When Harsh Mariwala first stepped out to carve a name for himself he was leaving behind a rich legacy and possibly risking everything he had ever worked for

Mr. Mariwala came from a rich family that had built an empire dealing with agriculture commodities for over a 100 years. The company was called Bombay Oil Industries but their expertise however was in the lucrative pepper trade which coincidentally also earned them the name “Mariwala” (mari means pepper in Gujarati). But after working for the family run empire for a couple decades, Harsh could clearly see that his ambitions were largely curtailed by the bureaucracy within the family which by now was overseen by multiple scions of the Mariwala family. It was perhaps disheartening to see that the consumer business he headed was by far the most lucrative division and yet, for all its potential, he could do very little to it without the consensus and the funds needed to grow the business and so, when Bombay Oil was finally carved into multiple subsidiaries Harsh had with him for the first time the autonomy to finally realize his vision. With reserves of about a couple Crores and two legacy brands, in Saffola and Parachute, Marico was born on April 2, 1991.

Parachute as we’ve already noted was originally conceived in the family run business of the Mariwala’s at Bombay Oil Industries. They were sold in huge tin cans of 15 liters each, mostly through wholesalers. But during the late 70’s traders in Bombay were already experimenting with different packs and sizes. Some of the more adventurous folks had begun to sell Parachute in smaller packs, more consumer friendly and were receiving considerable interest from buyers as well. When Harsh Mariwala got whiff of this, he immediately charted a plan to introduce Parachute in cheaper and more consumer friendly plastic bottles as well.

However retailers were wary of stocking parachute in plastic bottles. They were worried about the rats because rats liked nothing more than a good dose of coconut oil and the soft plastic bottles were no match for the rats as they could easily nibble on them and break into the bottles. Harsh and his team had to find a solution and it was at this time that the iconic rigid pack came into being. The earlier variants of plastic bottles came in box shaped containers and rats could easily latch on to them and bite into the bottles. The management’s simple solution was to make rounded containers with harder variants of plastic, and this small innovation was an instant hit with retailers and consumers alike.

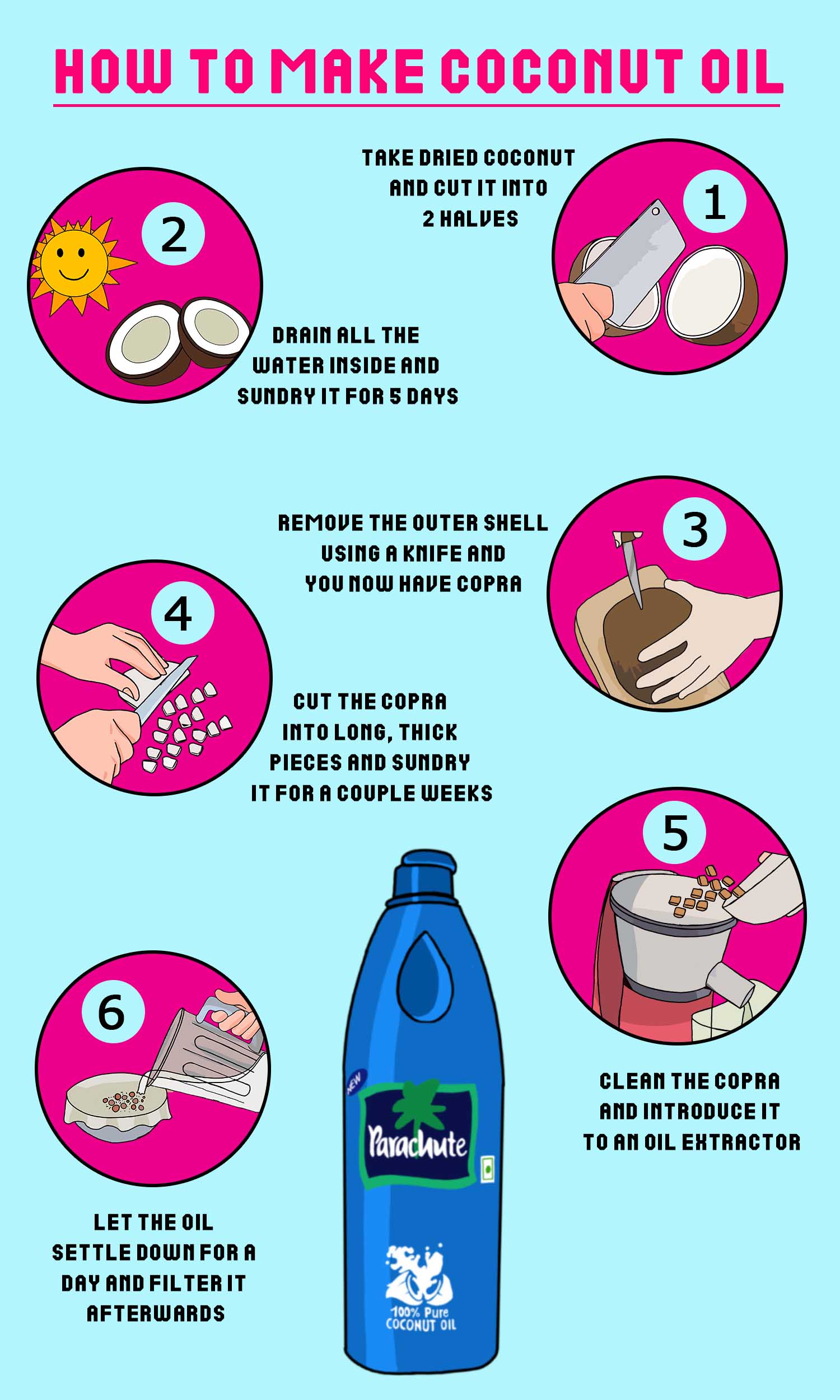

Today, Parachute Coconut oil forms roughly 40% of the company’s sales portfolio in India and its performance is vital to Marico’s share price. The company commands a staggering 60% market share in the coconut oil market and any impact on Parachute’s sales could have a detrimental impact on the overall financial performance. This is where copra enters the picture. Copra is a key raw material used to produce parachute coconut oil. When copra prices increase disproportionately, the company’s input costs rise in tandem. It becomes more expensive to manufacture coconut oil and in turn affects the company’s profit margins. Although the company does hike prices, a sustained increase could mean losing market share and the company takes great care to avoid such a scenario.

The operating margin for the India business was at 21.3% (before corporate allocations) versus 24.3% in FY2017. Lower operating margins can be attributed mainly to the gross margin contraction on account of the severe input cost push (rising copra prices) during the year — Annual Report 2018

But then in the beginning of 2018, copra prices started falling steeply. Now readers must bear in mind that it takes a while for the company to translate the gains in falling copra prices to actual improvements in profit margins. According to the company’s own estimates, margins should start improving post October. However, the falling prices were good enough for investors to push the share price to record highs.

Pro Tip: Although copra prices and Marico’s share price performance is not perfectly correlated, it still has a bearing on deciding the company’s fortunes. So keeping an eye out for copra prices might help you assess future performance of the company

While most folks are well aware of the Parachute brand and its rich legacy not a lot has been said about how parachute is sold and marketed. Parachute for the most part isn’t sold as hair oil, it’s sold as edible oil. Marico has been fighting in the courts to retain this status for the simple reason that edible oil is taxed at 5% while cosmetic hair oil is taxed at a whopping 18% . Despite the Parachute ads subliminally trying to indicate that they can be used as hair oil they don’t explicitly make this claim. The packaging too is devoid of any such communication, instead most of it is centered on the goodness of coconut oil and its apparent benefits to the human body.

We mention this because it is imperative to make a clear distinction between coconut oil and cosmetic hair oil. The cosmetic division for hair care largely comprises of value added hair oil. Parachute Advansed, Nihar, Hair& Care etc. combine to form the value added hair oil portfolio. This business contributes about 26% to the total domestic sales today. While Parachute with its large base has managed to post modest growth numbers, value added hair oil is expected to grow at a CAGR of about 20% over the next few years.

Pro Tip:Pay close attention to how value added hair oils perform over the coming years because it could hold the key to understanding where Marico is headed for the future.

There has been an interesting development off late. In the first quarter of the current financial year, rural sales grew by 28% while urban sales grew by 16% in total value. That’s a difference of 12 percentage points and it isn’t an aberration either. Rural sales has consistently outpaced urban growth over the past 4 quarters and this has proved to be quite an opportunity for Marico. Back in 2010, sales from rural areas contributed to about 26% of the total business. In 2015, this number stood at 33%. Over the past 3 years there hasn’t been much change on this front, but recent growth numbers in rural channels has piqued the company’s interest once again.

“With rural sales contributing 32% of domestic revenues, the Company expects to take this up by at least 3–4 percentage points in the next 3–5 years”- Annual Report 2018

As the rural economy starts contributing more to Marico’s overall business, it pays to see what drives the rural economy itself. If the farm hand has more to spend, that’s likely to aid growth in rural areas. Minimum support prices for crops, loan waivers and a good monsoon season could all aid consumer spending and in turn benefit Marico. However a bad monsoon or a crippling policy decision i.e. demonetization could halt momentum as it did during FY 2017, when Marico’s rural sales declined by 6%.

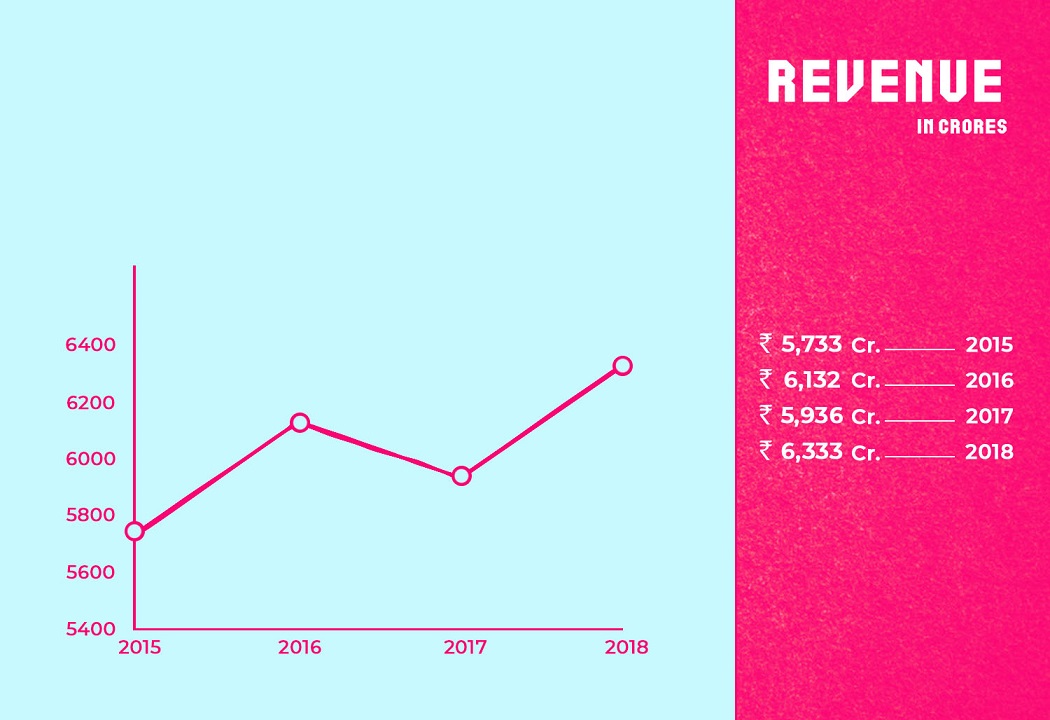

Marico’s Total Revenue during FY 2015–2018

Pro Tip:As the share from rural markets start increasing, monsoons could start playing a more decisive role in Marico’s financial performance

Saffola, like Parachute is a legacy brand. It was introduced back in the 60’s and like Parachute was mostly sold in large tin cans with little attention being paid to packaging or positioning. But it was in the 90’s that Saffola began to establish itself as a serious player. With ads filled with ambulance lights, sirens and heart rate monitors, the brand positioned itself as a ‘Life Insurance’ for heart patients. With this new tagline and fancy packaging, Saffola was able to sell itself as a premium brand for a healthy heart.

While in the initial years, the marketing gimmick worked exceedingly well, the brand became increasingly reliant on the heart patient to sustain growth and that became a problem as the years rolled by. So the brand had to then shift to communicating a much broader value proposition in that Saffola oil helps you maintain a healthy lifestyle.

The problem for Saffola it seems, is that it isn't the only brand that is now positioned to cater to the health conscious consumer. Fortune and Emami have been selling their own variants of healthy oil and they sell at competitive rates as well. Although Saffola is still a market leader in the super premium refined edible oil segment (69%) growth has largely remained flat over the past few quarters.

“Saffola Edible Oils had a challenging year (FY 2018). We have now diagnosed the issue and rolled out a multi-pronged action plan to ensure recovery and growth” — CEO, Marico

Another problem lies in the fact that Saffola sells its refined oil under 4 different sub-brands that all look eerily similar— Total, Active, Gold and Tasty. Unless the value proposition is communicated clearly, the subtle differences between the 4 different sub brands will be of little interest to the consumer and the purchase decision will be driven by price alone.

However there has been some good news recently. Sales is starting to pick up and Saffola edible oil is back to growing at 10% and the CEO, Mr. Saugata Gupta was confident of sales returning to normal levels within the next few quarters.

“Our promo and modern trade strategy is back on track, while we still have work to do on driving differentiation and communication between the variants. It will be a gradual recovery and it will take one or two quarters” — Q1FY19 Earnings Call

Another silver lining for the company is that it has been able to market its food products (oats, masala oats etc.) under the brand name Saffola using the same promise of a healthy lifestyle and this particular division has posted healthy growth rates and is expected to clock revenues close to 200 Crores the next year.

Canteen Store Department (CSD) is the largest retail store chain (by way of number of stores) in India stretching across the far fringes of this country serving a total of 12 million retired and serving defense personnel and their families. CSD stores are extremely popular because most products sold here are exempt of certain taxes and are available at bargain prices. But CSD also happens to be Marico’s biggest customer . Almost 7% of Marico’s India business could be directly attributed to purchases from the CSD.

“Sales to CSD was flattish for the year” — Annual Report 2018

But an over reliance on one channel poses its own set of risks. When CSD started reducing stocking levels during the GST implementation, it immediately had an impact on many FMCG companies, including Marico. There were also rumours of CSD cutting back on purchases and imposing stricter quotas to reduce pilferage and corruption, all of which could have a material impact on Marico’s sales.

Point of Interest : While Marico isn't overly reliant on sales from the Canteen Stores Department, a disruption in this channel will still have an impact on Marico’s financial performance.

After having intimately worked with a large family business for well over 2 decades, Harsh Mariwala knows fully well the problem of mixing family and business. “This is not a lala company, family members are not automatically entitled to succession. They have to prove their mettle by building a business.” — he says. Its a value that is echoed in both word and spirit. Mariwala’s two children do not play a role in the day to day working of the company. In fact Mariwala himself retired as CEO in 2016 and has left the company in the hands of strict management professionals.

But perhaps what binds them together is that both Harsh and the management professionals have an insatiable desire to innovate. Despite being market leaders in multiple consumer segments, Marico has continued to invest in new product offerings. It has also played a proactive role in taking the brand outside of India and is now present in 6 countries with the international business contributing about 22% of the company’s revenues. What is also heartening to see is how they have resorted to both organic and inorganic pursuits. Saffola Oats was an in house invention whilst Set Wet and Livon was introduced to its portfolio through an acquisition. But nonetheless both have gone on to become huge growth drivers for the company and have become mainstays in the company’s brand portfolio

“We are quite confident that the new engines of growth, namely Male Grooming and Serums, have reached points of inflection, which means we can grow 20% plus in value terms consistently” — CEO, Marico

But the company isn't resting on its laurels. It continues to invest in innovating incessantly. It recently introduced vending machines in the hope that it can get more people to try out its products. The company has over 200 vending machines already and they continue to keep adding more to drive trials and in the process register growth of over 30% in the food sector going ahead. The innovation doesn't stop at food, instead it extends to the whole wellness space — what Marico likes to call Neutraceuticals and Wellness. They recently picked up a 45% stake in the Ahmedabad based grooming company Beardo and also made an investment in the fitness based company Revofit — all this in an attempt to be an FMCG brand that can emerge from the shadows of the giants and find its place among the pantheon of the greats. It seems Marico has come a long way from its Bombay Oil days and still has a lot left in its tank but will Marico keep moving onwards and upwards?

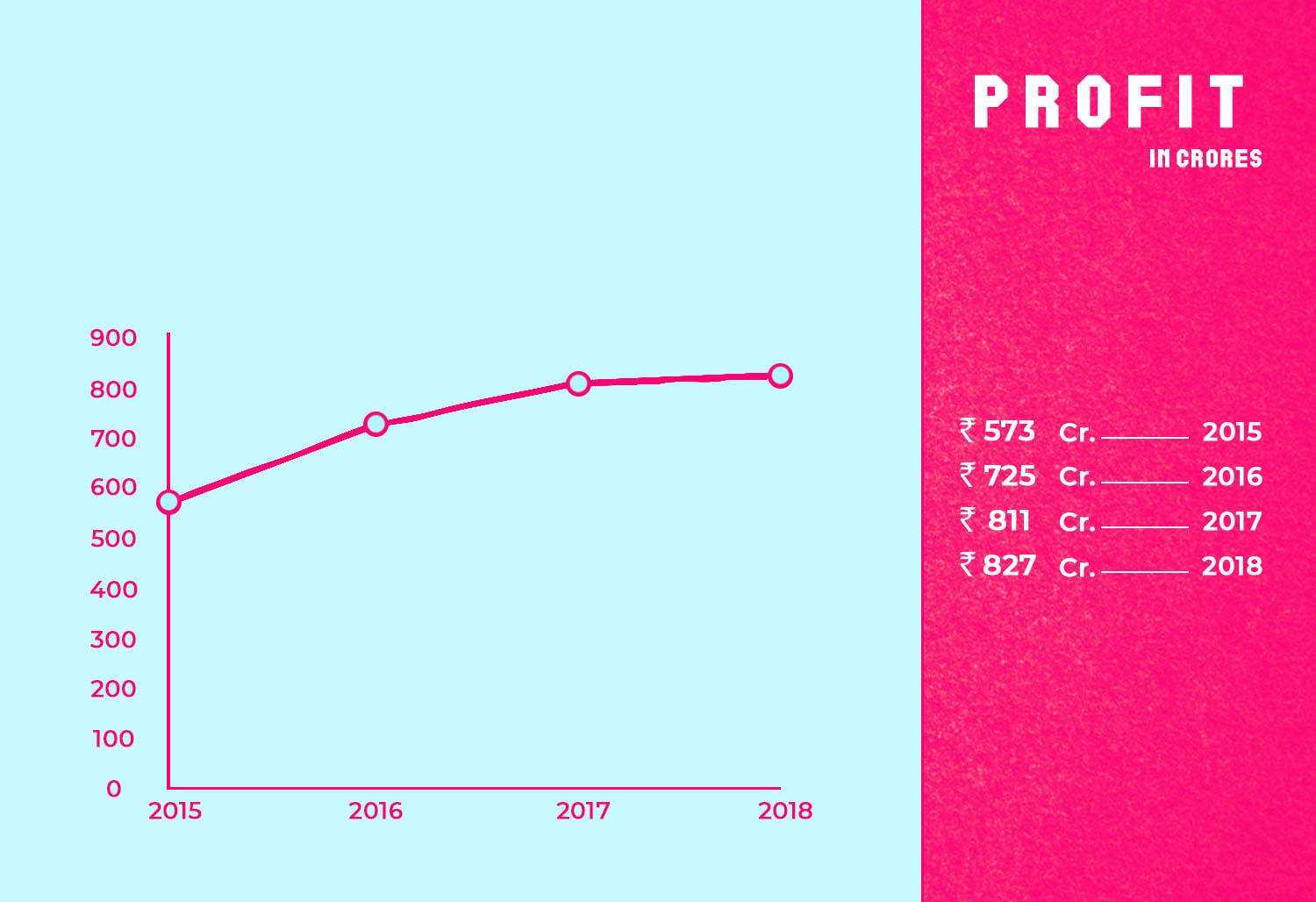

Marico’s Total Profits after tax during FY 2015–2018

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts