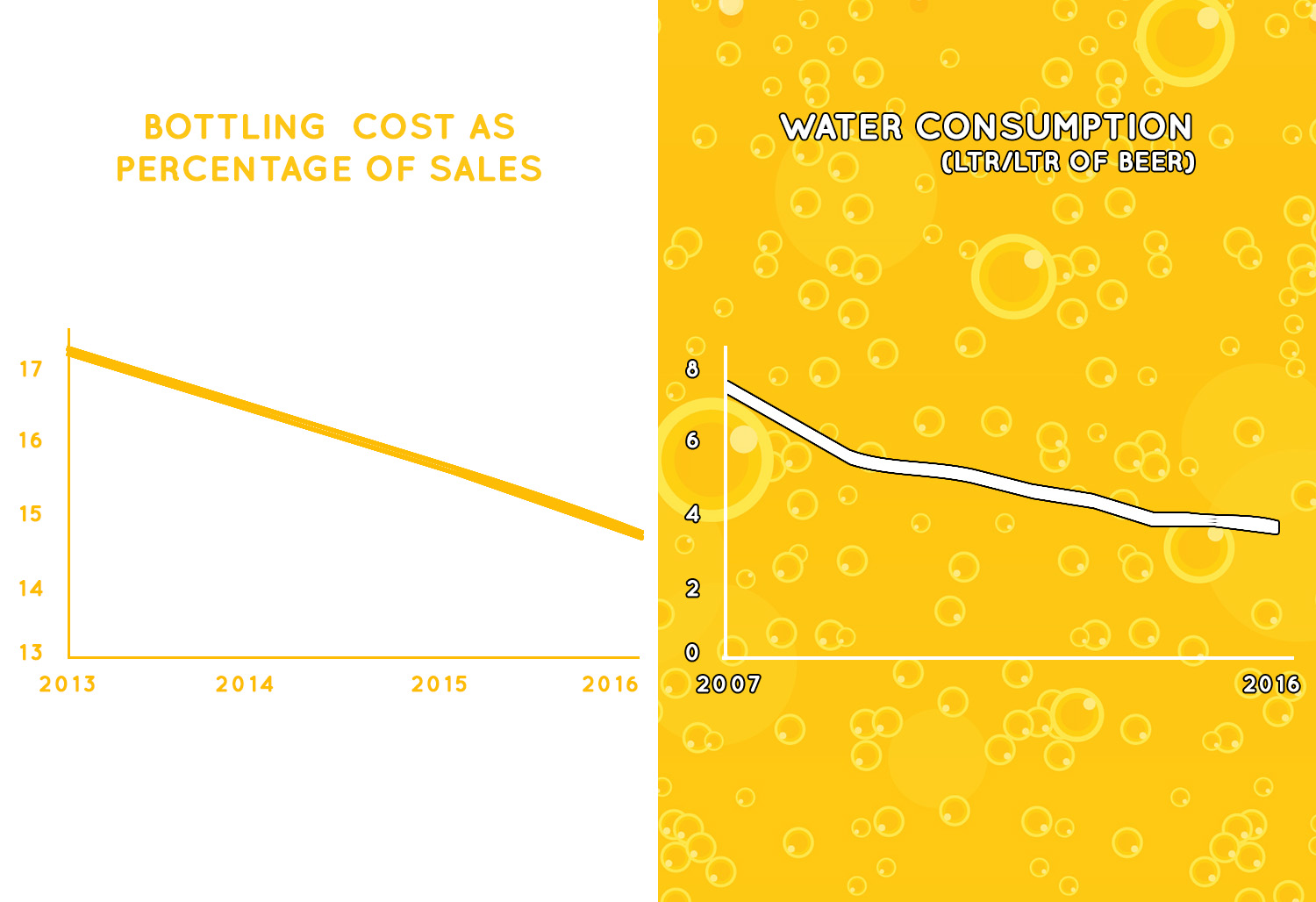

Apart from all the other things that go into making beer, there is one other element without which selling beer becomes virtually impossible and it’s the all important ‘Glass Bottle’. The glass bottle is an essential feature of most beer brands. Unfortunately though, they don’t come cheap. Bottles could form as much as 40% of the total raw material cost and companies spend considerable time and effort in trying to bring down this expense. Now, unlike most things, glass bottles can be reused. And its much cheaper to reuse bottles than to make new ones. On average it costs about Rs. 10 to buy a new bottle whereas you could get a used one for as little as Rs. 3. The only catch — you need to convince the retailers to sell used bottles back to you.

For United Breweries (UB) however, this turned out to be quite a challenge. Most retailers sold back used bottles to the highest bidder, not to the original manufacturer and competitors often bought UB’s used bottles by paying a premium (it was still cheaper to pay a premium for a used Kingfisher bottle than spend money making new ones). This meant that the company lost significant sums trying to outbid competition in an attempt to buy back their own bottles, a rather frustrating endeavor. And that’s when they started patenting their bottles with embossments, which effectively meant competitors could no longer use them. This helped the company bring down manufacturing costs considerably. On top of it, UB has also taken initiatives to introduce rain water harvesting and the likes to decrease consumption of water, in a bid to boost profit margins.

Data borrowed from Motilal Oswal’s Analyst Report

But why not simply pass this increase in cost to the consumer. Make the beer more expensive. Anyway, the alcoholics are immune to price hikes, they’ll pay anything to get their daily dose of beer. What are these guys worried about?

Multiple states have laws that prohibit beer manufacturers from raising prices unilaterally, which means any time there is an increase in input cost, the beer manufacturer has to bear the full brunt, until the state government finally decides to proactively negotiate or allow for price hikes. This isn't limited to input costs alone, instead it extends to excise duties as well. Excise is a duty charged on every case of beer the moment it leaves the brewery. On average, the company’s excise duty amounts to about 50% of its sales and this number has been constantly on the rise. But despite rising excise duties, state governments have been reluctant to let beer manufacturers increase prices

Take for example the case in Maharashtra. Despite increasing excise duty on beer last year, the state government did not allow for a commensurate increase in price. And then there are states that allow for price increases but charge excise duties so high that even the most hardened alcoholics move away from beer for a short while. In West Bengal this year, the company increased its price from Rs. 110 to Rs. 145 per bottle on the back of rising duties and the consumers promptly moved away, in some cases to country liquor. Each of the 29 states of India is a unique market with its own set of rules and regulations that keep changing with time. A company can simultaneously show excellent growth in certain regions, but fail to sell in others.

Pro Tip: There is no credible way to accurately forecast what states will do next. But one thing is clear — beer companies cannot set their own prices in most states. So the next time you see a bottle of beer costing you more than usual, rejoice for it does not happen often. Maybe you could make some money off of a UB Stock instead.

Prohibition is the act of banning the manufacture, sale, and transportation of alcoholic drinks within a particular location. Gujarat is a state that has had prohibition in place for a good number of years. There are a couple other states that have enforced prohibition but we wont bother with them. We will instead look at Kerala and Bihar. In Bihar, the chief minister enforced a state wide ban on alcohol. United breweries had little choice but to abandon production of alcohol and instead switch to non alcoholic beverages.

Since Bihar wasn’t one of the primary markets for beer, the impact on sales was muted. However when prohibition (outside of 5 star hotels) hit Kerala, the move sent shock-waves. Before the ban, the state had India’s highest per-capita alcohol consumption, at more than eight litres per person per year. Fortunately for United Breweries the new government has eased restrictions considerably and business is back to usual.

Pro Tip: While it is quite possible that a state wide prohibition might suddenly render beer manufacturers incapacitated, its unlikely to take effect on any large scale because excise revenue from alcohol forms a significant portion of most state’s revenues. They are unlikely to last.

Election season means a blanket ban on selling alcohol for designated periods as mandated by the election commission. There could also be a limit on the amount of alcohol a person can buy during this time. Sales are almost always affected. But whats particularly disconcerting for beer manufacturers is that a total of 10 states are poised to head to elections next year with the additional caveat of the General Elections.

Outside of the blanket bans, elections are also periods of extreme uncertainty. An opposition party might make prohibition its prime agenda while contesting an election, negatively impacting sales, while another party might offer massive incentives to the working class through subsidies and loan waivers, both of which could aid beer consumption. Its extremely difficult to forecast the real effect of state elections on beer production in the country except make an observation that the immediate future harbors extreme uncertainties.

Pro Tip: If you are someone who is risk averse and hates uncertainty, perhaps its best to wait and watch for another year until the elections conclude and there is more clarity on the policy front.

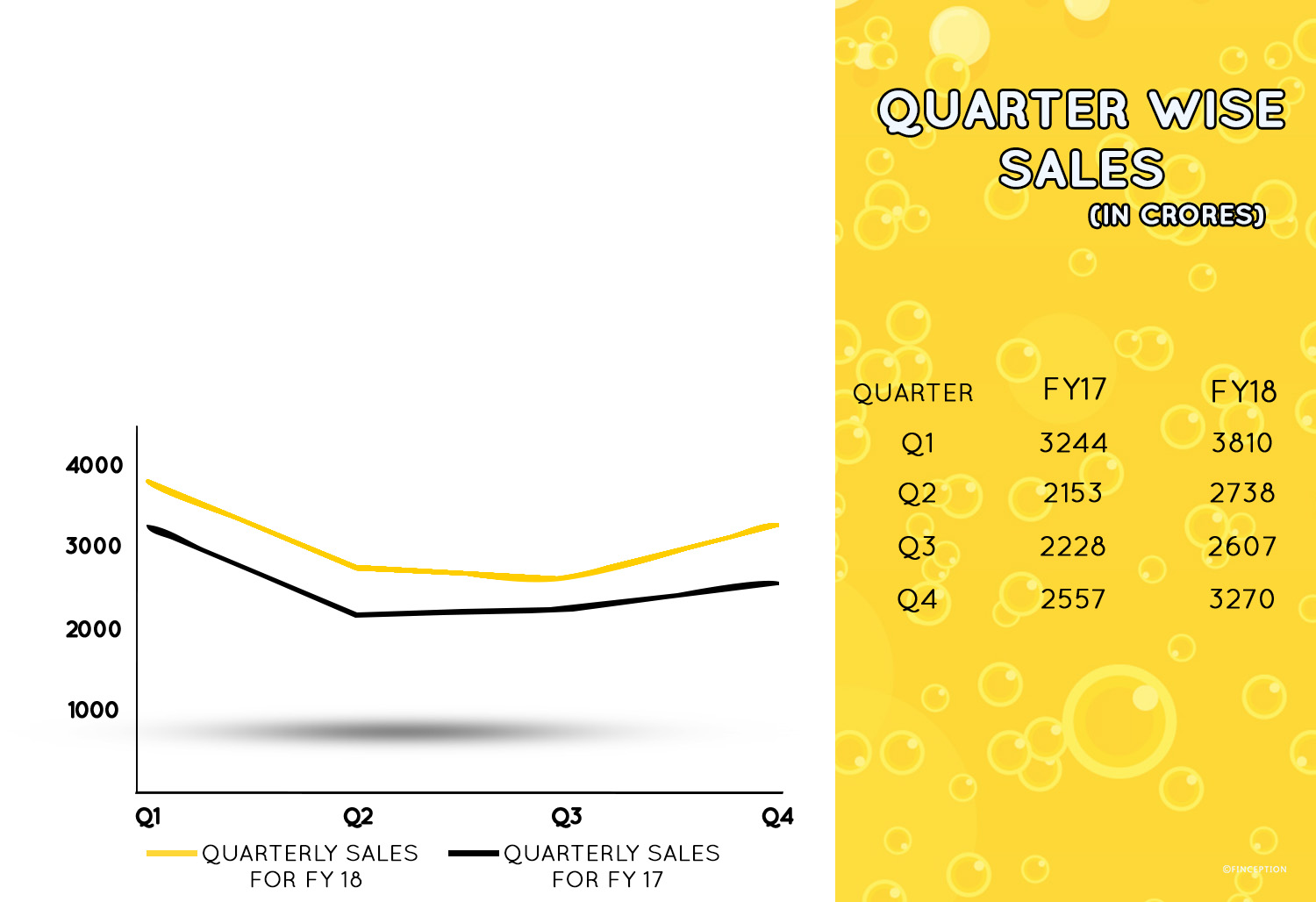

The demand for beer is seasonal in nature with 30% of total volumes being sold in the first quarter summer months. The second and third quarters of the year, constitute traditional low season and together account for 40% of annual volumes.

But why?

India is a hot country during the summers. The first quarter of the financial year begins in April and continues through to June and a chilled beer provides the perfect respite from the scorching summer heat. This is true for months January, February and March — 3 months that form the 4th quarter as well. During these months, breweries across India run at capacities close to a 100%. But then monsoon sets in. Monsoons and winters (Q2 and Q3) are particularly damaging to beer sales. Sales almost always declines and most breweries are left with excess capacity that they simply can’t put to any good use which is why most breweries show capacity utilization between 60–70% — because business is seasonal.

Pro Tip: Sales during Monsoon and Winter will almost always look depressed. So don’t panic if you see a minor dip during these months. Its all part of the process.

In 2017 however, the country saw something spectacular — a rather strange sequence of events, all combine together to render a death blow to beer manufacturers — Demonetization, GST and The Supreme court highway ban. Both sales and Profits immediately took a nose dive. First, it was demonetization. Most people bought alcohol with cash and when cash was hard to come by, they simply stopped visiting their favorite bars. Then, GST. We won’t take you through the whole dynamics of GST and how it impacts beer prices. But let it be known that as things stand, beer is more expensive than it used to be. The supreme court highway ban while in force prevented the sale of liquor within 500 metres of a highway and suddenly hundreds of outlets closed overnight.

Fortunately for United Breweries things changed rather quickly. The effects of demonetization waned. The supreme court highway ban was restricted to only some highways and sales rebounded. While effects of GST still linger, it wasn’t enough to prevent a spectacular rebound and in 2018, UB was back. But the uncertainty involved in all of this left a bad taste.

Pro Tip: Outside of elections and seasonality, there are still many uncertainties that could derail performance. Its very important to assess if the effects of such events are suspected to be temporal or long lasting

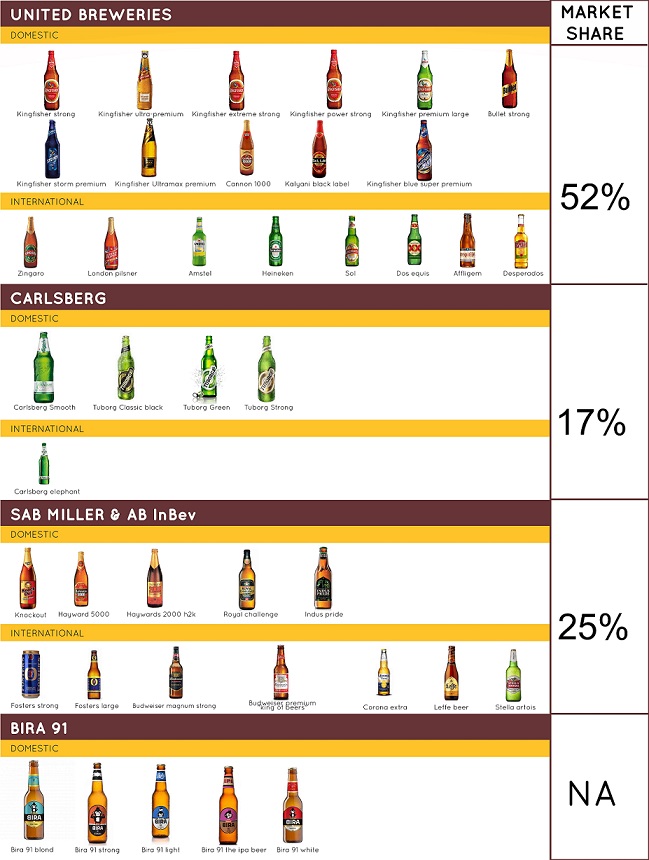

Because United Breweries holds 52 % of the market share and happens to be one of the few beer manufacturers to be profitable. It must also be noted that consumption of beer is perpetually on the rise and the hope is that this trend continues. India provides a market opportunity like no other. While in most countries the proportion of beer sales as a percentage of total alcohol sales stands at 87%, in India, it stands at a measly 20%. Indians are more inclined to consume spirits i.e. whisky, rum, which form 78% of total alcohol sales. The beer market is wide open and it’s there for the taking. Don’t believe us? Take it from Heineken who currently own ~44% of United Breweries. When Heineken was plotting to increase their stake in the company back in 2012, they had a rather interesting set of numbers to present whilst elaborating on the Indian Beer Market.

India has a total of 90,000 outlets selling beer. China on the other hand has over 44,00,000. While an Indian has to work 46 minutes to buy a bottle of beer, a Chinese national in Guangdong can buy one after working for only 10 minutes. The bottom line is that Beer is expensive and not enough outlets sell them. The hope is that if government policies and tax structures are favorable, India could prove to be a valuable market for future expansion.

Point of Interest : Outside of the regular Kingfisher brands, United Breweries also manufactures and sells beers made by Heineken, thus giving it access to a larger portfolio of beers.

Despite being the dominant player in the market, United Breweries is up against some stiff competition from the likes of Carlsberg and the Joint Venture of SAB Miller (Makers of Haywards &Royal Challenge) and AB Inbev (Makers of Budweiser and Corona). By now, almost all beer manufacturers are talking about premiumization — A phenomenon where an ever increasing portion of beer enthusiasts are shifting to more expensive beer. While UB has traditionally owned the markets for cheaper variants, its ability to hold sway in the premium sector is still suspect. Then there is the whole phenomenon of Craft Beer i.e. Bira 91 and although the definition of what constitutes craft beer is still up for debate, growth in the craft beer industry is expected to reach double digits soon.

In the face of an ever changing landscape, United Breweries isn't resting on its laurels. It continues to invest in building its brand and has been expanding its portfolio in a big way. Last year, the company released Kingfisher Storm, a premium strong beer, to ride on this new wave of premiumization ( It sold 1 million cases ). UB also expects Heineken to play a leading role in promoting its international brands in India. As part of this expansion plan, the company has already introduced Amstel, a super premium strong beer to compete against the likes of Carlsberg. UB is also planning to add a craft beer to its portfolio soon and the opportunities seemingly looks endless. But with a new wave of elections and policy changes, how much of this opportunity will actually materialize to growth? We don’t know.

Review & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts