The year is 2000. There is eerie silence in the drawing room as Xerses Desai, the Managing Director of Titan ponders over the company’s future. He has long been searching for a worthy successor to carry his Legacy forward, but its no easy task picking a leader to run the burgeoning watchmaker.

He has finally boiled down his list to two candidates. On the one hand is Bhaskar Bhat, an alumnus of the IIM Ahmedabad, a veteran of the group and experience working in multiple divisions. On the other hand there is Vasant Nangia, an IIM Calcutta alumnus, Vice President Marketing and the hands on man at Tanishq. After much deliberation, Xerses chooses Bhaskar Bhat to lead India’s largest Watch company. Nangia is asked to take charge as COO. But this decision doesn’t seem to go well with Nangia And the day after the decision,

“The entire sales and marketing team resigned on that day. The company was rocked by what happened. Many thought this would be finally the way Titan closed down its jewellery business. After all, we were in our fifth consecutive year of losses then,” says Jacob Kurian, COO of jewellery Business.

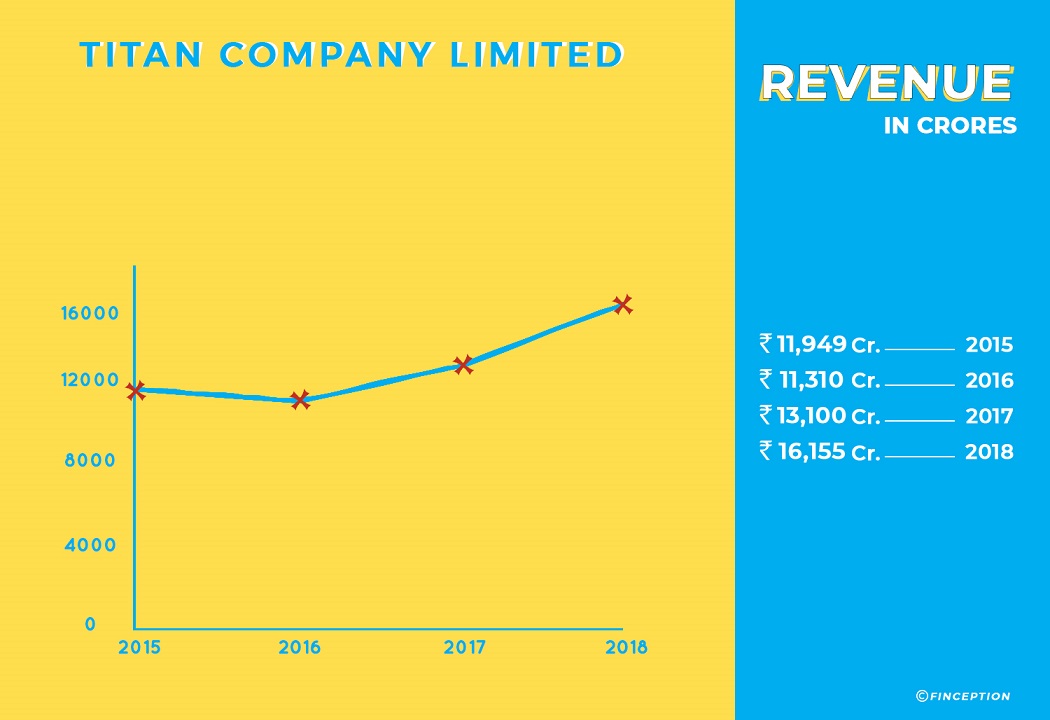

As history would have it, Bhaskar Bhat would immediately seize control, steady the ship, turn the loss-making Tanishq into a profitable entity and chart a turnaround story for the ages. From a mere ~700 Crores in revenues (FY 2001) to ~16,000 Crores today, Titan would go on to become a behemoth in its own right and a darling of the investor community, mainly thanks to Tanishq.

Titan is, after all, a watchmaker. Wouldn’t it be prudent for this story to concentrate on the watches segment or Fastrack or even eyewear? Why is the story about gold? Why isn’t it about any of the other businesses?

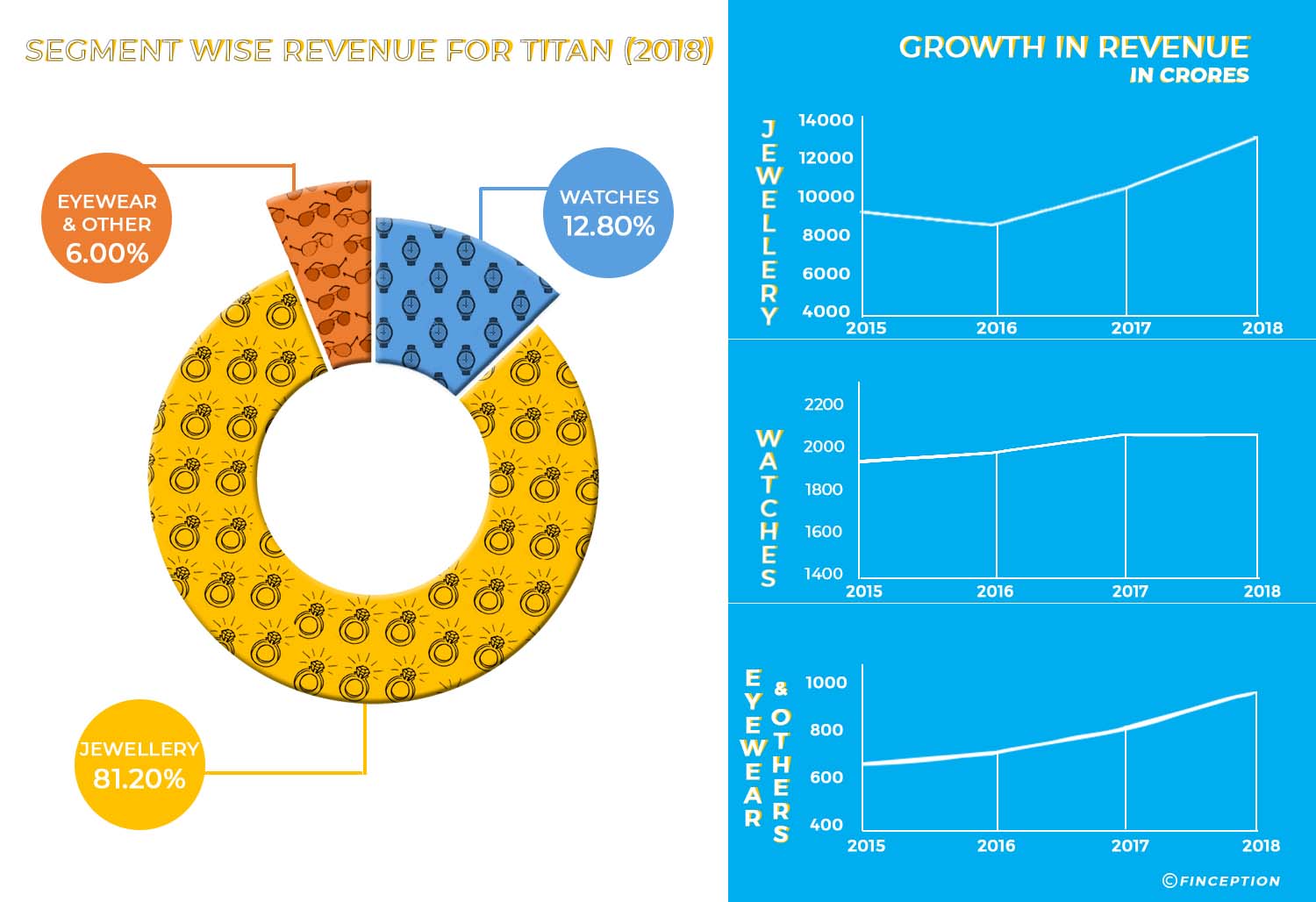

Well, to answer this we must first look at the revenue contributors for Titan. Let’s pick the eyewear segment. Eyewear contributes about 2% of the company’s revenue. It doesn’t matter how much they grow, its overall impact on the company’s finances will continue to be negligible. Then there are the other peripheral segments that include perfumes, wallets and handbags, all of which contribute less than 4% to Titan’s top line — a contribution touch better than eyewear, but still largely insignificant. Watches, on the other hand, have a more pronounced impact. Fastrack, Titan, Helios and Xylys together combine to form about 13% of the company’s revenues. While the segment has a rich history and sentimental value growth has been unimpressive and that leaves us with the cash cow — Tanishq. The company’s jewellery business occupies a whopping 82% in revenue share and is the primary growth driver. So while Titan is popular with the masses for being a watchmaker it’s Tanishq that’s driving the business forward.

And so without further ado, we jump into the nitty-gritty of Titan’s lucrative Jewellery business.

. . .

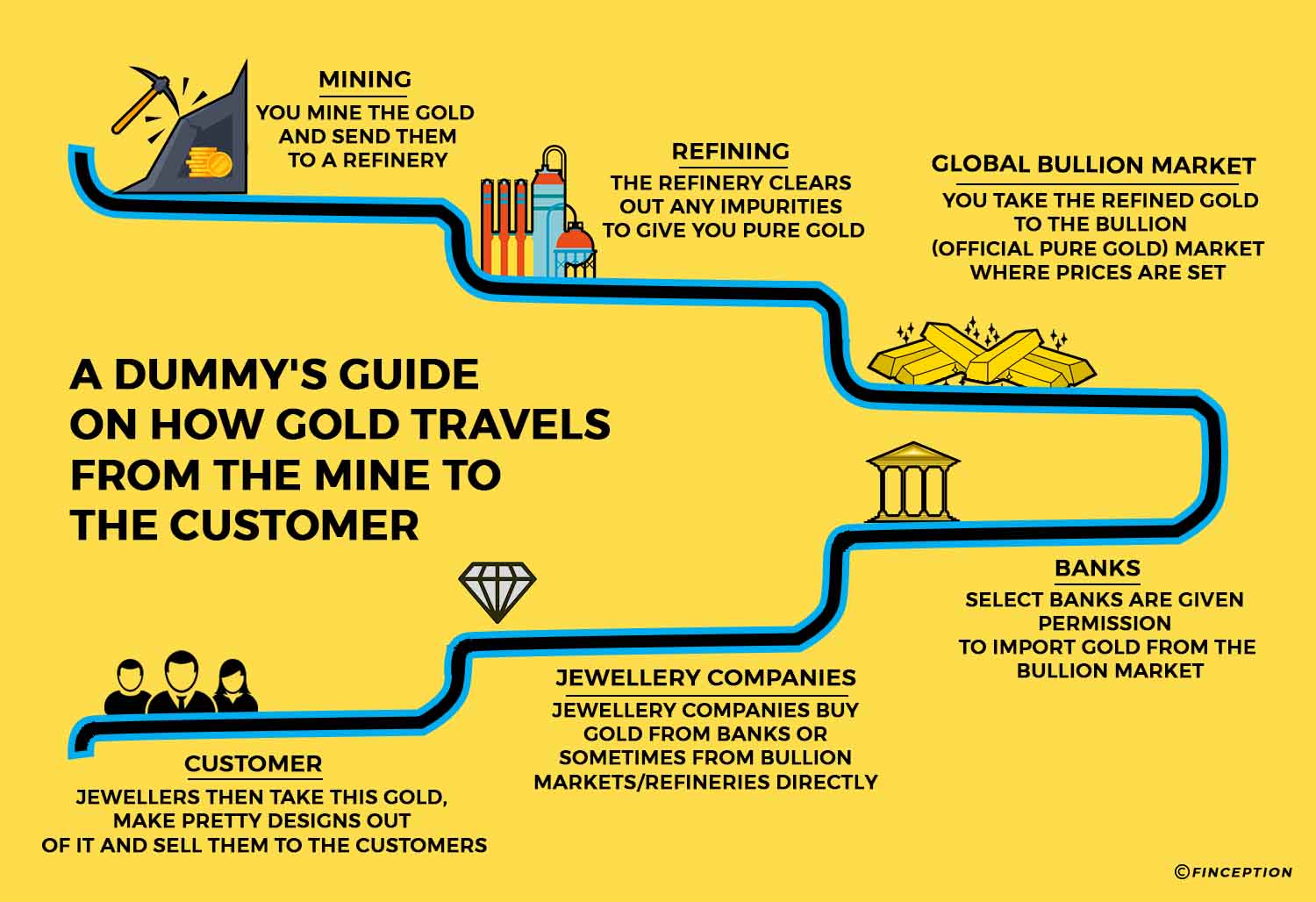

Imagine one day you decide to enter the Jewellery business. You set up a small shop next to your neighbourhood and start making arrangements to get your business up and running. You strike a deal with one of the authorised banks and start buying gold at a fixed price of Rs. 32,000 for 10 grams. You use up all the gold to make the finest jewellery and you are days away from opening your store to the general public. But unbeknownst to you, gold prices start sliding over the next few days and by the time the final touches are complete, the market price for gold has crashed to Rs. 25,000 (10gms). Not accounting for the making and wastage charges, you are poised to lose Rs. 7000 for every 10 gms of gold you sell, a devastating blow to your business. You close your shop the next day and go back to completing that MBA your parents always wished for.

This is precisely the kind of scenario Titan wants to avoid. To this extent, it has worked out a rather elegant solution. Titan doesn’t purchase most of its gold outright, instead, it buys them on lease and makes payment only after the gold has been sold based on the quoted market price that day. This way they don’t have to worry about gold prices fluctuating and can focus their efforts on making and selling Jewellery, their core business. Leasing gold also happens to be a much cheaper alternative than buying gold outright. You pay a much smaller interest when you lease gold and you need less cash to make these purchases, further easing the financial burden. However, there is one tiny problem.

Off late news channels have prominently highlighted two major issues in the Indian economy. A falling rupee and something called the current account deficit. We won’t talk too much about the rupee because enough has been said about the spectacular decline of our currency over the past few months. Instead, we will focus our attention on the more esoteric subject i.e. the current account deficit. In simple terms, the current account deficit or CAD is a measurement of a country’s trade where the value of imports exceeds the value of exports. When the country as a whole starts importing more than it exports, this gap increases. While it is beyond the scope of this story to explain all the intricacies involved, let it be known that a disproportionate increase in CAD is a bad omen for the economy and so the government does everything in its power to reduce this deficit.

How does it do it? Well, for starters the government can introduce policies that make it expensive for people to import certain goods and commodities. The two biggest imports that are largely responsible for driving CAD include oil and gold. While oil is an essential commodity, gold isn’t. So as the current account deficit becomes more of a problem, the government usually resorts to reducing gold imports instead of oil. Why is any of this relevant? As of today, India’s current account deficit has already reached dangerous levels* and Dalal street has been rife with rumours about further reforms aimed at curbing gold imports. But how does all of this affect Titan? A small detour will help us better understand how these factors play out when the current account deficit starts reaching perilous levels.

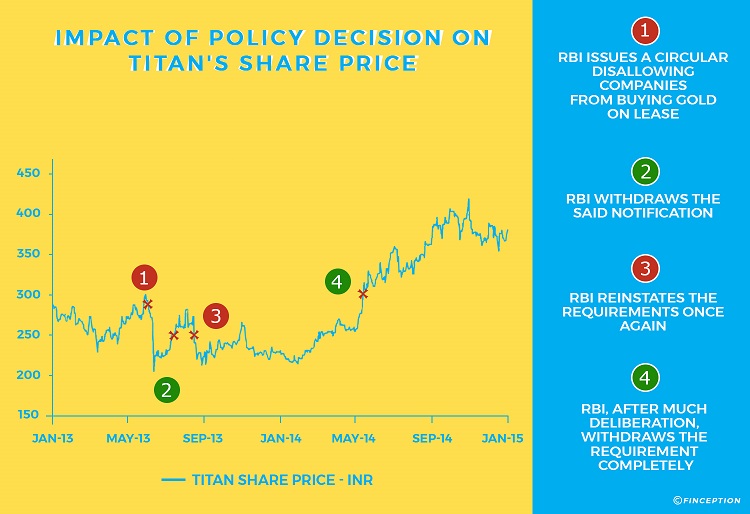

Back in 2013, when the country’s CAD started becoming a priority issue, the government was actively mulling over ideas to curb gold imports and bring the deficit back to manageable levels. It was at this time the government called upon its trusted lieutenant RBI to the forefront. The Reserve Bank of India issued a circular stating that companies could no longer buy gold-on-lease, instead had to pay the entire amount upfront. Remember how leasing gold is a much more cost-effective method of buying gold. Yeah, once the notification was made public, Tanishq and the other jewellery companies could no longer benefit from the gold-on-lease scheme. Imports started to fall, the current account deficit declined and Titan’s stock price tanked ~25%. Did it warrant a 25% fall? Well, that’s debatable, but what you cannot deny is the fact that this decision has had a material impact on the company’s finances and most savvy investors who accounted for this, sold their stake immediately, prompting the fall in stock price. You can observe a similar trend when RBI lifted these restrictions, only this time the stock price moved in the opposite direction as evidenced in the charts below.

Pro Tip: Policies on gold imports/exports will have a material impact on the company’s finances. So it pays to keep an eye out for news that might influence these factors.

Rakesh Jhunjhunwala: You have written-off Rs.75 crores. Over the next year, how much do you propose to write off further?

Bhaskar Bhat: No-no, we do not expect to write off any further, but we have just been conservative in our accounting.

Rakesh Jhunjhunwala: Your belief is (to) make money?

Bhaskar Bhat: Yes, of course, we will but it will take us at least five years before we start making money.

Rakesh Jhunjhunwala: Ready to invest for five years?

Bhaskar Bhat: We will continue to invest for five years.

This particular conversation between the CEO of Titan Industries and the ace investor Rakesh Jhunjhunwala is about Titan’s acquisition of the luxury watchmaker Favre Leuba. Back in 2011, the company acquired the brand for around 8 crores in a bid to expand its international presence by reviving the iconic Swiss brand. Unfortunately for Titan, the acquisition is yet to bear fruit. The company has already made investments amounting to about 145 Crores and it’s quite evident through the call transcripts that the management no longer believes it can recover about half of that investment. Although the company still plans to pour more money (+55 Cr.) and make the business work, this investment is one for the future and has little implication for the present.

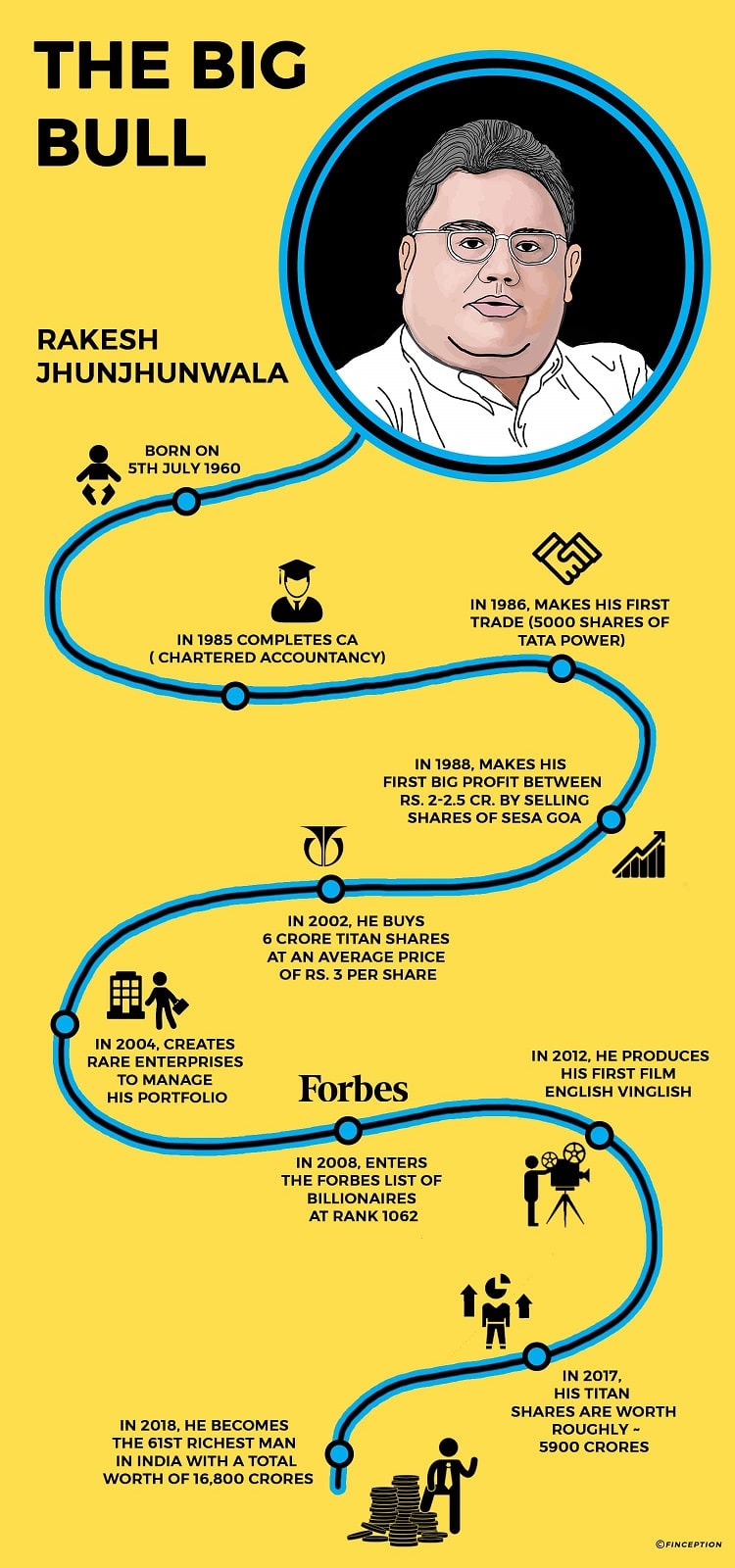

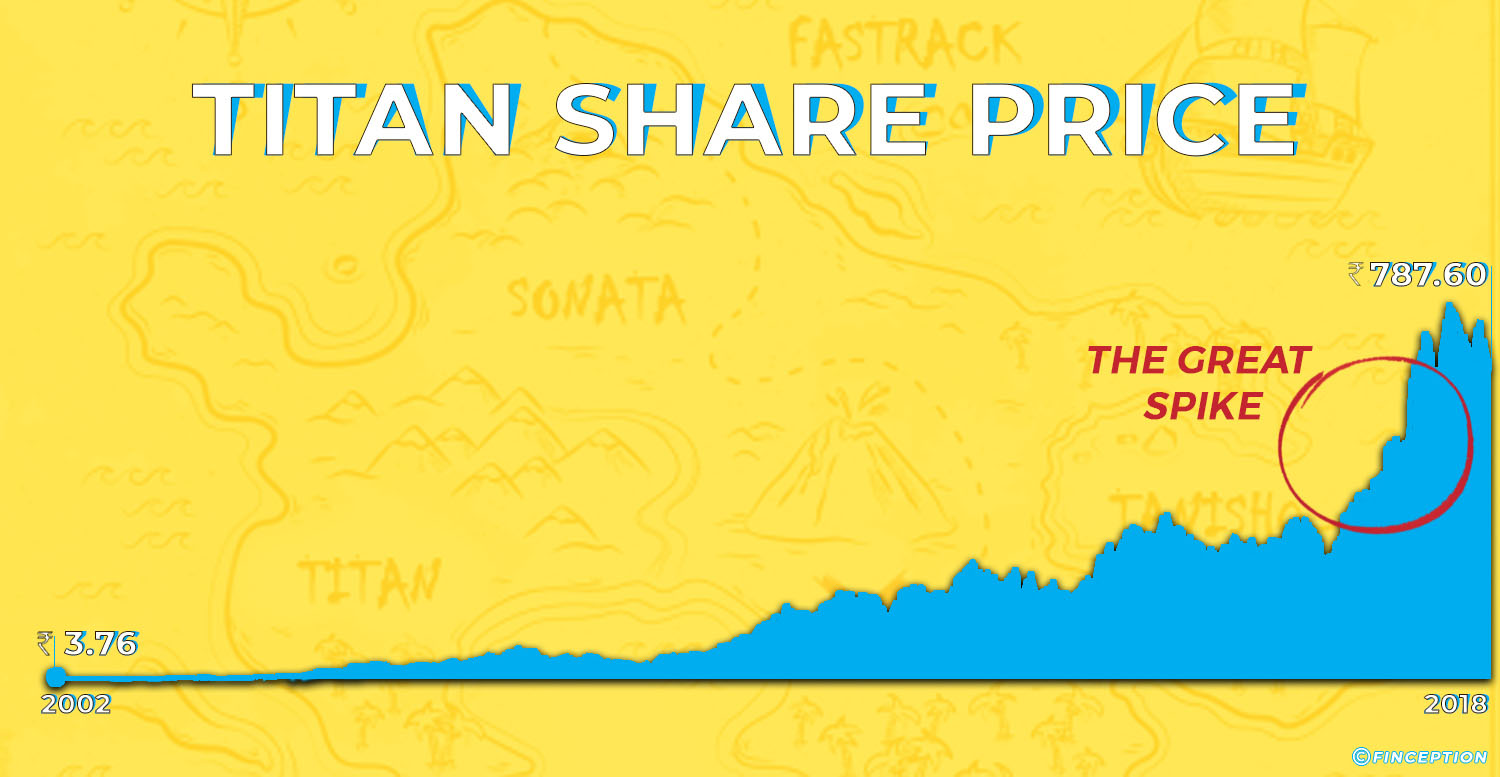

So why are we talking about it? Well, the story here isn’t about Favre Leuba, instead, it’s about Rakesh Jhunjhunwala — a man whose name is perhaps synonymous with stock markets. The big bull currently holds about 7.3% of the company amounting to ~Rs. 5,100 Crores. In 2002, when he first bought Titan, the shares of the company were trading at a measly price of ~Rs. 3(adjusted for splits). Over the years, Jhunjhunwala has also built a reputation for being an astute investor and a market mover, meaning any sufficiently large transaction he executes in the market is bound to make news and in some cases affect the stock price as well. There have been instances in the past when Titan’s stock price has slid on the back of Jhunjhunwala cutting his stake but such events are never a foregone conclusion. The last time news of Jhunjhunwala selling Titan shares was made public the stock price went up ~5%. So it is wise to exercise some discretion while buying and selling Titan stocks based on what Jhujhunwala does with his portfolio.

Pro Tip: The big bull might be a market mover. But relying on his every move to make your investment decision is perhaps not a wise choice

It is perhaps common knowledge that Diwali, Durga Puja, Christmas and the great Indian Wedding season brings families across India to jewellery stores in droves. This period of abundance is marked by an insatiable appetite for gold and usually lasts anywhere between 3–4 months beginning in October and pushing through to January providing a significant boost to jewellery sales across the country. This also makes Titan’s business seasonal in nature. On most occasions, you will be able to see a clear uptick in revenue figures during this time.

Does a seasonal business also mean Titan’s stock price will move in tandem with the sales numbers? Not quite, because investors already account for seasonality in most cases. As we have noted, it is common knowledge that sales improve during the festive season and so it comes as no surprise to most investors when Titan and other Jewellery companies post better sales numbers during this period. However, imagine there is a sudden dip in sales instead, it is quite possible that the unexpected shock could then lead to investors losing confidence, in turn affecting the stock price negatively.

Pro Tip: Stock price movements are more exaggerated when there are uncommon, unpredictable events, as opposed to events premised on common knowledge

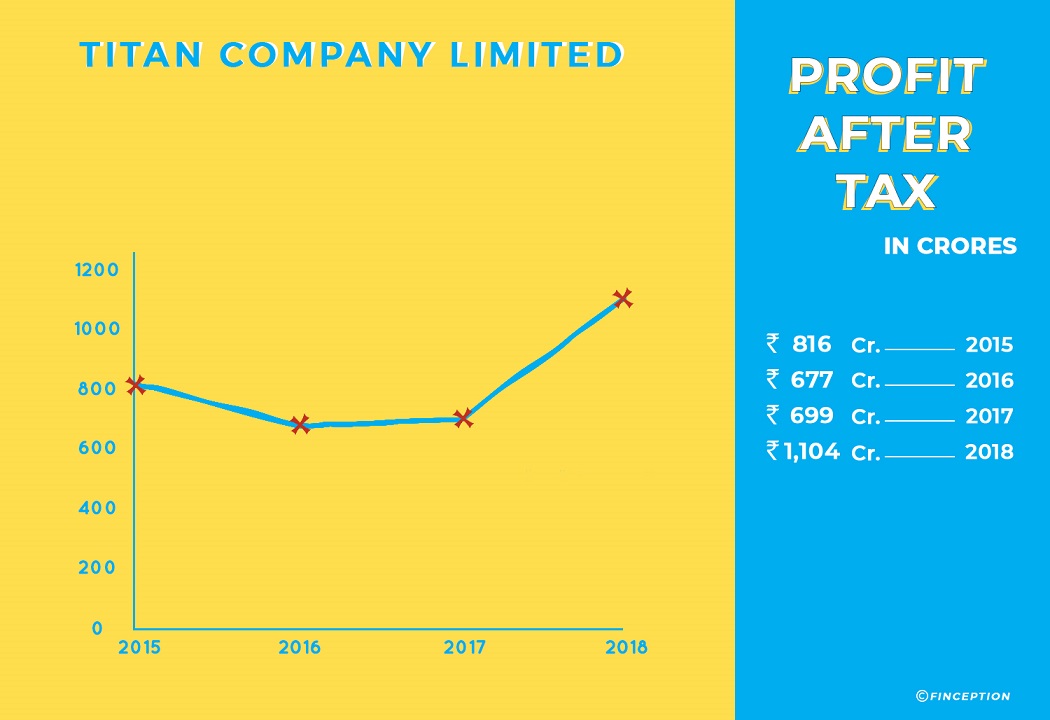

Right after honourable Prime Minister Narendra Modi announced demonetisation the market was overrun with fear of the unexpected fallout of such a brazen move and panic ruled Dalal Street for quite some time. However, once the dust settled Titan’s stock price went on a record-breaking rally. From a modest figure of Rs. 340 to jaw-dropping highs of Rs. 1000, Titan shareholders have been rewarded handsomely for their patience over the past couple of years. But why? Well, for one Titan has been posting some solid numbers. Both revenues and profits have seen robust growth and there is considerable optimism about Titan’s future prospects as well.

But these numbers aren’t exceptional and it’s highly unlikely that the financials alone could have propelled the stock price to such euphoric highs. Instead, it is more likely that the rally was premised on a combined effect of GST, market sentiments and demonetisation. For large parts of 2017 and 2018, investors have been on a buying spree that has seen the whole market move up and not just Titan. And as the markets slowly lost their mojo, Titan’s stock price has plateaued in tandem and it now trades at about Rs. 788. GST and demonetisation, on the other hand, has a much more pronounced effect in that it is likely that the impact will be more long-lasting. The Jewellery market has traditionally been dominated by a slew of small unorganized players who have been crippled post demonetisation and the introduction of GST. The expectation is that their loss will, in turn, be Titan’s gain and more people will shop from the likes of Tanishq, Tribhovandas Bhimzi Zaveri and Malabar Gold as the smaller jewellers start shutting shop.

And as Titan sits pretty all bets are on Tanishq and its ability to keep growing. Despite the governments aggressive measures to help ween India off of its obsession for gold, Jewellery companies continue to thrive and Titan has promptly capitalized on the gold rush. It recently acquired a majority stake in Carat Lane , an online jewellery company with expertise tending to the younger customer segments. Since the acquisition, Carat Lane has gone on to expand its offline presence and now has 36 stores spread across India. Titan also spends aggressively on marketing and advertisement as they continue to shore up their market share and prepare for the future. Currently Titan has a market share of about 4–5% in the Jewellery segment. It wants to double this number by 2023. The challenge is tall but the expectations set.

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts