The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man. -George Bernard Shaw

The unreasonable man has been an essential feature of modern India. From business icons of the yesteryears that built the foundation and paved the way for the country to become an economic superpower; to modern-day startup gurus who continue to breathe new life into India's growth engine — India continues to produce its fair share of innovators. But sandwiched between the two epochs are stories of men less talked about — whose exploits have been sidelined by the more glamorous individuals but whose impact on Indian commerce has been as important to India's growth-cause as the achievements of their more renowned peers.

At a time when most movie theaters in India carried single screens and offered very little beyond the traditional movie experience Ajay Bijli, then 23 years old was still a student at Delhi's Hindu College. After joining the family business in 1991 and working under his father's tutelage for a while he knew he had no real interest in the transportation business. Instead his attention was firmly affixed on the family owned movie theater 'Priya'. It was this love affair that would eventually spur him on to play a pioneering role in how Indians interacted with cinema.

Ajay saw that the Indian theater experience was rather primitive and had immense scope for improvement and so he focused all his interests on 'Priya' and with a gambit of ₹ 30 Lakh and his father's vote of confidence he began renovating the facility. For a while, it seemed to work. More people started turning out and it looked like 'Priya' was being primed for success. But with a single screen and a rather select set of movies, it would be impossible for Ajay to create the kind of impact he had always envisioned for himself.

All that changed when a visiting Universal Pictures associate connected Ajay with executives at Village Roadshow (VRS), an Australian company that specialized in multiplexes. Ajay pounced on this chance meeting and immediately struck a deal with VRS and formed a joint venture — Priya Village Roadshow (PVR) and by 1997, Delhi had its first 4 screen multiplex at Saket.

All of PVR's screens operate out of leased space except the one at Saket — a purchase borne out of sentimental value perhaps?

It was at this time that the innovator-in-chief surged away from the pack building screens at a pace that belied expectations. However Ajay's insatiable desire to expand hit a roadblock when VRS decided to exit the partnership as part of its divestment plan back in 2002. In a moment of rare audacity, Ajay bought out Village Roadshow, retained the name PVR and continued to march along.

After this minor blip, the focus was back on growing the business. Ajay knew that much of his initial success depended on quality content and exercising some control over it would aid his business. To this extent, he set up PVR Pictures in a bid to back and promote movies that found no backers.

"We knew if these movies were released at right locations, and at appropriate show timings, they would be profitable"- Ajay Bijli on setting up PVR Pictures

In the meantime, he also looked at pricing. Most industries followed dynamic pricing structures. Yet the 'cinemas' paid very little attention to it. Ajay, in a bid to attract patrons devised pricing models based on actual demand — Weekdays, you pay less, Weekends you pay more, it's that simple.

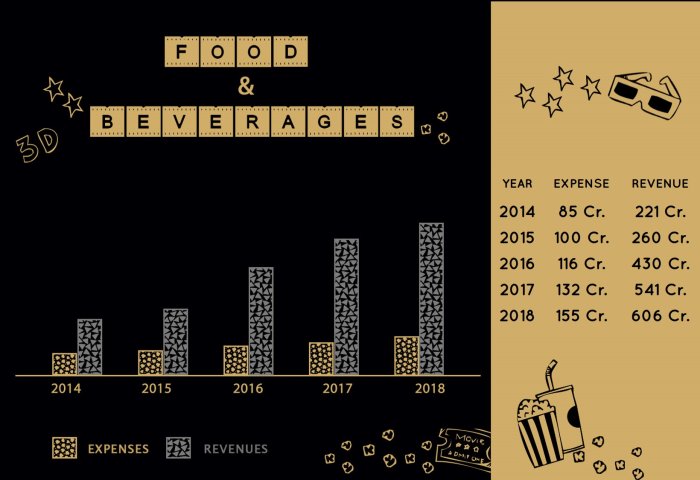

This flexible pricing model extended to Food & Beverages (F&B) as well. The company realized that by introducing product incentives i.e. offering "combo" products at cheaper prices, it was possible to extract more value from each customer and in a sneaky move devised ways to make you pay more every time you visit the cinemas.

PVR was also one of the first multiplex chains to tap into the corporate market and introduce bulk bookings. It installed electronic ticket kiosks at its facilities and partnered with online booking services to enable patrons to access ticketing services on-the-go. It introduced luxury at a time when luxury was hard to come by and continued to stay ahead of the curve. PVR wanted to create the ultimate cinematic experience. Its sole objective — To walk with Giants.

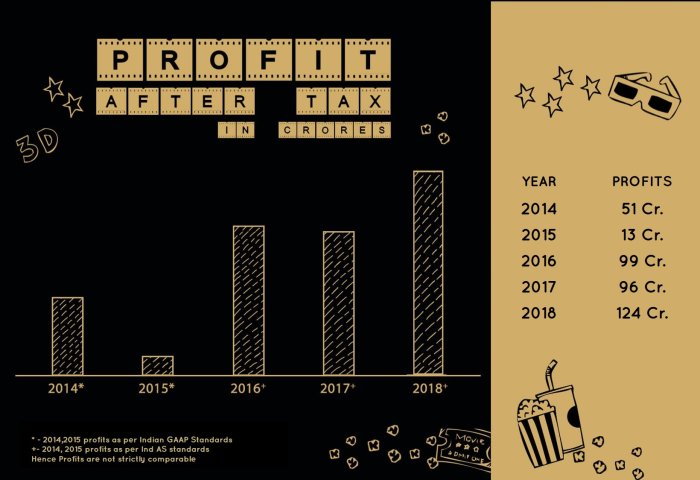

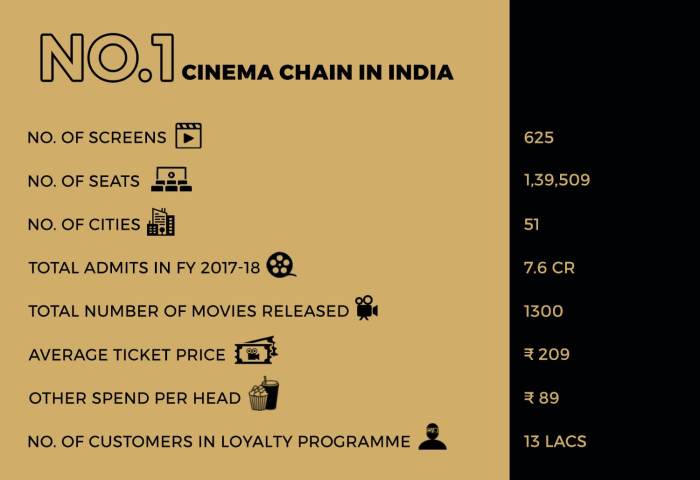

And today, at 634 screens, spread across 51 cities, PVR is the worlds' 7th largest multiplex chain (By way of Total Admits) and continues to remain the undisputed market leader in India. It made revenues of about ~2250 Crores and profits of ~124 Crores during 2018 and with it created considerable wealth for its shareholders.

A comparison of its share price performance with INOX shows just how impressive PVR has been over the years

But the good old days are behind us. Dark forces gather at the horizon. It seems PVR has a new nemesis.

It all began with a bluff when an irate customer threatened to take a multiplex owner to court after personnel from the movie theater refused to let an old couple carry bottled water inside. By this time however, customers had become increasingly frustrated over the callous attitude most cinema halls adopted over food. There was a blanket ban on outside foodstuff and they were almost always being sold inside theaters at exorbitant rates so much so that when the annoyed gentleman decided to take matters into his own hands, he found support from all corners.

When the customer eventually filed a public interest litigation with the Bombay High Court, the public rejoiced — a sentiment echoed by the lawmakers as well. The courts immediately directed city officials to frame guidelines preventing movie theaters from charging exorbitant prices and banning foodstuff inside cinema halls. On the face of mounting opposition, the state's food minister reiterated that there was no legal provision for multiplexes to deny customers their right to carry food and by the time the dust settled PVR's stock price was down 13%.

To understand the dynamics at work we must first dissect the economics of running a multiplex. In FY18, revenues from food and beverages stood at about ~600 Cr and corresponding expenses at ~150 Cr (excluding the fixed and common overheads) offering PVR a profit margin of over 300%. A detrimental impact to this business could spell a death sentence to PVR. It's as simple as this — tickets don't make money, popcorns do.

Since the Bombay High Court ruling, multiple states have issued similar diktats. But in almost every case, the order was subsequently challenged and the matter went back to the courts. However in a bid to prevent further escalation, both parties are seeking a compromise — The ban stays but the prices come down. Since the matter is still sub judice perhaps it pays to keep an eye out for the verdict.

Pro Tip: The outcome of the popcorn wars could have a material impact on PVR's stock price. So the next time you visit a PVR, take some chips with you and see if they let you in. If they don't, maybe it's about time you start thinking about buying some PVR stock.

The high court ruling was merely a blip. While it shook investor confidence for a short while there was consensus that it did not affect long term prospects. However, with the introduction of Netflix and other OTT (over-the-top) platforms the very future of cinema looked shaky. But is there any real merit to such a claim?

Let's talk IPL. During the first season, there was considerable fear that IPL would have a detrimental impact on cinema. The rationale was that people would now spend less time going to the movies and this in turn would affect occupancy rates. These claims weren't completely unfounded as in the early days, producers tried to stay clear of the IPL season. But as movies started coming out thick and fast, producers were left with little choice but to release them during the dreaded summer months . However, much to their surprise the move did not have a material impact on movie turnouts, instead, in almost anticlimactic fashion, IPL served as a platform for actors to promote their new movies.

While it's possible that Netflix could draw some users away from cinema, it could also end up aiding its growth. This point is best summarized by the Chief Content Officer at Netflix, Mr. Ted Sarandos.

Back in the day, people used to say video stores would kill theaters, now they assume streaming sites like Netflix will be the death knell. In hindsight, video stores actually saved cinema. It introduced new filmmakers and artists who were previously unknown. People always worry about how something is going to hurt when they should be focusing on how it is going to help. What it helps is the eco-system of movie making

Pro Tip: Don't believe in Doomsday conspiracy theories. Cinema in all likelihood will continue to survive even with the proliferation of Netflix

So what then drives the movie business? What is the secret sauce that propels growth in the industry?

Well, to put it simply — Success in the film exhibition business is heavily dependent on the flow and quality of content. Good content almost inevitably guarantees better footfall and PVR like any other multiplex is at the mercy of filmmakers and audiences alike. Take for example what happened in 2015. At a time when PVR was posting stellar numbers and firmly affixed on the growth path, this particular feature surrounding content played out rather spectacularly.

During the year, the company entertained fewer patrons owing to a disappointing box office performance of the movies. Despite their best attempts to shore up the financials, revenues failed to impress and they were unable to reign in expenses. Profits fell from 50 Crores to 20 Crores. In what was a testing year, the company's only saving grace came from advertising and F&B revenues. Content had played spoilsport.

Pro Tip: If there aren't enough "Sallu Bhai" movies passing around for the year, maybe its time you sold some of that PVR stock.

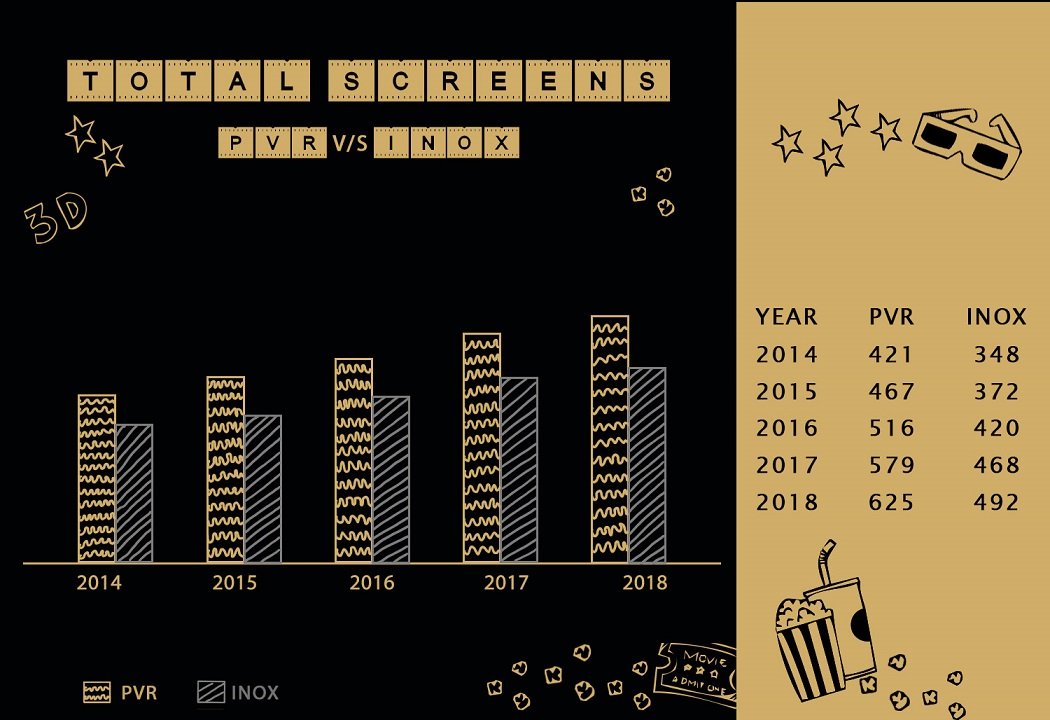

But the most important indicator of stock performance is growth. All is forgiven if a company can find new avenues to grow. The challenge, however, is that growth is hard to come by in the movie business. There are only two ways in which a company like PVR can expand its top line by a significant margin— Adding new screens to its already burgeoning portfolio or by increasing occupancy rates. Unfortunately, occupancy rates have been consistently falling over the past few years.

So the only viable alternative for PVR is to add more screens. Building your own screens however is a time-consuming affair. You are ultimately relying on real estate developers to construct shopping malls in prime locations; for you to then lease out that space. Add to this the mandatory regulatory approvals and you are immediately looking at glum prospects

INOX planned to open 55 new screens in FY18, but owing to regulatory approvals they had to stop at 24.

And so in a bid to keep the growth engine running, the company has resorted to acquisitions. Acquisitions give you a workaround. You don't have to seek regulatory approvals or worry about real estate or footfalls. Somebody else does all the work for you until you go and buy them out.

PVR acquired 138 screens from Cinemax in 2013 and 32 screens from DT Cinemas in 2016.

Take for example the recent acquisition of SPI Cinemas, a South Indian multiplex chain. PVR acquired the entity for a fee of about 1000 Cr. and in the process added 89 screens to its tally with a simple stroke of a pen. (PVR increased its screen count from 155 to 243 in South India). The acquisition helped them gain access to a market that otherwise would have taken them years to enter.

Tamil, Telugu and Kannada movies put together contribute about 37% of the total box office collections in this country. Yet Multiplexes have been unable to tap into these markets because of the continued domination of single screen theaters and so an acquisition like this adds considerable value to PVR.

However acquisitions come at a premium. The company paid a net total (Enterprise Value) of about 11.7 Cr per screen, a considerable sum.

Pro Tip: Every time there is an acquisition, the company releases a document outlining the merits of the deal. Read this document carefully. Its got nuggets of cool information in it that could help you create some wealth of your own.

However with great growth comes great responsibility. One of the fundamental markers of a good company is its ability to keep its margins up as it expands. Unfortunately for PVR, margins (EBIDTA) have steadily decreased over the past few years. While in 2015, the company's margins stood at 14%, today it languishes at about 8%.

EBITDA margin is an assessment of a firm's operating profitability as a percentage of its total revenue. It is equal to Earnings before Interest, Tax, Depreciation, and Amortization (EBITDA) divided by total revenue.

But investors have fleeting memories. They will almost always overlook minor transgressions if the company can find new avenues to grow. After rallying for a few years the stock price now sits at about ₹ 1300. For all of PVR's pioneering work in the past, its future now rests squarely on its ability to find new, more ingenious ways to grow. For its part, however, the company has outlined grand ambitions. Expansion outside India, loyalty programs, an on-demand screening service, the list is seemingly endless. But all of this counts for precious little if they don't translate to tangible results.

For now, the target is set — "A 1000 screens in India by 2020"

The need of the hour — "Unreasonable Men"

Review & Analysis by Pawan, IIM Ahmedabad

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts