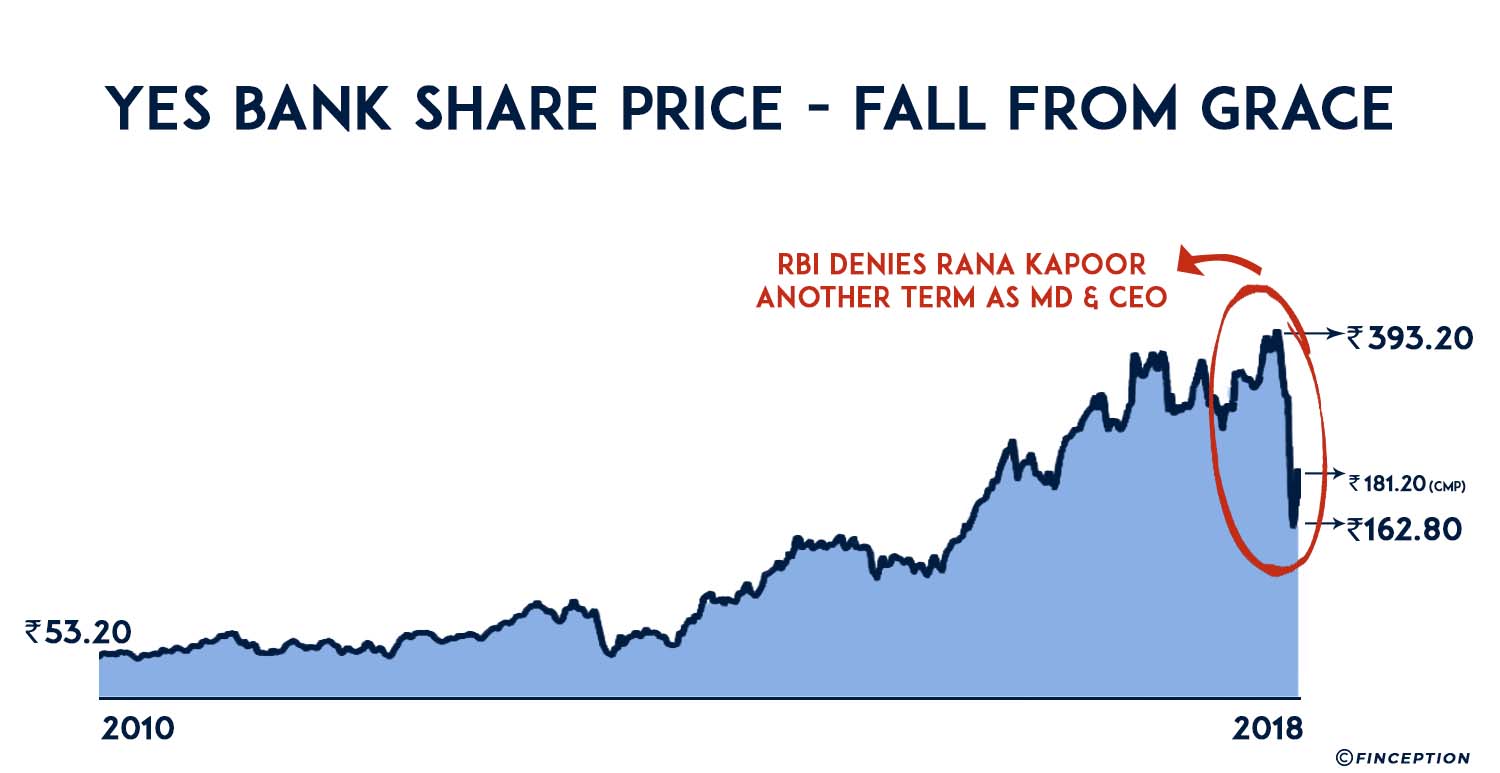

How much is a CEO worth to you ? 1 Crore? 10 Crore? How about 100 Crores. As the dust settled in the markets on the fateful day of September 21st, Yes Bank had lost 22,000 Crores in a single day of trading. For those fleeting~6 hours, the CEO’s position at Yes Bank was valued at a mind-boggling 22,000 crores, for the RBI had released a circular the previous day denying the promoter of Yes Bank, Rana Kapoor an additional term to carry on as CEO. Yes Bank’s stock was on a free fall. To truly understand the events leading up to this spectacular fall we must go back in time and understand the fundamentals of the stock and the company.

. . .

Before we delve into the insides of Yes Bank, it’s important we get some perspective. Yes Bank is, after all, a private bank and it happens to be the only bank which was offered a banking license without any prior experience. Although the promoters did spend considerable time working in big banks, at the time of its inception Yes Bank was literally a startup. Now as a startup, we can vouch for one thing. Funding is hard to come by and if you are a private sector bank trying to build a financial institution of the kind Yes Bank was trying to build, the problem is further compounded. It would so happen that the promoters of Yes Bank, each had with them enough money to pool in about 150 Crores to begin operations and within the next year the company had raised an additional 300 Crores through an IPO.

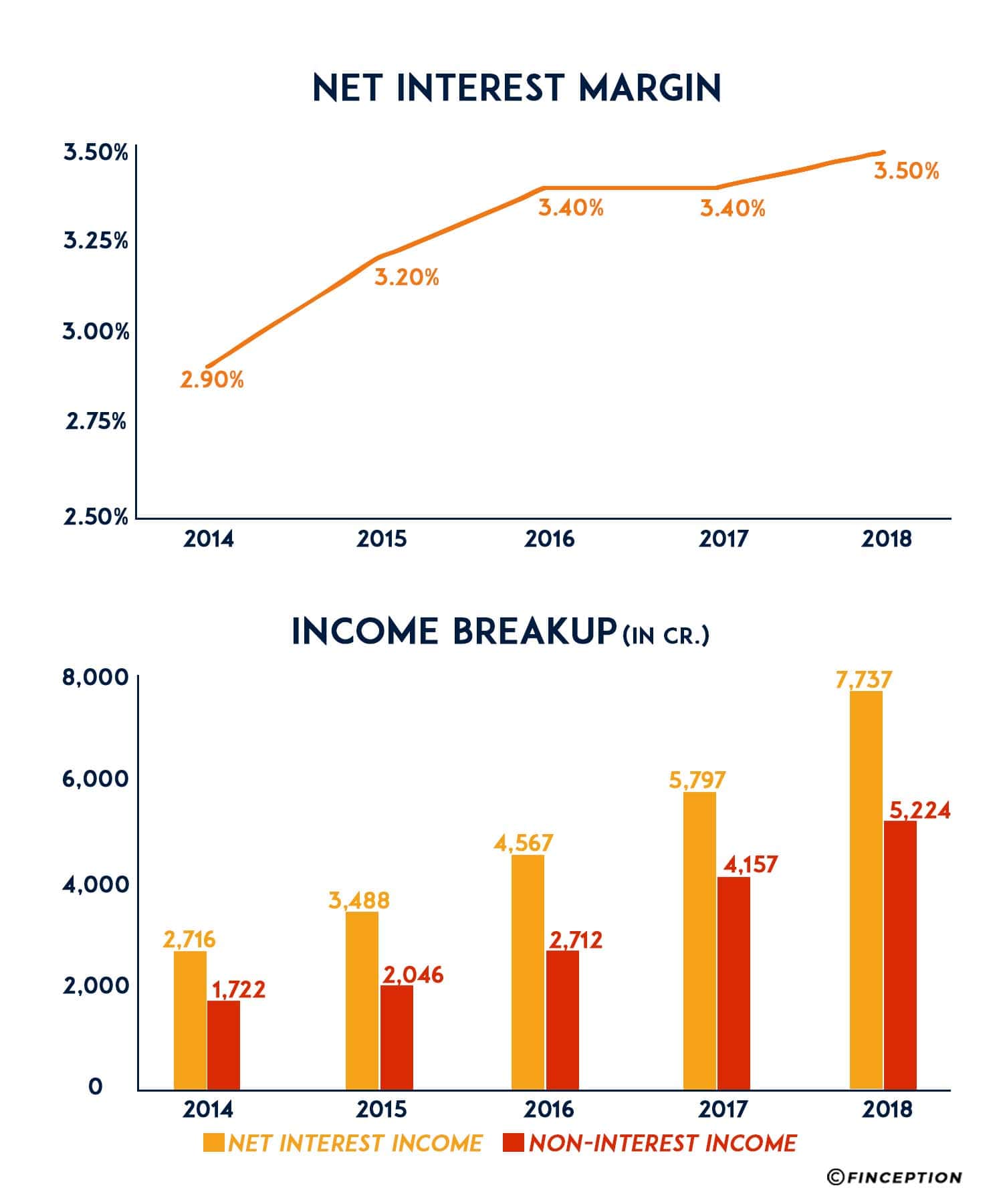

In addition to these funds, Yes Bank has another seemingly endless source of cash. Banks work by collecting money from the public, paying a modest interest rate on the deposits and lending this money as loans to individuals or companies at a higher interest rate. This difference in interest rate allows banks to profiteer from such transactions and the extra income they generate in the process is called the Net Interest Income (NII). NII, when calculated as a percentage of the average loan book gives us Net Interest Margin (NIM). A higher NIM means the bank makes more money and it is this very metric that drives the performance of most lending institutions, including our very own Yes Bank.

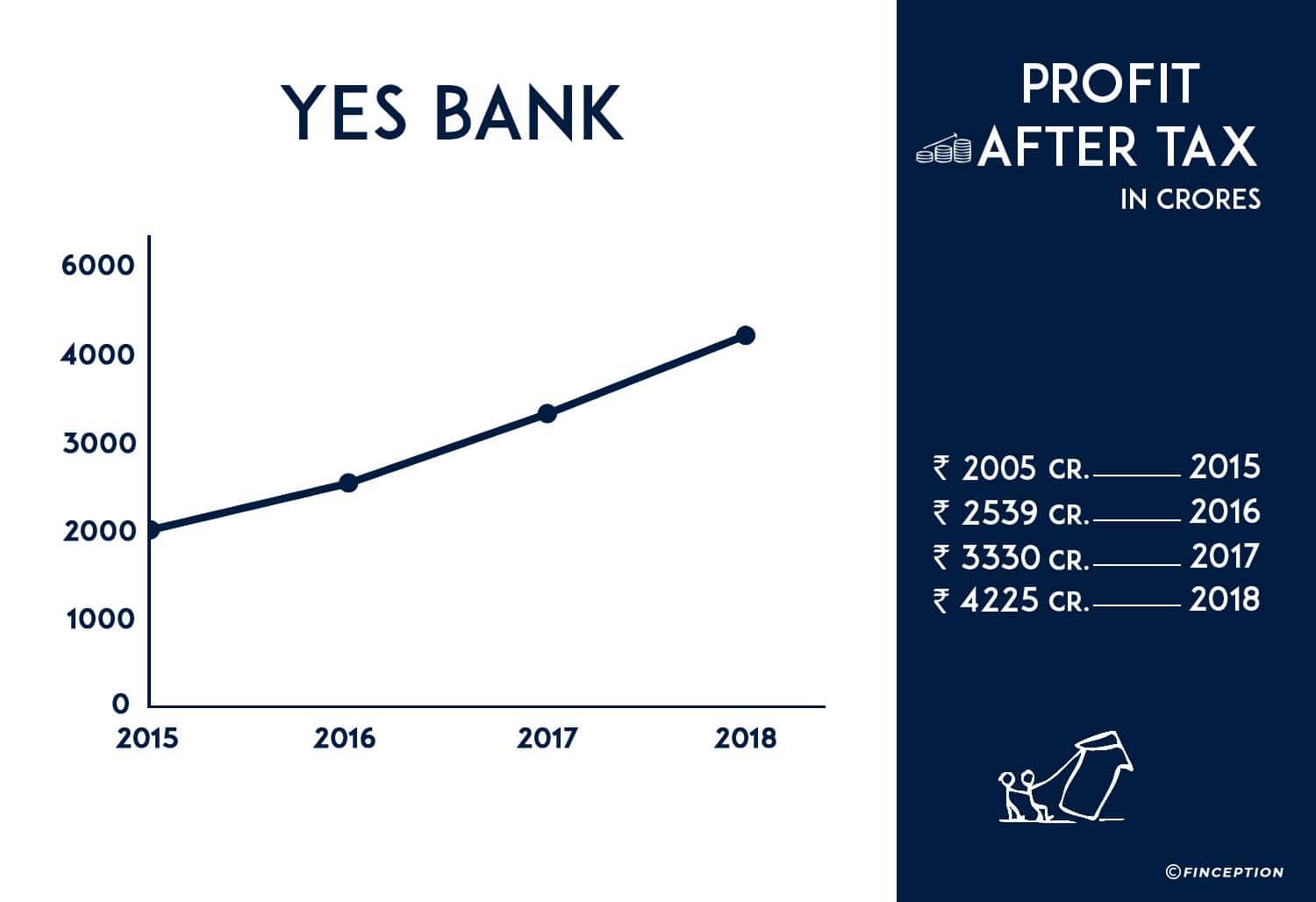

While the bank does have other sources of income, in that it earns from overdraft fees, ATM charges, cheque handling fees, other investments and income from mergers and acquisitions, it’s extremely difficult to track these numbers and make an educated guess about future performance, which is why interest income gets all the attention. It is easy to track and intuitive to analyze and interpret. It is also worth mentioning that Yes Bank’s NIM has been on a constant rise over the past few years, which also happens to coincide with its meteoric rise over the same time period.

Pro Tip: Any significant change in NIM can have a material impact on the company’s profitability and the stock price. So it pays to keep an eye on this number.

But how do you improve this number? What dark magic do you employ to keep the NIM ticking? Well, unfortunately, there is no dark magic, it’s not even that exciting, to be honest. You can improve NIM by either borrowing at cheaper rates or lending at higher rates — as simple as that, or is it?

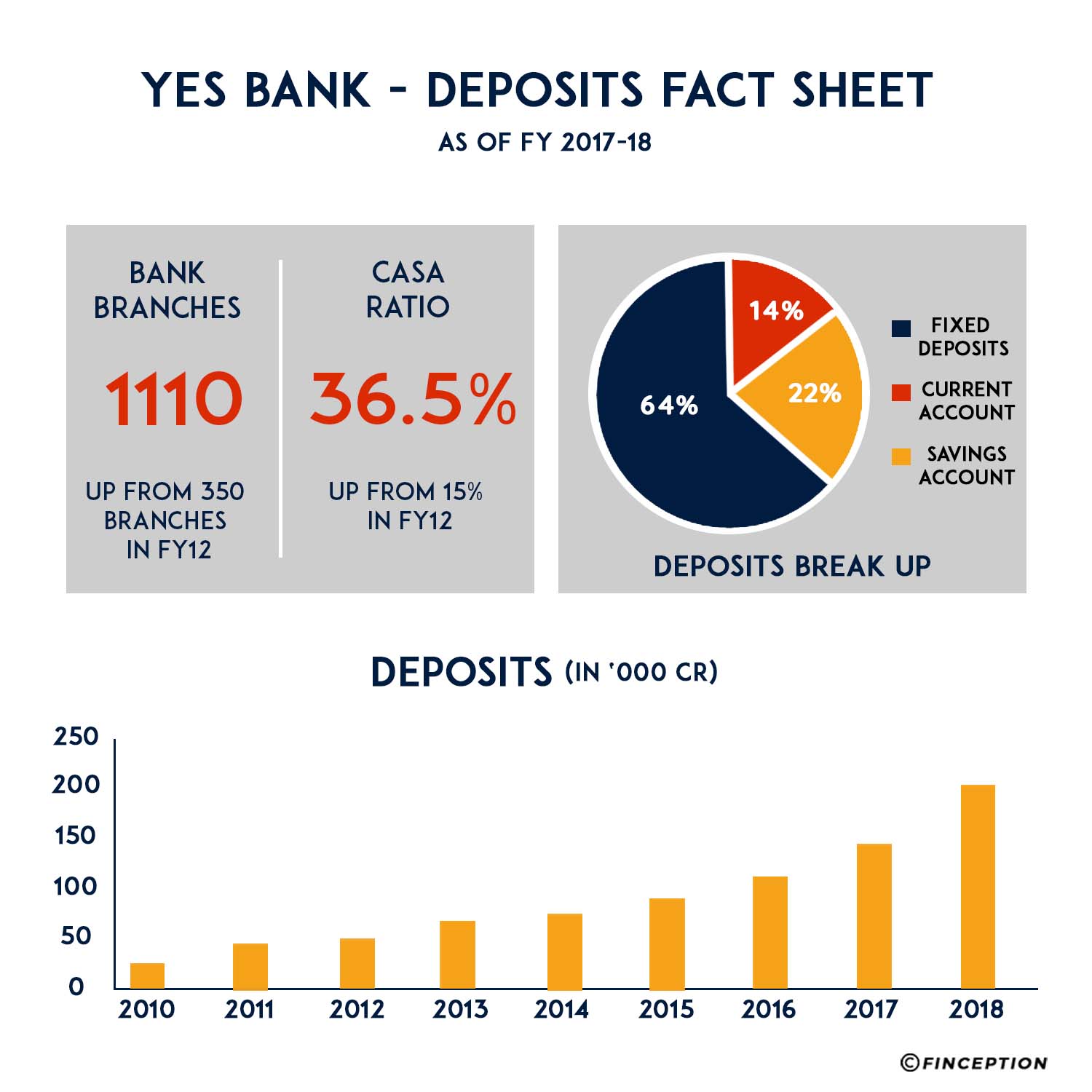

Let’s discuss borrowing first. As a bank that accepts deposits from the public, you have to be quite wary that your customer might want to deposit funds in a current account, savings account or a fixed deposit.

Current Account: No interest is paid. No restrictions on withdrawals. Money deposited earns you a whopping 0% interest rate

Savings Account: A modest interest( typically 3–4%) is paid for the money in this account. Banks, however put certain restrictions on withdrawals.

Fixed Depostis: Money is locked for a stipulated time and earns higher interest rates (7 to 8%) than money deposited in a savings account

If you were a profit-seeking entrepreneur you would quickly realise that funds deposited in a current or savings account come at a much cheaper rate when compared to fixed deposits. So if a bank were to receive Rs. 100,000 in deposits, ideally they would want most of it deposited in the current and savings account. This fundamental premise gives rise to a rather important financial ratio — CASA, that banks try to maximise. A higher ratio means a larger portion of a bank’s deposits are in the current and savings accounts and is generally seen as a positive indicator for the company’s profitability.

But it is quite rich to assume that a new company like Yes bank had the ability to entice customers to deposit their funds in its savings/current account when people had at their disposal a variety of more renowned banking options including SBI, HDFC, ICICI etc. For a young, up and coming bank, our company had to find a recourse quick and in 2011, a stroke of luck catapulted Yes bank firmly into the growth path. Until then, RBI had a cap on how much interest banks could offer on savings deposit and when in 2011, RBI removed these restrictions, Yes Bank quickly pounced on this opportunity and started offering 6–7% interest rates on a savings account when most other banks were still offering 4% at best. Customers poured into Yes Bank’s offices and the bank’s total deposits and CASA ratio went into overdrive.

While in the early years, profitability did take a hit (because of the high-interest rates on savings) it was able to create a loyal customer base that helped the company grow by a considerable margin. Even today, the company continues to offer 5–6% interest on savings account, much higher than the industry average, but its focus has firmly shifted towards profitability. With an ever-increasing deposit base and improving CASA ratio, Yes Bank continues to cement its position as a bank with considerable upside potential.

Pro Tip: A rising deposit base and an improving CASA ratio are generally seen as positive indicators for the bank’s financial performance.

Now that we are through with the borrowing bit, perhaps some insight into the company’s lending operations will provide us with clues on how Yes Bank plans to maximise profitability on this front. To do this, we must go back in time, when Yes Bank was still a fledgeling financial institution with just 150 Crores in the bank. As a bank, you could perhaps make a case for disbursing the 150 Crores to people like you and me in small chunks of a few lakhs, in which case the promoters would have to have dealt with a logistical nightmare to set up offices and find enough customers to disburse the entire amount. Bankers like to call this retail lending and small banks with limited resources largely stay away from such a tedious endeavour, instead, they simply rely on corporates. When you lend to corporates or big institutions it becomes much easier to disburse large loans even accounting for the limited network of working branches at your disposal.

Yes Bank began operations tending to corporates and it was at this time that the two promoters fully took charge. With their prior experience working in the banking industry, they had very few problems finding clients and growing the business in the yearly years. But their insatiable desire to grow meant that they had to delve into uncharted territories — offer loans to small and medium enterprises whose credit history was sketchy at best. The company refused to hire traditional loan officers instead brought domain experts to adjudge creditworthiness based on business potential. This worked wonders for the company as they were able to grow their loan portfolio bearing very little risk.

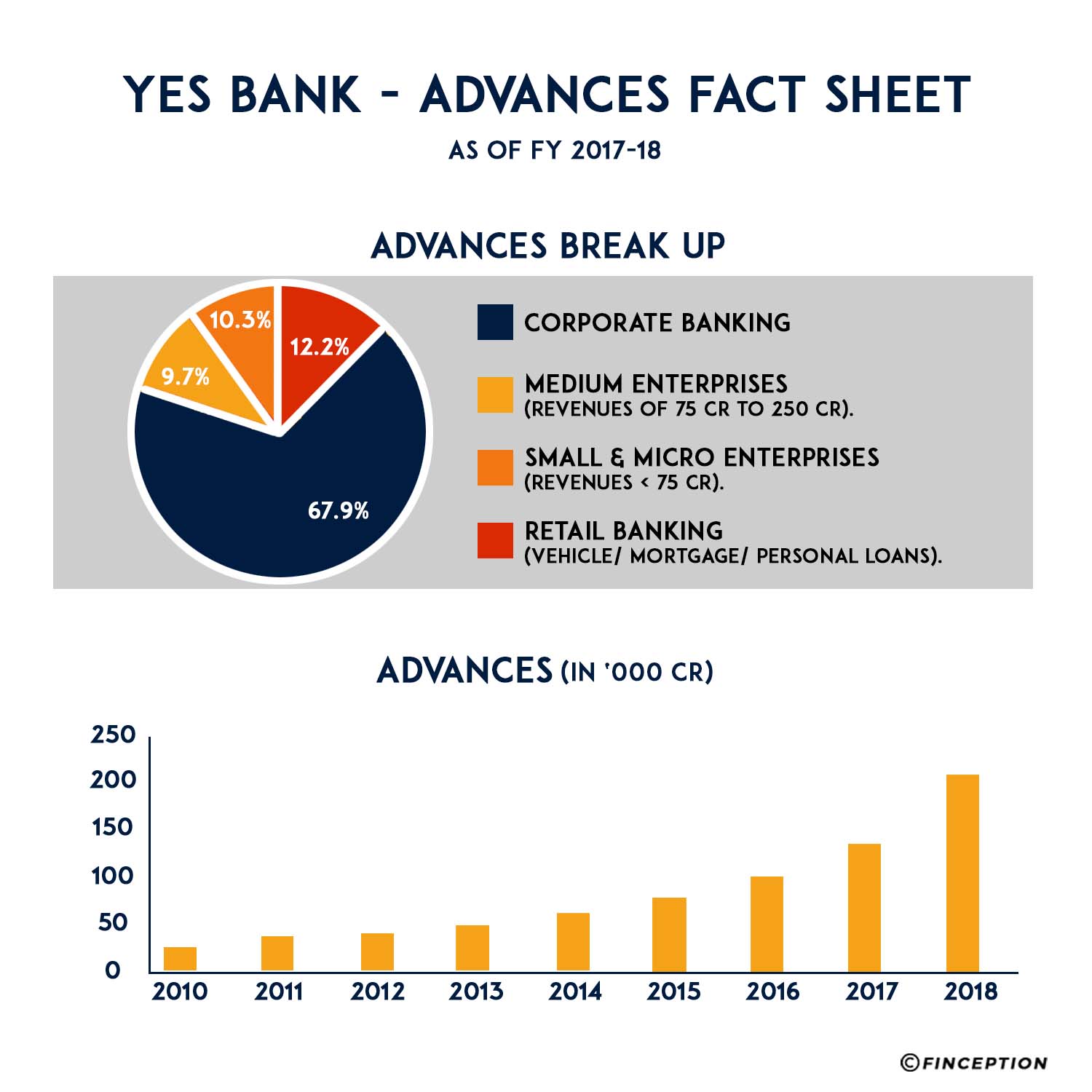

And finally in 2010, when the company started to increase its push into retail, the expectation was that such loans would form a considerable part of the total loan portfolio. However 8 years on, corporate loans still form roughly 90% of the total loan base. Although in the recent investor updates, there is evidence to suggest that the company wants to change this, readers must bear in mind that retail lending is much more expensive than corporate lending. Today, the company’s total loan book stands at 2.4 Lakh crores, a far cry from its loan portfolio of 22,000 crores back in 2010. And the advances continue to keep rolling in.

Pro Tip: Pay attention to the divide between the company’s corporate and retail loan books. A changing pattern might also bring changes in the profitability metrics as well.

So if retail lending is expensive. Why not simply stick to corporate lending? Well, there is a tiny problem with corporate loans.

India has had a problem with people not paying back their loans. The current estimate is that there is a whopping 10 Lakh Crores worth of bad loans in the system i.e. loans that are likely never going to be paid back to the original lender, in which case it is classified as a Non-Performing Asset (NPA). Investors and banks are spooked by the mere mention of NPA’s and Yes Bank, in particular, has a lot to lose if some of its clients were to go awry. Why? you ask. It so happens that some of the worst offenders in the banking industry are large corporates and as we have already discussed in great detail — about 90% of Yes Bank’s loans are offered to such corporates. The problem in lending to such institutions is that the ticket sizes are usually so large that even a couple large defaulters could cause great pain to banks and investors alike. So what bearing does this have on the company?

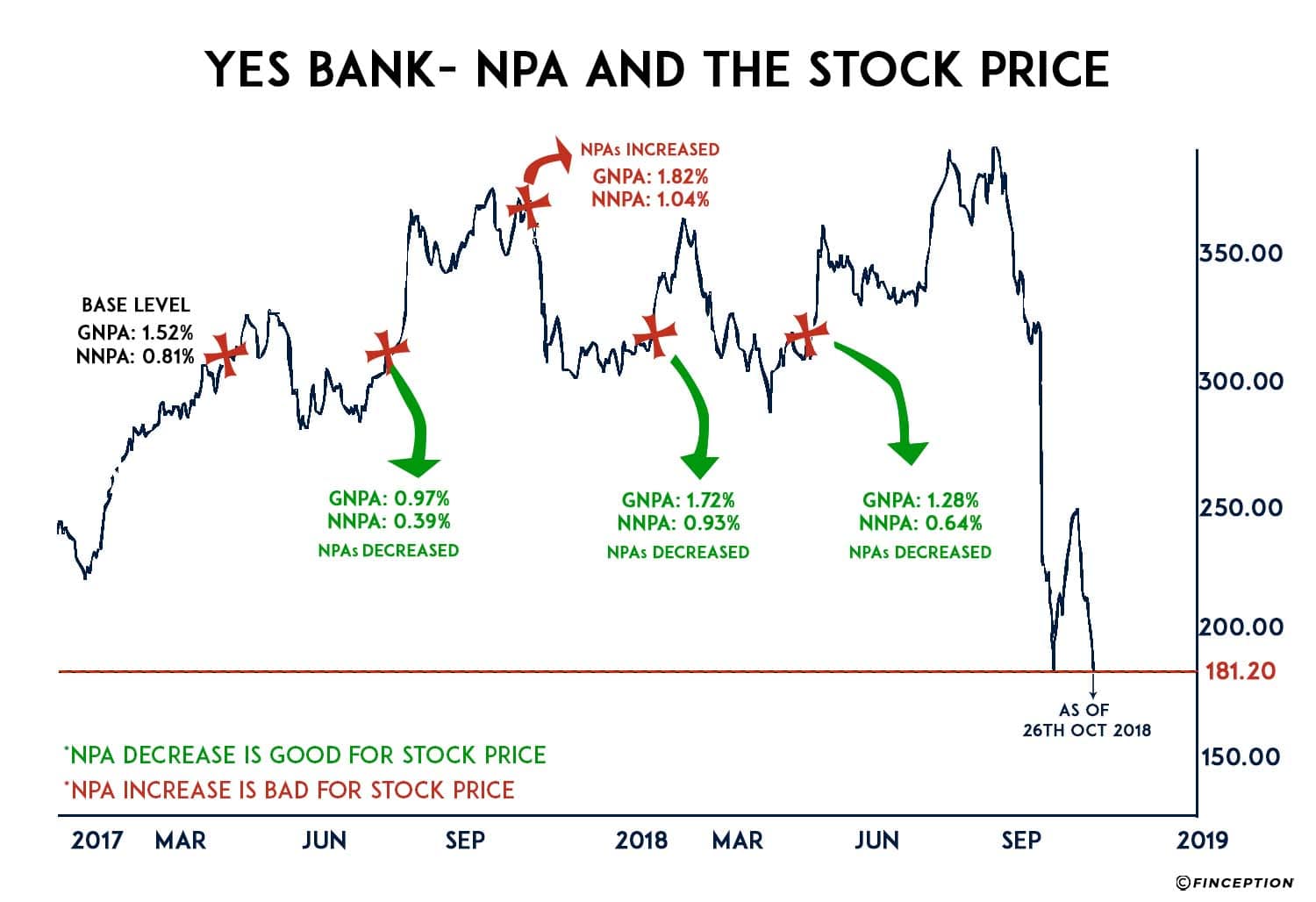

Imagine you were running a bank and you figured that some of your clients are unlikely to pay back their loans. Being a prudent money manager you set aside some funds in case these suspect clients default. This process is called provisioning and the impact is that such provisions eat into your profits because you can’t use this money elsewhere. But there is comfort in knowing that you presented to your investors an accurate picture of your finances. But unbeknownst to you, more clients default and you find out at the end of the financial year that you haven’t provisioned enough. The total defaults are classified as Gross NPAs (GNPA) and the extra amount that you haven’t provisioned for is classified as Net NPA (NNPA). What we have presented here is an oversimplified explanation of how banks classify NPAs which in reality is a terribly complicated affair that is subject to multiple interpretations and beyond the scope of this story. But it is highly likely that a disproportionate rise in the NPAs will have some material impact on the stock price as evidenced in the charts below.

Pro Tip: Investors must bear in mind that stock price movements are predicated on a confluence of multiple factors and an analysis of the NPA alone will not suffice.

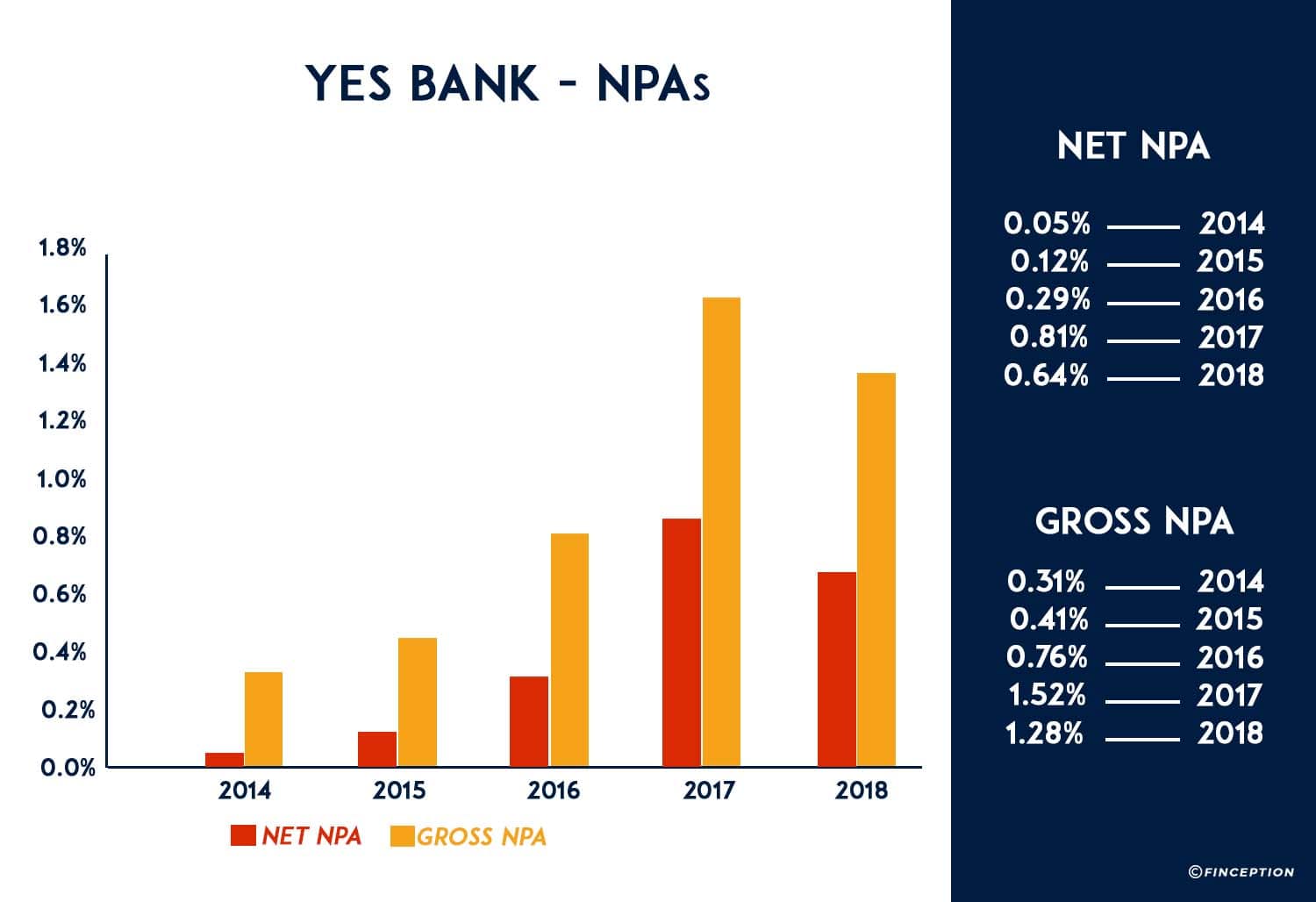

In 2018, Yes Bank reported that 1.28% of its total loan portfolio was classified as GNPAs, out of which 0.64% of its portfolio was deemed to be NNPAs. These numbers were a marked improvement from the previous year, however, there was visible concern among many investors about a recent event that had sparked much debate within the community. As we have already stated, there is considerable room for interpretation when classifying loans as Non Performing Assets and as such different interpretations might lead to grossly varying numbers. Back in 2017, Yes Bank reported total non performing assets amounting to about 2000 Crores, again a nominal amount that did not create much panic, but when the Reserve Bank of India conducted its independent audit of the financial statements, it reported that this number ought to have been much higher, close to around 8300 Crores instead. This gave rise to the problem of Divergence, a mismatch in reporting NPAs to the tune of about 6300 crores and Dalal Street was rife with rumours about how Yes Bank was underreporting NPAs and wilfully fudging numbers, misleading tens of thousands of investors.

However, the truth is much more nuanced. While the RBI did, in fact, peg NPAs at a much higher level, it must be noted that a subsequent review by the company found that at least 81% of the 6,300 Crores were either recovered /resolved or continue to be classified as standard assets, meaning the bank thinks it can recover the full amount and this should have no bearing on the income statement. Although RBI’s review ultimately led the company to reclassify an additional 1,300 Crores worth of loans as non-performing it had very little implication on the financials and the stock price as Yes Bank continued to soar. Then there was the small matter of the NCLT notification — in which the RBI listed a bunch of large corporates that are likely to go under i.e. liquidated. In addition to making the list available it also sounded the alarm bells notifying banks to make provisions against loans made out to these companies. Yes Bank’s total exposure to these companies stands at about 630 Crores, and it has already provisioned for about 50% of this amount. So it seems Yes Bank is in the clear for now.

Gross and Net NPAs as % of Total Loan portfolio

Which brings us to the final point, in that through the ups and downs, and the testing times of the financial crisis, through the NPA epidemic and the unrelenting pressure of the markets, through the personal turmoils and the professional hardships Rana Kapoor has stood tall, breaking barriers, steadying the ship and guiding Yes Bank towards greater heights. But Rana Kapoor will no longer be at the helm 3 months from now. RBI denied the board’s request to extend his term by an additional 3 months and in all probability this is Rana Kapur’s final chapter with Yes Bank.

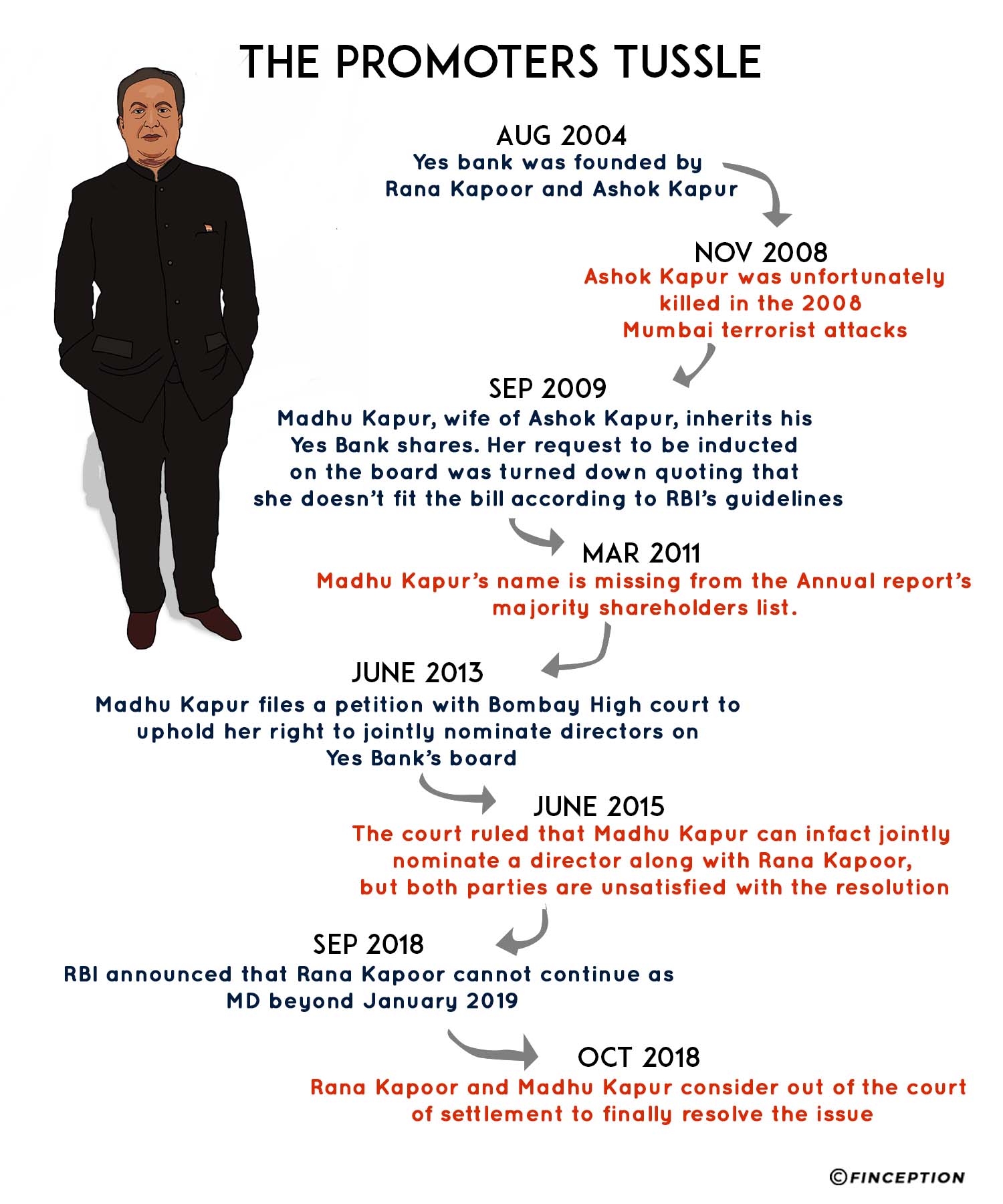

Before he leaves he has to appoint a worthy successor, to continue his legacy but there is another pressing matter that needs his immediate attention. After the death of the erstwhile promoter, Ashok Kapur in the Mumbai terrorist attacks, his wife, Madhu Kapur has been leading a lone battle to obtain rights to nominate a candidate to the Yes Bank Board. After fighting it out in the courts, Rana Kapoor has finally relented and is looking to settle the matter amicably. With the recent fall in stock price, all eyes are on Rana Kapoor as he sets to depart with one last hurrah. How will Yes Bank’s stock price look once the dust settles?

. . .

Disclaimer: No content on this website should be construed to be investment advice. You should consult a qualified financial advisor prior to making any actual investment or trading decisions. The author accepts no liability for any actual investments based on this article.

Liked what you just read? Get all our articles delivered straight to you.

Subscribe to our alertsREAD NEXT

Get our latest content delivered straight to your inbox or WhatsApp or Telegram!

Subscribe to our alerts